Unraveling a Fiscal Shift in Healthcare Funding

In an era where state budgets are increasingly strained, the Centers for Medicare & Medicaid Services (CMS) dropped a seismic update on November 17, with preliminary guidance that reshapes the Medicaid funding landscape. Stemming from the One Big Beautiful Bill Act, signed into law earlier this year under the Trump administration, this policy introduces stringent restrictions on provider taxes—a key revenue tool for states to fund their share of Medicaid. With nearly all states relying on these taxes to draw federal matching funds, the new rules signal potential disruptions for healthcare providers and state finances alike. This market analysis delves into the specifics of the CMS guidance, examines current trends in Medicaid funding, and projects the financial and operational impacts for stakeholders. The aim is to provide clarity on how this policy could redefine the healthcare market and what it means for strategic planning in the near term.

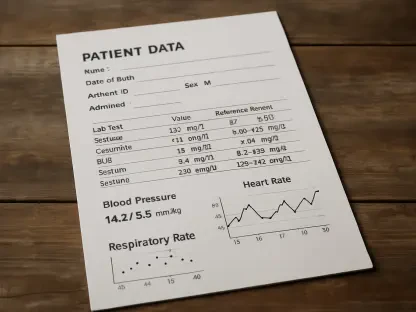

Dissecting the Medicaid Funding Market: Trends and Data

Policy Breakdown: New Restrictions and Timelines

The core of the CMS guidance lies in a bold prohibition on new provider taxes or increases in existing rates, a direct mandate from the recently enacted legislation. Beyond this, the guidance outlines a gradual reduction in safe harbor limits—mechanisms that have historically protected providers like hospitals from bearing the full weight of these taxes. Compliance deadlines are set for the end of fiscal year 2026 for taxes on managed care plans and 2028 for other entities, such as nursing facilities. Health policy research indicates that provider taxes often constitute a significant portion of state Medicaid budgets, and these timelines, while offering a transition period, could still strain financial planning. The federal government projects savings of over $200 billion over the next decade, positioning this as a major cost-cutting measure, though the burden of adaptation falls squarely on states and providers.

Financial Ripples: State and Provider Impacts

The financial implications of this policy shift are vast and complex, creating a ripple effect across the healthcare market. With diminished safe harbor protections, providers may face reduced net reimbursements as they lose the ability to fully offset tax costs through Medicaid payments. States, particularly those heavily reliant on provider taxes like California and New York, must now seek alternative revenue streams or consider program cuts. Data suggests that states with lower dependence on these taxes may fare better, but even they face challenges in maintaining service levels. Market trends point to potential increases in general taxation or innovative funding models as possible solutions, though the tight compliance timeline limits the scope for experimentation. The overarching risk is a potential reduction in access to care for vulnerable populations, an outcome that could reshape community health dynamics.

Regional Disparities: Uneven Market Challenges

Diving deeper into market segmentation, regional variations reveal stark differences in how this policy impacts states. Rural areas, often home to hospitals with razor-thin margins, stand to suffer more than urban centers with diversified revenue sources. States with high poverty rates may struggle to replace lost provider tax revenue, potentially exacerbating existing healthcare inequities. Analysis of market patterns shows that while the policy seeks to close fiscal loopholes, it may inadvertently deepen structural disparities in healthcare access. Federal policymakers argue for uniformity in cost-sharing, but the diverse Medicaid program designs across states complicate this goal. As further guidance is expected from CMS, the market awaits clarity on how these regional challenges will be addressed, with early indications suggesting a need for tailored state-level strategies.

Forecasting the Future: Medicaid Market Projections

Emerging Trends in Federal-State Dynamics

Looking ahead, the provider tax overhaul is a clear indicator of a broader trend toward reduced federal Medicaid spending and increased state responsibility. The One Big Beautiful Bill Act also introduces adjacent reforms, such as work requirements for beneficiaries and limits on state-directed payments, pointing to a comprehensive shift in policy direction. Market forecasts suggest that states may face heightened pressure to innovate, potentially leveraging technology for budget forecasting or exploring public-private partnerships. Economic factors like inflation could further complicate funding efforts, while regulatory uncertainty—stemming from CMS plans for additional rulemaking—adds another layer of complexity. The market is likely to see a push for exemptions or delays from state leaders, with advocacy groups poised to challenge policies that threaten care access.

Strategic Shifts for Stakeholders

Projections for the Medicaid market highlight a pivotal moment for stakeholders to adapt to a leaner fiscal environment. States are expected to pivot toward alternative funding mechanisms, with early data indicating a rise in targeted fees or sin taxes as potential stopgaps. Providers, especially in rural and underserved areas, may need to streamline operations or seek new reimbursement models to weather reduced payments. Market analysis also anticipates an uptick in lobbying efforts as states and healthcare entities push for federal flexibility during the transition period from 2025 to 2028. While federal savings are a clear win for national budgets, the projected strain on local healthcare systems could lead to long-term market instability if not carefully managed. The balance between cost control and care delivery remains a critical point of contention in these forecasts.

Reflecting on the Market Shift: Strategic Pathways Forward

Looking back on the analysis, the CMS guidance released on November 17 marked a transformative chapter for the Medicaid funding market. The stringent provider tax restrictions, underpinned by the One Big Beautiful Bill Act, aimed to curb federal spending by over $200 billion while fundamentally altering state revenue strategies. Regional disparities and tight compliance deadlines underscored the uneven challenges faced by stakeholders, with rural providers and high-poverty states bearing a heavier burden. As the dust settled, the projected trends pointed to a market grappling with innovation under pressure. Moving forward, states were encouraged to explore diverse funding avenues, such as public-private collaborations, while providers needed to prioritize operational efficiency. Federal engagement remained essential to refine guidance and mitigate unintended impacts on care access, ensuring that fiscal reforms did not erode the healthcare safety net.