Imagine a world where vascular implants don’t just act as temporary fixes but actually help the body heal itself, transforming into natural tissue over time. This vision is becoming reality thanks to Xeltis, a Netherlands-based medical technology innovator that recently secured an impressive €47.5 million ($55.1 million) in funding to push its groundbreaking solutions forward. Focused on patients with end-stage renal disease (ESRD) who depend on hemodialysis, Xeltis is introducing a game-changer with its vascular access graft called aXess. This isn’t just another medical device; it’s a step toward redefining how vascular challenges are tackled. With this substantial financial backing, the company is gearing up to commercialize its technology, expand globally, and address critical gaps in patient care. What makes this development so exciting is not just the funding, but the potential to improve countless lives through cutting-edge science and a commitment to regenerative medicine that could set a new standard in the industry.

Securing a Financial Powerhouse for Growth

Xeltis’ latest funding round, totaling €47.5 million, stands as a powerful endorsement of its mission to revolutionize vascular implants. Anchored by a hefty €37.5 million from the European Investment Bank through the European Commission’s Invest EU program, alongside €10 million from existing backers like EQT and Invest-NL, this investment reflects deep confidence in the company’s trajectory. It’s not merely about the money; it’s about the validation from major institutions that see Xeltis as a leader in addressing unmet needs for hemodialysis patients. This capital injection is poised to fuel the commercialization of their flagship product, ensuring it reaches those who need it most. Moreover, the funds will enable scaling up production facilities and assembling a skilled team to navigate the complex journey from innovation to market. This financial milestone isn’t just a number—it’s a catalyst for turning promising technology into tangible, life-changing outcomes on a global stage.

Beyond the immediate impact, this funding sets Xeltis on a strategic path to solidify its standing in the medical tech arena. The resources will support not only the rollout of their vascular access graft but also the groundwork for penetrating competitive markets. Think about the logistics: expanding manufacturing capacity means meeting demand efficiently, while hiring specialized talent ensures every step of the commercialization process is handled with expertise. Additionally, this backing from reputable investors sends a signal to the industry that regenerative solutions are not a distant dream but a viable, investable reality. It’s a vote of confidence that could inspire further innovation across the sector. As Xeltis leverages this financial muscle, the focus remains on delivering solutions that prioritize patient outcomes over mere profit, aligning with a broader movement toward sustainable healthcare advancements that could reshape how vascular conditions are managed for years to come.

Innovating with Endogenous Tissue Restoration

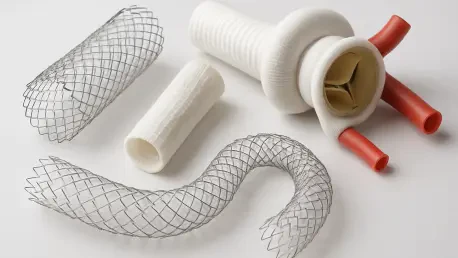

At the core of Xeltis’ transformative approach lies its proprietary Endogenous Tissue Restoration (ETR) technology, a true breakthrough in the realm of vascular implants. Unlike traditional grafts that often remain foreign objects in the body, prone to complications, the aXess graft works as a temporary scaffold designed to encourage the patient’s own body to regenerate natural blood vessels. Over time, this implant is absorbed and replaced by the patient’s tissue, offering a seamless integration that could redefine recovery. This isn’t just a technical tweak; it’s a fundamental shift aimed at solving persistent problems like thrombosis and stenosis, which plague conventional vascular access methods for ESRD patients. By harnessing the body’s innate healing power, Xeltis is crafting a solution that feels less like a medical intervention and more like a natural process, promising better long-term results for those on hemodialysis.

What makes ETR so compelling is its potential to reduce the burden on patients and healthcare systems alike. Traditional grafts often lead to frequent interventions due to blockages or infections, creating a cycle of hospital visits and added stress for individuals already managing chronic conditions. In contrast, the aXess graft aims to minimize these disruptions by fostering a biological replacement that aligns with the body’s own structure. This approach could mean fewer surgeries, less risk of complications, and a higher quality of life for patients. Furthermore, it showcases how innovation in medical technology is moving toward personalized, regenerative solutions rather than one-size-fits-all fixes. As Xeltis refines this technology, it’s paving the way for a future where implants don’t just patch problems but actively contribute to healing, setting a benchmark that could influence the broader field of vascular surgery.

Clinical Success and Global Ambitions

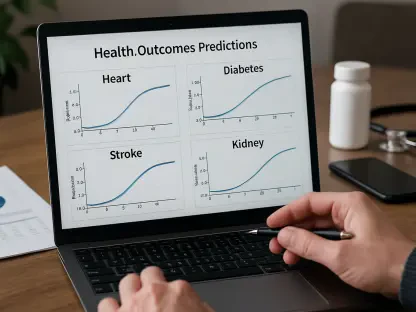

The promise of Xeltis’ technology isn’t just theoretical—it’s backed by solid evidence from a pivotal trial conducted across 18 European sites, wrapping up in September of this year. The results were striking: the aXess graft outperformed standard arteriovenous grafts in maintaining open, functional access for hemodialysis, a critical factor for patient survival. Not only did it show superior patency, but it also required fewer follow-up interventions and demonstrated impressive resistance to infections, a notorious challenge with traditional methods. These outcomes aren’t minor improvements; they represent a potential leap forward in care for ESRD patients who often struggle with the limitations of existing vascular access options. This clinical success underscores Xeltis’ ability to deliver on its vision, turning innovative ideas into real-world benefits that could alleviate suffering for thousands.

Building on this momentum, Xeltis isn’t content to limit its impact to Europe alone. The company has set its sights on the global stage, initiating a significant trial in the United States under the identifier NCT06494631, with interim data anticipated in 2026. This move signals a clear intent to address the needs of a broader patient population and tap into one of the largest healthcare markets in the world. Expanding internationally isn’t just about market share; it’s about ensuring that cutting-edge solutions reach as many people as possible, regardless of geography. Additionally, the strategic focus on global outreach ties into plans for enhanced production capabilities, ensuring supply can keep pace with demand. As Xeltis navigates these ambitious steps, the blend of clinical validation and international expansion paints a picture of a company determined to lead in transforming vascular care worldwide.

Expanding Horizons with a Diverse Portfolio

Xeltis’ vision extends far beyond a single product, showcasing a forward-thinking approach with a pipeline that includes other innovative implants like Xabg, a coronary artery bypass conduit tailored for patients with multi-vessel atherosclerotic coronary artery disease. Currently under evaluation in clinical trials across the EU, early data on Xabg suggests promising performance, hinting at the versatility of the ETR platform to address varied vascular challenges. This isn’t merely about diversification for the sake of growth; it’s a deliberate effort to tackle a spectrum of conditions that impact millions, from kidney disease to heart disease. By applying its regenerative technology across different applications, Xeltis is demonstrating that its core innovation has the potential to become a cornerstone of modern vascular medicine, offering hope for comprehensive solutions in areas long overdue for advancement.

Moreover, this broader portfolio aligns perfectly with industry trends, as the vascular graft market is projected to nearly double in value to $1 billion by 2034, fueled by rising rates of chronic diseases and a growing demand for better surgical options. Xeltis is positioning itself at the forefront of this expansion, not just as a participant but as a potential leader in regenerative approaches that prioritize patient outcomes over temporary fixes. The development of implants like Xabg, alongside aXess, reflects a strategic mindset that anticipates future needs while addressing current gaps. It’s a bold stance, suggesting that the company isn’t just reacting to market demands but actively shaping the direction of medical technology. As these projects progress, Xeltis’ commitment to pushing boundaries could inspire a wave of innovation, encouraging others in the field to rethink what’s possible in vascular care.

Pioneering a Regenerative Future

Reflecting on Xeltis’ journey, the €47.5 million funding round marked a turning point, providing the means to bring revolutionary vascular solutions to life. The clinical triumphs of the aXess graft in European trials set a high bar, proving that regenerative technology could outperform traditional methods in meaningful ways. Looking ahead, the path forward involves not just sustaining this momentum but amplifying it through strategic steps like global trials and production scaling. Xeltis’ focus on expanding its portfolio with innovations like Xabg highlighted a broader vision for tackling diverse health challenges. For stakeholders and patients alike, the next moves should center on monitoring trial outcomes in markets like the United States, advocating for accessible pricing models to ensure widespread adoption, and fostering partnerships that accelerate regulatory approvals. These actions will be crucial in cementing Xeltis’ role as a trailblazer, ensuring that regenerative implants become not just an option, but the standard for future vascular care.