The year 2025 has materialized not merely as another point on the calendar but as a crucible where the democratization of capital and revolutionary biological science are forging a new economic and social paradigm. This evolving landscape is driven by the maturation of alternative finance mechanisms, profound breakthroughs in personalized medicine, and the turbulent yet undeniable integration of cryptocurrency into the mainstream financial system. Together, these powerful forces are not just predicting the future; they are actively building a new reality where innovation is funded, developed, and adopted at an unprecedented and interconnected pace, setting the stage for the next decade of growth and disruption.

The Maturation of Alternative Finance

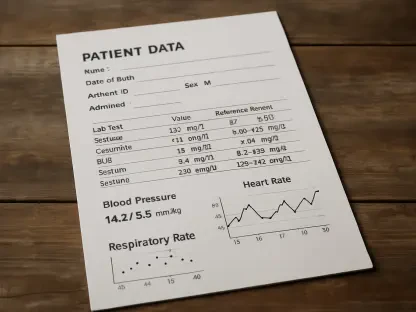

Crowdfunding has decisively transitioned from a nascent trend into an established and versatile component of the global financial ecosystem. Its enduring appeal, historically demonstrated by the dynamic activity in sectors like online gaming, now extends to a much broader spectrum of applications. This is most powerfully illustrated at the community level, where campaigns like the Görlitz Christmas Crowdfunding initiative have demonstrated an extraordinary capacity for civic engagement and localized impact. By successfully exceeding all its fundraising targets, the campaign enabled the complete funding of nine distinct community projects, showcasing how decentralized capital formation can empower grassroots movements and directly address local needs. This evolution highlights a fundamental shift, where financial power is becoming more distributed, allowing individuals and communities to support projects that align directly with their values and interests, bypassing traditional gatekeepers of capital.

This organic growth is now being reinforced by increasing formalization and institutional support, cementing crowdfunding’s legitimacy as a viable alternative to conventional financing. Governments are actively encouraging its adoption through initiatives like “Crowdfunding Grants,” which are available for business projects until early 2026 to support small and medium-sized enterprises. At the same time, the market has seen the rise of sophisticated investment platforms that are transforming the model into a structured vehicle for wealth creation. For instance, platforms like Sumar Inversión reportedly delivered an average return of 8.3% in 2025, building significant investor confidence reflected in an impressive 80% reinvestment rate. This high level of trust, combined with solid financial performance, signifies a model that has matured beyond simple fundraising into a credible and resilient investment class that offers both accessibility and attractive returns.

A New Frontier in Personalized and Sustainable Health

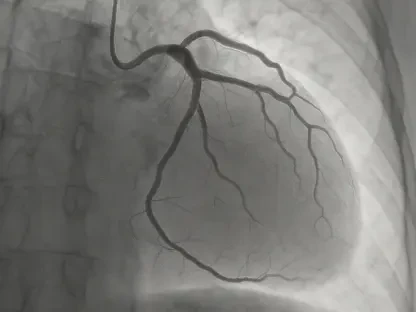

The biotechnology sector is experiencing a pivotal turning point, rapidly accelerating the translation of complex scientific research into tangible, real-world applications. The year 2025 is marked by a significant convergence of two core drivers that are reshaping healthcare. First is the maturation of gene editing and gene therapies, which are moving from experimental concepts into viable clinical treatments, offering unprecedented precision in treating genetic disorders. Second is the transformative impact of artificial intelligence, which is revolutionizing everything from medical diagnostics to the intricate processes of drug discovery. This powerful synergy is creating a feedback loop of innovation, enabling the development of highly personalized medical interventions that are tailored to an individual’s unique genetic makeup and disease profile, heralding a new era of proactive and predictive medicine.

Beyond personalized medicine, the biotechnology field is also at the forefront of tackling global sustainability challenges through groundbreaking innovation. While advanced treatments like CAR-T therapies continue to transform cancer care, the industry is simultaneously addressing their limitations, such as high costs and toxicity, by developing next-generation solutions like mRNA-based in vivo generation to make them safer and more accessible. This spirit of refinement is mirrored in the push toward a circular economy. A compelling example comes from Salmoss Biotech, a startup pioneering regenerative medicine by creating advanced bone implants from salmon-bone waste. This approach not only yields a high-value medical product but also provides an ingenious solution to industrial waste. Having been validated in over 360 surgical procedures, this technology embodies how biotechnology can create powerful synergies between human health and environmental stewardship.

The Duality of Digital Asset Integration

The cryptocurrency market is navigating a complex and often contradictory phase of its evolution, characterized by a simultaneous push toward mainstream acceptance and persistent, significant price volatility. The trajectory for Bitcoin in 2025 exemplifies this duality. On one hand, the asset has gained considerable mainstream momentum, buoyed by positive catalysts including a more favorable political stance and sustained capital inflows into regulated Bitcoin ETFs. However, this growing institutional and retail acceptance has not translated into price stability. Projections showed Bitcoin’s value experiencing notable weakness, ending 2025 near $88,000 after a dip of approximately 5 percent year-on-year. This decoupling of adoption from short-term price action suggests the market is entering a more mature and complex phase, where fundamental value propositions are beginning to outweigh speculative hype.

Ethereum’s journey through 2025 has been similarly defined by turbulence and resilience, marking a period of what could be described as strategic renewal. The network faced both sharp price swings in the broader market and significant internal challenges, including disputes within the Ethereum Foundation that culminated in leadership restructuring. Despite this period of intense pressure, Ethereum demonstrated remarkable fortitude and growth. The network not only weathered the storm but also succeeded in achieving a new all-time high, ultimately strengthening its overall market position. This ability to navigate internal and external stressors while continuing to innovate underscores a maturing ecosystem that is hardening its infrastructure and governance for long-term viability. The volatility, rather than signaling weakness, appears to be a catalyst for necessary adaptation and consolidation within the leading smart contract platform.

A Blueprint for Interconnected Innovation

The developments of 2025 provided a clear verdict on the future of innovation, where the lines between finance, technology, and health had irrevocably blurred. The maturation of crowdfunding platforms did more than just democratize investment; it created new pipelines for capital to flow directly into pioneering sectors like biotechnology, enabling ventures focused on sustainable and personalized solutions to secure funding outside of traditional venture capital. At the same time, the institutional embrace of digital assets, despite market volatility, began laying the groundwork for more efficient and transparent financial rails. This synergy demonstrated that progress was no longer siloed. Instead, it was driven by an interconnected ecosystem where financial innovation directly fueled scientific breakthroughs, which in turn generated new, valuable asset classes, creating a powerful, self-reinforcing cycle of growth and disruption.