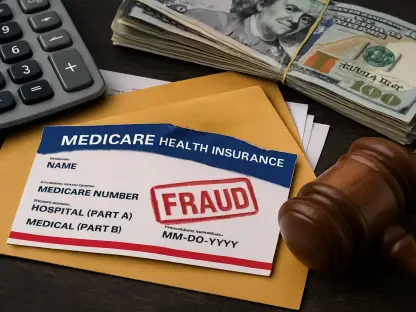

What happens when a single courtroom decision could alter the healthcare landscape for millions of seniors, igniting a firestorm of debate across the nation? On August 20, a federal judge in Texas struck down a key regulation aimed at curbing financial incentives for brokers in the Medicare Advantage program, raising critical questions about whether seniors are now more vulnerable to biased advice or if the decision preserves necessary flexibility in a complex system. The stakes are high for the aging population navigating an often bewildering array of healthcare choices, and the outcome of this legal battle could redefine trust in how plans are marketed to them.

A Federal Ruling Shakes Up Senior Healthcare Choices

The heart of this controversy lies in a decision by Judge Reed O’Connor of the Texas Northern District Court, who overturned a Centers for Medicare & Medicaid Services (CMS) rule designed to limit payments to brokers and marketing organizations. This regulation, intended to prevent predatory practices, was seen by many as a shield for seniors against being pushed into unsuitable plans for profit. Its rejection has sent shockwaves through the industry, with smaller Medicare Advantage (MA) plans and patient advocates expressing concern over a potential return to unchecked marketing tactics.

The ruling has also spotlighted a broader tension between government oversight and industry autonomy. By vacating the CMS mandate, the court has essentially prioritized broker and insurer flexibility over stricter controls, a move that some argue could expose vulnerable beneficiaries to manipulation. Reports of seniors being enrolled in plans without consent have fueled the urgency of this issue, making the decision a flashpoint for how healthcare options are presented.

This moment serves as a critical juncture for the MA program, which covers millions of older Americans through private insurers. The implications of this legal outcome extend beyond a single courtroom, potentially shaping the very framework seniors rely on to make informed decisions about their health. Understanding the depth of this ruling is essential to grasping its impact on an aging demographic often reliant on guidance from intermediaries.

Why Broker Payments Matter to Seniors in Medicare Advantage

Medicare Advantage offers an alternative to traditional Medicare, providing additional benefits like dental or vision coverage through private plans. Yet, the brokers who assist seniors in selecting these plans often operate under financial incentives tied to specific insurers, raising red flags about impartiality. A Senate Finance Committee report revealed that marketing-related complaints from beneficiaries more than doubled in a short span, highlighting a systemic issue of trust in how plans are sold.

These financial arrangements can create a conflict of interest, where brokers might steer clients toward plans that yield higher commissions rather than those best suited to individual needs. For many seniors, navigating the dense landscape of MA options is daunting enough without the added worry of biased recommendations. The CMS rule sought to address this by capping payments to third-party marketing organizations, but its removal has reignited fears of exploitation.

The significance of broker influence cannot be overstated, as roughly one-third of MA enrollees depend on these agents for guidance, according to a Commonwealth Fund study. Without clear regulations, the risk of seniors ending up in plans that exclude their preferred doctors or fail to cover essential services looms large. This dynamic underscores why payment structures are not just a technical detail but a cornerstone of equitable healthcare access for older adults.

Unpacking the Judge’s Decision and Its Ripple Effects

At the core of Judge O’Connor’s ruling is the assertion that CMS overstepped its authority by attempting to regulate payments beyond direct broker compensation and by dictating contract terms between insurers and marketing entities. Labeling this as unauthorized “ratemaking,” the judge effectively halted efforts to limit financial incentives that could sway brokers to favor certain MA plans. This decision has far-reaching consequences for how marketing practices are governed within the program.

One immediate effect is the perpetuation of a competitive imbalance between larger and smaller MA plans. Larger insurers, with deeper pockets, can continue offering substantial payouts to brokers, often overshadowing smaller players who supported the CMS rule as a way to level the playing field. This disparity risks limiting the diversity of options presented to seniors, as brokers may gravitate toward plans with the most lucrative rewards.

Additionally, the ruling stalls progress on curbing predatory tactics, such as unauthorized enrollments or misleading advertisements, which have been documented in numerous beneficiary complaints. While a minor provision protecting beneficiary data privacy was upheld, the broader rollback of payment caps leaves a gap in consumer safeguards. This legal outcome not only redefines regulatory boundaries but also challenges the industry to find alternative ways to protect its most vulnerable participants.

Voices from the Field: Experts and Advocates Weigh In

The fallout from this decision has drawn sharp reactions from across the healthcare spectrum. Patient advocates, particularly from groups like the Alliance of Community Health Plans, have decried the ruling as a blow to senior protection. A spokesperson emphasized, “Without limits on broker payments, larger insurers dominate the market, and seniors are left with advice that prioritizes profit over need.” This sentiment reflects a growing frustration among those championing fairness in MA enrollment.

Conversely, broker organizations have hailed the court’s stance, arguing that the CMS regulation threatened their ability to sustain operations. They contend that flexibility in compensation allows them to serve clients effectively, especially in a competitive environment. Yet, stories persist of seniors like 78-year-old Margaret Hensley from Ohio, who was switched to a plan without her knowledge, only discovering later that her primary doctor was out of network—a stark reminder of the human cost at stake.

Analysts and researchers add another layer to the discourse, pointing to data that illustrates the reliance on brokers. A recent report noted that many beneficiaries lack the resources or expertise to research plans independently, making impartial guidance critical. These varied perspectives—from advocates, industry players, and affected individuals—paint a complex picture of a ruling that divides opinion while impacting real lives in profound ways.

Navigating the Future: What Seniors and Stakeholders Can Do

Amid the uncertainty following this legal setback, seniors and stakeholders must take proactive steps to safeguard interests within the MA framework. For beneficiaries, independent research into plan options is vital; resources like State Health Insurance Assistance Programs (SHIPs) offer unbiased support to counter potential broker bias. Asking pointed questions about a broker’s incentives can also help ensure transparency during enrollment discussions.

Smaller MA plans, meanwhile, face the challenge of competing without the marketing muscle of larger insurers. Building direct connections with communities through local events or partnerships with trusted organizations can help bridge this gap. By focusing on personalized outreach, these plans can differentiate themselves and foster trust among potential enrollees, even in a tilted market.

For policymakers and advocates, the path forward involves pushing for legislative clarity on CMS authority to regulate marketing practices. Crafting reforms that can withstand judicial scrutiny is essential to prevent future rollbacks of protective measures. These strategies, tailored to address the unique challenges of the MA ecosystem, provide a roadmap for navigating a landscape altered by the recent court decision, empowering all parties to adapt and advocate for change.

In reflecting on this pivotal moment, it becomes clear that the judge’s ruling marks a significant turning point for senior healthcare protections. The debate over broker payments has exposed deep fissures in how Medicare Advantage operates, leaving many to wonder about the balance between regulation and industry freedom. Looking back, the decision has not only reshaped immediate policies but also sparked a broader conversation about equity and trust. Moving forward, stakeholders need to prioritize legislative solutions and grassroots education to empower seniors, ensuring that future reforms address the vulnerabilities laid bare by this ruling. The path ahead demands collaboration to rebuild a system where every beneficiary can make informed choices without fear of exploitation.