The recent transition of Omada Health to a publicly traded company marks a pivotal moment in the evolving narrative of digital health. This is not an isolated event but rather indicative of a shift toward renewed interest in this sector’s public offerings. The industry’s landscape, which experienced a lull in public market activity, seems to be reawakening with Omada Health’s Initial Public Offering (IPO) on the Nasdaq. Following closely on the heels of Hinge Health’s public listing, Omada’s IPO represents more than just a financial milestone; it is emblematic of the warming sentiment toward digital health solutions. Despite the unpredictable nature of recent years, signaling a new chapter where innovation and chronic condition management take center stage in public investment portfolios presents a promising yet complex canvas for the future.

Omada Health: Pioneering Public Markets

A Strategic Leap into IPO

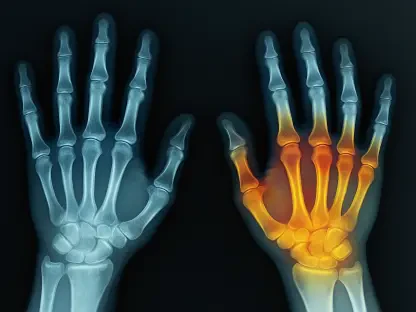

Omada Health’s decision to go public is as much strategic as it is a signal of its confidence in navigating the volatile waters of public markets. Founded in 2011, Omada has carved a niche in chronic condition management through digital therapeutics targeting diseases such as diabetes and hypertension. Equipped with connected devices like digital scales and blood pressure cuffs, the company enables efficient patient monitoring and personalized treatment plans. By raising $150 million with its IPO, Omada set its initial share price at $19, which quickly surged to an opening price of $23 per share. This leap is reflective of investor confidence, rooted in Omada’s innovative business model, scalable solutions, and substantial growth potential within an expanding healthcare market landscape.

The context of Omada’s IPO is critical. Historically, digital health companies have faced a roller-coaster ride in attracting investor interest, notably through public offerings. After an effusive market surge in 2021, marked by numerous special purpose acquisition company (SPAC) mergers, companies found themselves grappling with adverse economic conditions. Many struggled to sustain post-IPO optimism, casting a shadow on the prospects of others contemplating a similar path. However, Omada’s traction in the public domain could be setting a precedent, invigorating cautious optimism among investors and innovators alike. This development highlights the significance of preparedness, which hinges on operational maturity, robust financials, and a strategic understanding of market dynamics.

Investor Sentiment and Market Confidence

Omada Health’s foray into the public markets reflects a broader, albeit cautious, investor sentiment toward digital health’s potential. Investors are assessing these IPOs with a discerning eye, evaluating both current market conditions and long-term viability. The successful transition of Omada and Hinge Health into public companies has sparked interest across the sector, promising a renaissance if conditions are appropriate. While the landscape has been challenging, marked by economic volatility and global geopolitical tensions, the credentials of these digital health companies offer a compelling narrative of adaptation and resilience. Omada’s IPO provides a tangible signal of market confidence, potentially influencing other digital health firms to reconsider their readiness and timing for similar ventures.

This renewed investor interest in digital health IPOs underscores the importance of credibility and a results-driven ethos. Such companies are aligning their strategies with broader market expectations, emphasizing scalable solutions that address chronic health needs. Omada’s ability to manage chronic conditions effectively, thereby reducing healthcare costs while enhancing patient outcomes, is a critical factor in its favorable market reception. It highlights an emerging trend where digital therapeutics are becoming integral to healthcare delivery, providing both accessible and proactive solutions to prevalent health challenges. The evolution of this sector will depend significantly on the sustained performance and adaptability of companies like Omada, both within their operational models and in responding to investor expectations.

The Broader Canvas of Digital Health IPOs

Economic Conditions and Timing

The IPO landscape is inherently influenced by prevailing economic conditions, which play a pivotal role in shaping public offerings’ success. Recent years have seen technology companies delay public listings, mindful of market instability exacerbated by geopolitical tensions. Industry analysts emphasize that stable economic conditions serve as fertile ground for successful IPOs. This principle guides digital health companies contemplating the transition to public markets. Edward Best, co-chair of the capital markets practice at Willkie Farr & Gallagher, highlighted the need for a delicate balance between readiness and timing in public ventures. For digital health companies, the synchronization of internal readiness with external market stability becomes the linchpin for a successful public market debut.

Digital health’s growing importance in the global healthcare ecosystem suggests that companies entering the IPO arena must navigate an array of challenges. These challenges extend beyond mere financial considerations to encompass technology adoption, regulatory landscapes, and competitive dynamics. As companies like Omada Health pave the way, their experiences offer valuable insights into managing these complexities effectively. Their strategic decision-making and commitment to innovation shed light on how digital health organizations can position themselves for success. Furthermore, they illustrate the intricacy of harmonizing technological advancement with investor and patient expectations, ultimately fostering an environment conducive to growth and stability.

Influences and Implications

Omada Health’s IPO achievement, coupled with Hinge Health’s successful market entry, serves as a potential catalyst for further developments in the digital health domain. These milestones have sparked a renewed discourse among industry stakeholders, creating an environment ripe for strategic evaluations. While some firms may find themselves reassured by Omada’s journey, others may use this opportunity to reevaluate their own paths. Prospective public offerings are likely to undergo scrutiny against a backdrop of global economic uncertainty, prompting companies to enhance their operational and financial readiness meticulously. This approach to IPO readiness could yield significant advantages as organizations navigate the complex interplay of economic fluctuations, investor sentiment, and technological innovation.

Omada’s and Hinge’s trajectories are crucial indicators of the interplay between technological advancements and public market receptivity. They underscore the imperative for digital health entities to refine their approaches, aligning innovation with strategic planning to leverage the benefits of going public. The implications extend beyond financial transactions, as these IPOs represent a broader shift toward recognizing digital health as a pivotal component of future healthcare delivery. By capitalizing on opportunities for growth and collaboration, organizations can chart a course that not only addresses current market trends but also anticipates long-term shifts in healthcare paradigms. These shifts herald a future where digital health continues to play an integral role in shaping healthier societies and driving innovation within the broader healthcare framework.

Shaping the Future of Digital Health

Omada Health’s move to go public is both strategic and a bold statement of its confidence in handling the unpredictable nature of public markets. Established in 2011, Omada specializes in managing chronic conditions via digital therapeutics, focusing on ailments like diabetes and hypertension. The company uses connected devices such as digital scales and blood pressure cuffs to facilitate effective patient monitoring and personalized care plans. With its IPO, Omada raised $150 million, setting an initial share price of $19, which rapidly jumped to $23 per share at opening—a testament to investor confidence in its innovative approach, scalable solutions, and growth potential within the expanding healthcare sector.

Understanding the context of Omada’s IPO is crucial. Digital health companies historically experience fluctuating investor interest, especially in the public sphere. After a market upswing in 2021, fueled by numerous SPAC mergers, many faced challenging economic circumstances post-IPO. Omada’s public traction now might pave the way for renewed optimism, underscoring the importance of operational readiness, sound financials, and strategic market insight.