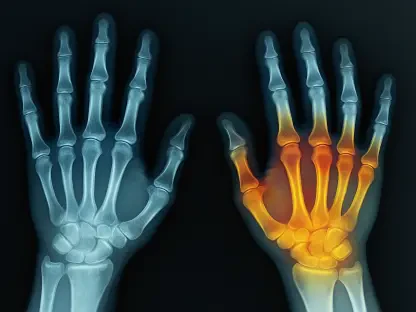

Caris Life Sciences Inc. (CAI) is capturing the attention of investors with its cutting-edge diagnostic technologies; however, there are considerations that need to be carefully weighed. Renowned for its pioneering work in medical testing, the company offers a unique single blood assay for comprehensive whole-exome and whole-transcriptome sequencing. This service places CAI at the forefront of the precision medicine revolution, catering both to clinical oncology needs and the pharmaceutical R&D sector. Observers have noted encouraging growth metrics, such as a notable 28% rise in revenue and a 31% increase in case volume. Despite these promising signs, challenges persist with respect to financial assurance and investor security, which paint a more complex picture of its investment potential. Acknowledging this dichotomy between innovation and uncertainty sets the stage for a deeper examination of CAI’s strategic prospects and potential risks.

Balancing Innovation with Caution

Caris Life Sciences Inc., known for its advancements in precision medicine, faces skepticism from investors due to not achieving profitability over its 17-year history. The company’s financial reports raise concerns, particularly a significant weakness in their internal controls, which could impact long-term financial health. With its incorporation in Texas, CAI encounters distinct challenges in protecting minority investor rights, as local regulations could negatively sway shareholder decisions, contributing to the investment’s overall risk.

Despite these hurdles, Caris Life Sciences remains a notable innovator, driving forward with AI-powered insights and diagnostic technologies that not only align with present healthcare trends but also cater to future demands in genomics and personalized medicine. Investors are advised to keep a close eye on CAI’s operational maneuvers and how it adapts to market shifts. While there’s potential for impressive returns, understanding and monitoring execution risks is crucial. This dual perspective promotes a cautious optimism, urging stakeholders to follow CAI’s development to evaluate its potential in the competitive landscape.