The healthcare industry stands at a pivotal moment, grappling with unprecedented challenges and opportunities driven by aging populations, intricate regulatory frameworks, and rapid technological advancements that reshape care delivery. Within this complex environment, hospital administration and operational expertise have risen to prominence as the silent yet indispensable forces ensuring the sector’s stability and progress. Far removed from the clinical spotlight, these non-clinical roles manage critical functions like financial oversight, compliance with stringent laws, and the seamless integration of innovative tools. As hospitals strive to balance cost efficiency with high-quality care, the strategic importance of skilled administration cannot be overstated. Investing in this area represents not just a financial opportunity but a chance to support the very backbone of healthcare delivery. This article delves into the compelling reasons why focusing on hospital administration expertise at this juncture is a timely and impactful decision for forward-thinking investors.

The Critical Role of Operational Mastery

Hospital administration serves as the linchpin of effective healthcare systems, far beyond mere clerical duties. It encompasses a broad spectrum of responsibilities, from managing tight budgets to ensuring smooth patient flow through facilities. Administrators are tasked with navigating the labyrinth of regulations, such as those mandated by the Health Insurance Portability and Accountability Act, while simultaneously driving operational efficiencies. Their work directly influences a hospital’s ability to deliver care without financial strain, as they identify areas of waste and implement streamlined processes. In an era where healthcare providers face relentless pressure to maintain quality amid shrinking margins, the expertise of administrative professionals becomes a cornerstone of success. This makes the sector a compelling focus for investment, as the demand for such skills continues to grow in response to systemic challenges.

Moreover, the impact of operational expertise extends to shaping patient experiences and outcomes indirectly. Efficient administration ensures that resources are allocated effectively, reducing wait times and enhancing service delivery. For instance, optimized scheduling systems prevent bottlenecks, while robust financial management secures funding for critical equipment. These behind-the-scenes efforts often go unnoticed by the public, yet they are vital for sustaining a hospital’s reputation and functionality. As healthcare systems worldwide grapple with increasing complexity, the need for specialized administrative talent has never been more pronounced. Investors who recognize this trend can position themselves to support an area that underpins the entire industry, reaping benefits from its steady and essential nature.

Unpacking the Market’s Robust Growth

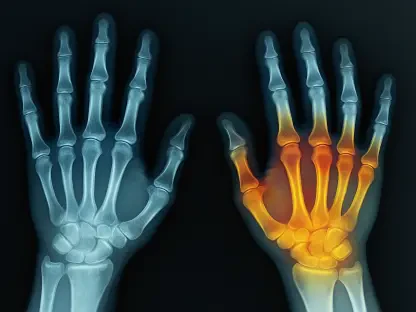

The financial landscape of hospital services presents a striking case for investment, with the U.S. market alone projected to reach an impressive $3.79 trillion by 2033, growing at a consistent rate of 4.85% annually. This expansion is propelled by undeniable demographic shifts, including an aging population that requires more frequent and specialized care. Additionally, the rising incidence of chronic conditions demands sustained healthcare engagement, while patient preferences shift toward outpatient settings and home health services. Notably, the home health segment is experiencing remarkable growth of 10–12% each year, driven by innovations that make remote care more accessible. For those considering where to allocate capital, this sector offers a rare combination of scale and resilience, capable of weathering economic fluctuations.

Beyond sheer numbers, the growth trajectory reflects deeper systemic trends that favor non-clinical expertise. The move toward outpatient and ambulatory care reduces the burden on traditional hospital infrastructure, but it increases the need for sophisticated administrative systems to coordinate dispersed services. Administrators play a pivotal role in ensuring these transitions are seamless, managing logistics and maintaining quality standards across varied settings. This evolving dynamic underscores the long-term potential of investing in operational capabilities, as they are integral to adapting to new care models. With such strong market indicators and structural shifts, the hospital administration sector stands out as a fertile ground for sustained financial returns.

Technology’s Transformative Impact

The integration of technology into hospital administration marks a revolutionary shift, opening up significant avenues for investment. Platforms operating on a Software-as-a-Service model, such as Epic Systems and Athenahealth, are redefining how administrative tasks are handled, from managing electronic health records to streamlining billing processes. These tools alleviate the burden of repetitive tasks, allowing staff to focus on strategic priorities. The cost-saving potential is substantial, with AI-driven solutions automating complex processes like claims processing and achieving reductions of up to 30%. For investors, this digital transformation represents a high-growth opportunity, as technology continues to reshape the operational landscape of healthcare.

Furthermore, the adoption of advanced tech solutions addresses critical pain points in hospital management, enhancing overall efficiency. Artificial intelligence not only speeds up administrative workflows but also provides predictive insights that aid in resource planning. Telemedicine platforms, integrated through administrative oversight, expand access to care while reducing overhead costs. However, the reliance on technology also introduces risks, such as cybersecurity threats that can disrupt operations. Despite these challenges, the momentum behind digital tools in administration is undeniable, making it a dynamic area for capital deployment. Investors who target tech-driven administrative solutions can tap into a segment that promises both innovation and scalability.

Diverse Investment Pathways

The realm of hospital administration offers a spectrum of investment opportunities, catering to varying risk appetites and strategic goals. Healthcare exchange-traded funds provide a relatively low-risk entry point, delivering diversified exposure to the sector’s growth. These funds are particularly appealing for those prioritizing stability over rapid gains, as they mitigate the volatility associated with individual stocks. On the other hand, private equity investments focus on driving efficiency through consolidation of healthcare providers and integration of proprietary technologies, offering higher potential returns alongside increased risk. Each option allows investors to engage with the non-clinical side of healthcare in a way that aligns with their financial objectives.

Additionally, tech-centric investments in Software-as-a-Service platforms present a unique proposition for those captivated by the digital revolution in healthcare. These platforms, with their scalable models and recurring revenue streams, are at the forefront of administrative innovation. They enable hospitals to outsource complex tasks, reducing costs while maintaining operational rigor. Yet, investors must remain mindful of challenges like cybersecurity vulnerabilities that could impact returns. By carefully weighing these factors, capital can be directed toward avenues that best match long-term visions, whether through broad-based funds or targeted tech solutions. The diversity of approaches ensures that hospital administration remains an accessible and adaptable investment frontier.

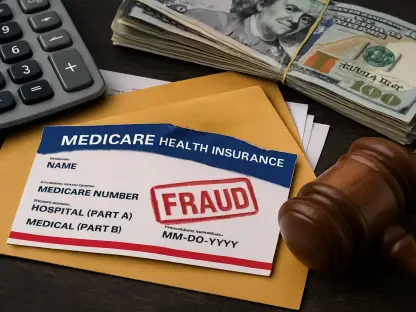

Tackling Industry-Wide Hurdles

Hospitals confront a myriad of obstacles that only skilled administration can effectively address, highlighting the urgency of investment in this area. Cost containment remains a perennial issue, as providers strive to deliver top-tier care under tight financial constraints. Administrators are instrumental in devising strategies that trim excess spending without compromising service quality. Regulatory landscapes, shaped by entities like the Centers for Medicare & Medicaid Services, add layers of complexity that demand specialized knowledge to ensure compliance. The expertise required to navigate these challenges positions administrative roles as critical assets, worthy of financial backing to bolster healthcare’s operational framework.

Equally pressing is the shift toward value-based care, a model that emphasizes patient outcomes over service volume, necessitating a complete rethinking of operational approaches. Administrators lead the charge in aligning hospital practices with these new priorities, implementing systems that track and improve care metrics. Labor shortages in non-clinical roles further complicate the situation, potentially inflating costs and straining resources. Investing in administrative expertise means supporting the professionals who turn such hurdles into opportunities for growth and efficiency. This focus not only addresses immediate needs but also fortifies hospitals against future uncertainties, ensuring they remain competitive and effective.

Building a Future on Stability

Hospital administration distinguishes itself as an investment area through its inherent durability and alignment with enduring trends. Demographic realities, such as an expanding elderly population, guarantee a steady demand for healthcare services, and by extension, the administrative systems that support them. Unlike industries prone to sharp cyclical swings, non-clinical healthcare offers a buffer against economic volatility, providing a stable foundation for capital growth. The emphasis on operational efficiency and technological integration further aligns with the sector’s long-term goals, making it a prudent choice for those seeking lasting impact.

Reflecting on the strides made in this domain, it’s evident that past investments in administrative expertise have yielded tangible improvements in healthcare delivery. Hospitals that prioritized operational talent navigated regulatory shifts and cost pressures with greater agility, setting a precedent for future success. The next steps for stakeholders involve identifying specific niches within administration—be it technology adoption or regulatory compliance—where targeted funding can drive outsized results. As the industry continues to evolve, a commitment to bolstering non-clinical capabilities will remain a cornerstone of sustainable progress, offering both financial returns and societal value.