The healthcare private equity landscape irrevocably shifted in 2025, culminating in a seismic $190 billion in deal value that sent ripples across the entire industry, signaling a new era of investment intensity. This massive influx of capital is not merely a financial footnote; it represents a powerful force actively shaping the future of healthcare delivery, accelerating technological adoption, and redefining the standards of patient care. The following analysis dissects the key data from 2025’s historic performance, explores the high-growth sectors fueling this momentum, examines future market forecasts, and identifies the core strategies required for success in this increasingly competitive environment.

Anatomy of a Record-Breaking Year

The Data Driving the 2025 Surge

The monumental scale of 2025 was meticulously documented in a landmark Bain & Company report, which painted a picture of unprecedented activity. The headline figure of $190 billion in total deal value was complemented by 445 buyouts—the second-highest volume on record—and an estimated $156 billion in exit value, indicating a healthy and fluid market. This surge underscores a profound investor confidence in the long-term resilience and growth potential of the healthcare sector.

A critical factor behind this record-breaking figure was the prevalence of large-scale transactions. Deals valued at $1 billion or more became a defining feature of the year, contributing significantly to the total value. This trend was not confined to a single region; robust market activity was observed across geographies, with a particularly strong resurgence of large deals in North America and sustained high-level investment across Europe. This global dynamism highlights a widespread recognition among investors of the transformative opportunities available within healthcare.

Spotlight on High-Growth Sectors

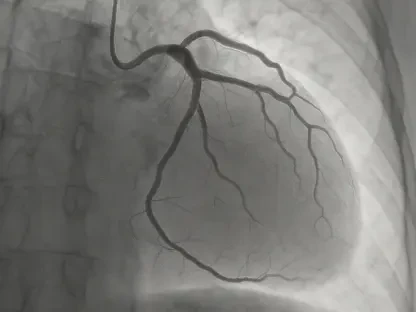

The flow of capital in 2025 was highly targeted, with Health IT and Medtech emerging as the primary catalysts for growth. These sectors attracted immense interest due to their potential to address systemic inefficiencies, improve patient outcomes, and generate substantial returns. Investors demonstrated a clear preference for technology-enabled solutions that promise to modernize the healthcare ecosystem from the ground up.

The boom in Health IT was particularly striking, with investments doubling to an estimated $32 billion. This capital was directed toward high-growth niches such as advanced analytics, workforce optimization tools, and integrated platform solutions that enhance interoperability. Similarly, the Medtech sector saw its deal value nearly double to $33 billion, a reflection of strong investor confidence in proven value-creation strategies centered on revenue growth and margin expansion. This targeted investment signifies a strategic shift toward technologies that deliver both clinical and financial value.

Expert Insights on Market Nuances

While the overall market soared, analysis from Bain & Company revealed divergent trends within the healthcare provider space. Deal value in this segment surged by an impressive 57%, a rise attributed not to a greater number of transactions but to the execution of higher-value deals. This indicates a strategic move by investors toward acquiring larger, more established provider platforms with significant potential for consolidation and operational improvement.

In contrast, investment in physician groups experienced a notable decline as a share of provider transactions. This cooling of interest was largely driven by post-COVID headwinds, including persistent labor shortages and mounting reimbursement pressures that have squeezed margins and complicated growth forecasts. However, the report emphasizes that opportunities persist for investors who can navigate these challenges. Innovative models focused on value-based care, integrated delivery systems, and strategic partnerships with ancillary services continue to present viable and attractive pathways for investment.

The Road Ahead: Forecast and Strategy for 2026

Looking ahead, the outlook for healthcare private equity remains decidedly optimistic, with experts forecasting another active year. Market activity is expected to be fueled by a confluence of factors, including an increase in public-to-private transactions, a steady stream of corporate carve-outs, and a robust environment for sponsor-to-sponsor deals. These drivers suggest that the high-velocity deal-making of 2025 is poised to continue.

Health IT, in particular, is identified as a prime area for generating returns. The industry’s ongoing need for solutions that enable workflow digitization, ensure data interoperability, and support the transition to value-based care models creates a fertile ground for investment. As healthcare systems continue to modernize, the demand for sophisticated technological infrastructure will only intensify. The central challenge for investors, however, will be navigating the intense competition for quality assets. In this crowded field, those with clear, effective, and well-executed value-creation playbooks will be best positioned for success.

Conclusion: Key Takeaways for a Competitive Future

The record-setting performance of 2025 was a definitive statement on the strategic importance of the healthcare sector to private equity. This historic year was fundamentally driven by sophisticated, forward-looking investments in Health IT and Medtech, which are now at the forefront of the industry’s evolution.

The trend’s significance extended beyond mere financial metrics; it confirmed that private equity has become a primary engine of change, actively reshaping the operational and technological foundations of healthcare. The capital deployed in 2025 is now at work, accelerating innovation and driving efficiency across the ecosystem. In the high-stakes environment that has emerged, success hinged not just on identifying assets but on possessing the strategic clarity and a well-defined plan to create tangible, lasting value.