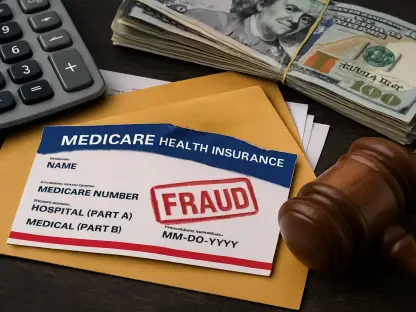

In the increasingly complex world of pharmaceuticals in the United States, the role of Pharmacy Benefit Managers (PBMs) has garnered substantial scrutiny, driven by the dominance of three key players. CVS’s Caremark, Cigna’s Express Scripts, and UnitedHealth’s Optum Rx have become synonymous with control over the vast prescription market, collectively holding sway over as much as 80 percent of it. Recent discussions in Washington, D.C., highlighted the significance of dismantling these powerful conglomerates, urging Congressional action to foster transparency and reduce prescription drug costs for consumers. This dominance is largely attributed to their integrated operations with major healthcare organizations, which empower these PBMs to influence various aspects of drug pricing and accessibility.

The Structure of PBM Influence

Vertical Integration and Market Control

The vertically integrated business model of these PBMs enables them to exert formidable influence over the pharmaceutical supply chain. They are not just intermediaries but are involved across multiple stages of drug distribution, from manufacturing to delivery to the end consumer. This extensive involvement provides these entities with a platform for significant profit generation, often at the expense of competitive pricing and transparency. By consolidating various roles within the pharmaceutical supply chain, these PBMs establish substantial barriers to reforms that aim to decentralize their power and promote fair market practices. Their embedded position within the healthcare system grants them unprecedented leverage in negotiating drug prices, creating an environment where reform efforts face stiff resistance.

Political and Legislative Challenges

Amid calls for reform, lawmakers from both Republican and Democratic camps have introduced proposals to enhance transparency and decouple PBM compensation structures from drug rebates negotiated with pharmaceutical companies. They aim to overhaul pricing arrangements that allow PBMs to extract profits from disparities between what pharmacies are reimbursed and what insurers charge for medications. However, experts argue that merely targeting business practices like banning rebates is insufficient. True reform must penetrate deeper, confronting the leverage these giants possess over critical sections of the supply chain. Industry experts emphasize that remedying choke points within the system is necessary, suggesting laws and regulations need to address more than just surface-level practices.

Adaptation and Resistance

Strategic Maneuvers by PBMs

Throughout efforts aimed at curbing the influence of PBMs, these firms have demonstrated remarkable adaptability in circumventing regulatory changes and maintaining profitability. In states like Ohio, despite attempts to ban spread pricing—a tactic where PBMs charge payers significantly more for drugs than what they reimburse pharmacies—the anticipated financial savings failed to materialize. PBMs swiftly adjusted their pricing models and strategies to restore their profit margins even under tightened regulations. This demonstrates the nimbleness and deep understanding of market dynamics possessed by these entities, allowing them to effectively sidestep legislative intentions aimed at reforming their operations.

Legislative and Regulatory Responses

Lawmakers and antitrust regulators are now focusing on reducing the consolidation within the PBM sector, seeking to dismantle their integration with insurers and pharmacies. Initiatives like those in Arkansas, which prohibit PBMs from owning pharmacies, exemplify state-level efforts to challenge their entrenched dominance. Similar legislation is being introduced in states such as Vermont, Texas, and New York, underscoring nationwide concerns about PBM control. At the federal level, a proposed bipartisan bill aims to compel PBMs to divest their pharmacy operations, although industry opposition poses substantial obstacles. The urgency in enacting these changes is underscored by actions from federal institutions like the FTC and DOJ, both keen on addressing the overbearing influence and alleged cost inflation by the Big Three PBMs.

Potential for Reform and Its Complexities

Opportunities for Comprehensive Change

While significant overhaul at the national level appears uncertain in the short term due to existing legislative hurdles, there is a possible pathway for meaningful reforms promoting transparency and fairness. Among potential strategies is the requirement for PBMs and health insurers to reveal more details about their operations, including rebate agreements and pharmacy fee structures. Some policymakers call for substantial changes in how rebates are handled, illustrated by efforts under the Trump administration aimed at ensuring Medicare patients benefit from rebate savings directly. Despite its ambitious nature, this rule has yet to be enforced, revealing the complexities of implementing reform initiatives in a sector fraught with opposition from vested interests.

Navigating Systemic Obstacles

Efforts to address PBM transparency woes must carefully consider the underlying profit mechanics that may undermine surface-level changes. Given claims by PBMs that they already pass most savings to clients, reforming rebate frameworks alone could inadvertently introduce new complications. The profit landscape for PBMs has shifted away from traditional reliance on rebates, diversifying into lucrative areas like specialty pharmacy dispensing and manufacturer fees. This evolving model necessitates that reform measures are robust enough to tackle foundational issues of oversight and concentration of power, ensuring that any increased transparency does not inadvertently provide PBMs additional means to exploit existing structures for continued profit making.

Looking Forward in the Pharmaceutical Sector

Even with concerted efforts aimed at reducing the influence of Pharmacy Benefit Managers (PBMs), these companies have shown a remarkable ability to adapt and maintain profitability in the face of regulatory changes. In places like Ohio, attempts to eliminate spread pricing—a method where PBMs charge health plan payers more for medications than what they actually pay pharmacies—have not led to the expected cost savings. Instead, PBMs swiftly adapted their pricing models and strategies to recover their profit margins even under stricter regulations. This quick adaptability reflects their profound understanding of market dynamics. They have honed the ability to maneuver around legislative measures intended to reform their business practices. Their adeptness and strategic insight enable them to effectively sidestep efforts aimed at enforcing tighter controls. Consequently, PBMs continue to retain their stronghold, demonstrating their capacity to preserve profitability despite intended legislative reforms aimed at their operational processes.