Recent developments in the international healthcare landscape have positioned Singapore as an emerging global leader in diagnostics. In the face of significant reductions in U.S. federal funding for health research, particularly affecting the National Institutes of Health (NIH), Singaporean diagnostic firms are stepping in to bridge the resulting gaps. The funding cuts by the U.S. government have resulted in the termination of critical NIH programs and projects, curbing research efforts into diseases such as Alzheimer’s, cancer, and various viral infections. Consequently, this shift is seen as a disruptive force in the global diagnostics market, opening a $100 billion opportunity that Singapore is poised to seize.

Singapore’s Strategic Position

Innovation and Precision Technologies

Singapore’s diagnostic firms are capitalizing on the abrupt U.S. funding reductions through their pioneering innovation, agility, and a keen focus on underutilized markets. The country’s strategic advantage is evident in various aspects, including its investments in cutting-edge precision technologies and artificial intelligence. For instance, Biolidics, a leading Singaporean firm, specializes in delivering rapid diagnostics on a large scale. The global market for rapid diagnostics tools is projected to reach significant heights, and Singaporean companies are well-equipped to meet the growing demand. Using AI-enhanced POC devices, firms like Biolidics can address urgent healthcare needs in both urban and remote settings across the U.S. Their devices are adaptable for various infectious diseases, including dengue and Zika, offering practical solutions where the U.S. healthcare infrastructure currently falls short.

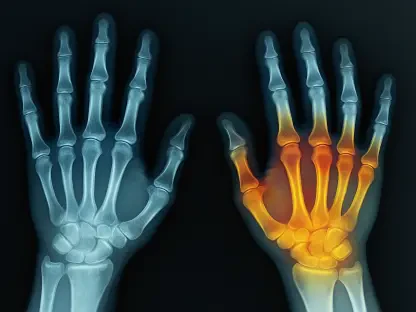

Genomic testing is another area where Singapore is making strides in health equity. As the U.S. grapples with a decline in genomics research programs, Singapore’s GenScript has become a prominent player in this domain. Leveraging AI to power affordable genomic testing kits, the firm provides essential services to underserved communities. These efforts have already proven successful in multiple Southeast Asian countries, and GenScript’s strategic alliances bolster their rapid scalability into the U.S. market. Their partnerships with regional governments and operational groundwork in Singapore render them a viable competitor in filling the genomic testing void left by the U.S.

AI-Based Infrastructure Optimizations

Parallel to its advancements in precision diagnostics, Singapore has fostered a prosperous environment for AI-driven infrastructure solutions. Under the ambit of Singapore’s “Smart Nation” initiative, firms such as VisEn Medical have emerged at the forefront of diagnostic workflow optimization. By applying AI, these firms are remarkably reducing laboratory costs—an attractive proposition for U.S. healthcare institutions reeling from diminished NIH funding. Their state-of-the-art cloud platforms offer a lifeline to U.S. hospitals navigating financial constraints, showcasing Singapore’s technical aptitude and strategic foresight in crafting innovative solutions.

Singapore’s focus on AI-driven improvements does not solely address financial burdens; it also aims to enhance efficiency and accuracy in diagnostics. As AI continues to shape various facets of medical technology, Singapore’s proactive investments and expertise allow local enterprises like VisEn Medical to deliver systems that optimize the diagnostic process comprehensively. This dual approach of lowering costs and boosting precision holds substantial appeal, particularly in a U.S. market constrained by budgetary limitations but striving for high-quality healthcare outcomes.

Navigating Challenges in a Shifting Landscape

Regulatory and Competitive Dynamics

Despite the promising outlook, Singapore faces several hurdles in navigating the U.S. market. Establishing a foothold involves overcoming regulatory barriers set by the U.S. Food and Drug Administration (FDA), which maintains rigorous standards for foreign medical products. Additionally, Singaporean firms contend with competitive pressures from established U.S. diagnostics companies, including major industry players like Roche and Abbott Laboratories. These entrenched corporations possess extensive resources and well-established market dominance, presenting considerable challenges for new entrants to the sector.

Policy uncertainties also pose a significant risk as ongoing legal challenges threaten to alter the landscape of federal budget allocations. The combination of these policy fluctuations and regulatory stringency necessitates that Singaporean firms adopt comprehensive risk management strategies. Balancing these challenges while highlighting competitive advantages will be essential to overcoming structural barriers and achieving sustained market penetration.

Investment and Strategic Positioning

In light of the evolving global diagnostics market, prudent investment strategies capitalize on Singapore’s burgeoning role. Investors are encouraged to consider core positions in tested entities such as GenScript, recognized for its adeptness in genomic testing. These positions can be complemented by investing in promising firms such as Biolidics and VisEn Medical, which boast innovative diagnostic technologies and untapped potential. Moreover, timely investments are advised to capitalize on the current geopolitical and healthcare shifts before market saturation takes hold.

Judicious investment strategies should focus on identifying undervalued opportunities in the diagnostic landscape, where Singaporean companies play an increasingly significant role. These strategies should also account for the evolving competition and legal environment, leveraging market insights to navigate challenges while optimizing returns. This proactive approach allows investors to align their interests with Singapore’s strategic goals as it rises to meet global healthcare needs.

Singapore’s Promise in Diagnostic Innovation

In recent times, Singapore has emerged as a rising global powerhouse in the field of diagnostics, influenced by changes in the international healthcare landscape. A substantial downturn in U.S. federal funding for health research has led to significant impacts on institutions such as the National Institutes of Health (NIH). These financial constraints have forced the halting of crucial NIH programs and projects aimed at researching diseases like Alzheimer’s, cancer, and a variety of viral infections. The slack in research due to U.S. funding cuts has created a void in the global diagnostics market estimated to be worth $100 billion. Singaporean diagnostic companies are stepping up to fill this gap, highlighting the nation’s growing presence in global healthcare innovation. As the U.S. scales back its investment, Singapore sees the opportunity to extend its influence and potentially transform market dynamics, becoming a key player in advancing diagnostic technology amidst global shifts.