In a significant challenge to the long-criticized practices that drive up prescription drug costs in the United States, the Federal Trade Commission (FTC) has finalized a landmark settlement with Express Scripts, one of the nation’s most powerful pharmacy benefit managers (PBMs). This agreement effectively allows the Cigna-owned company to withdraw from a major FTC lawsuit that accuses the PBM industry of systematically inflating the prices of essential medications like insulin. In return for its dismissal from the litigation, Express Scripts has committed to a sweeping overhaul of its business model, addressing many of the core issues that critics argue have made medications unaffordable for millions of Americans. The deal represents one of the most substantial regulatory interventions into the opaque world of drug pricing in recent history, setting a potential new standard for an industry under intense scrutiny from lawmakers and the public alike. The key provisions focus on delinking PBM profits from high drug prices and introducing unprecedented transparency.

A Fundamental Shift in Business Practices

The cornerstone of the settlement is a commitment by Express Scripts to fundamentally alter its revenue model by delinking its compensation from the list prices of pharmaceuticals. For years, the PBM industry has operated on a system of rebates negotiated with drug manufacturers. These rebates are often calculated as a percentage of a drug’s high wholesale acquisition cost, or list price. Critics, including the FTC, have long contended that this structure creates a perverse incentive for PBMs to favor more expensive drugs on their formularies—the lists of medications covered by a health plan—in order to secure larger rebates and, consequently, higher profits. This practice can sideline cheaper, equally effective alternatives, contributing to rising costs across the healthcare system. Under the new agreement, Express Scripts is mandated to cease giving preferential formulary placement to drugs with high list prices when chemically equivalent, lower-cost versions are available, a change aimed at realigning its business interests with the financial well-being of patients and health plan sponsors.

This restructuring of incentives is designed to translate directly into tangible savings for consumers at the pharmacy counter. The settlement stipulates that for its standard employer plans and all of Cigna’s fully insured health plans, Express Scripts must now calculate members’ out-of-pocket costs, such as copayments and deductibles, based on the net price of a medication. The net price represents the actual cost of the drug after all negotiated rebates, discounts, and other savings have been applied. This is a critical departure from the common practice of basing patient cost-sharing on the much higher, often artificially inflated, list price. By ensuring that the discounts PBMs negotiate are passed through to patients, this provision aims to shield consumers from shouldering a disproportionate share of drug costs. The FTC projects that this and other reforms contained within the settlement could collectively reduce patients’ out-of-pocket drug expenditures by as much as $7 billion over the next decade.

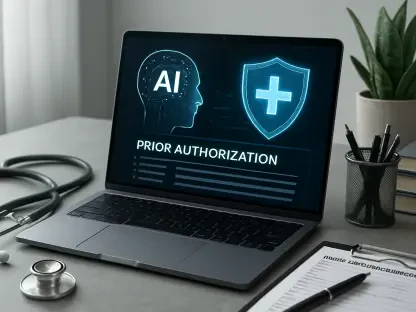

Mandating Transparency and Reshoring Operations

Another major facet of the agreement tackles the pervasive lack of transparency that has long defined the PBM industry. Express Scripts will now be required to disclose any payments, commissions, or kickbacks it provides to insurance brokers and consultants who advise employers on their choice of PBM. This measure is intended to expose and prevent potential conflicts of interest, ensuring that employers receive unbiased guidance when selecting a partner to manage their pharmacy benefits. Additionally, the company must furnish its employer clients with more detailed and comprehensive data on drug costs and overall spending. This increased flow of information is designed to empower employers, giving them the tools and insights needed to better understand and control their pharmaceutical expenditures. These requirements align with a broader push from federal agencies and legislators to force greater accountability and openness upon the PBM sector, which has historically operated with minimal public oversight.

In a particularly surprising and impactful component of the deal, the FTC has mandated that Express Scripts reshore its group purchasing organization (GPO), Ascent, from its current headquarters in Switzerland back to the United States. GPOs serve to consolidate the immense purchasing power of multiple PBMs, allowing them to negotiate even larger volume-based rebates from pharmaceutical manufacturers. By operating from an offshore location, GPOs like Ascent have been criticized for creating an opaque financial structure that can obscure the flow of rebate dollars and effectively sidestep U.S. regulatory authority. The FTC stated that bringing Ascent’s operations back to American soil will subject it to domestic laws and regulations, increasing oversight. Furthermore, the agency projects that this move will return an estimated $750 billion in economic activity to the country over a ten-year period, representing a significant repatriation of a key part of the pharmaceutical supply chain’s financial infrastructure.

The Ripple Effect on Pharmacies and the Industry

The settlement also directly addresses the financial precarity faced by many community pharmacies, which have struggled under complex and often unpredictable reimbursement systems. Express Scripts has agreed to transition its pharmacy reimbursement methodology to a more straightforward and transparent cost-plus model. Under this new framework, pharmacies will be paid based on the actual acquisition cost of a drug, supplemented by a pre-negotiated professional dispensing fee. This change is a significant departure from the current opaque systems, which can leave independent pharmacy owners uncertain about their revenue. While the specific rates were not detailed in the agreement, pharmacy advocacy groups such as the National Community Pharmacists Association have lauded the shift, arguing that it will provide the predictable and fair reimbursement necessary for these vital local healthcare providers to remain financially viable and continue serving their communities.

Despite the “landmark” designation from the FTC, industry analysts have pointed out that the immediate financial impact on Express Scripts and its parent company, Cigna, may be less severe than initially perceived. This is largely because the company was already in the process of proactively implementing many of these changes. For instance, Express Scripts had previously announced a move toward a rebate-free model called ClearNetwork and already offered cost-plus reimbursement options to its network of independent pharmacies. Consequently, the settlement largely serves to codify and accelerate a strategic direction the company had already embraced, likely in anticipation of future regulatory or legislative action. This proactive posture may have helped Express Scripts avoid more drastic outcomes, as the settlement includes no admission of wrongdoing and imposes no monetary penalties. With Express Scripts exiting the litigation, the FTC’s lawsuit now continues against the other two PBM titans, UnitedHealth’s Optum Rx and CVS’ Caremark, who will face mounting pressure to adopt similar reforms.

A New Precedent for Prescription Pricing

Express Scripts was given a clear timeline to implement the settlement’s provisions, with most of the required changes slated for completion by 2027. The full transition to the cost-plus pharmacy model, the new transparency requirements, and the complete reshoring of Ascent were mandated to be finished by 2028. Following this implementation phase, the company entered a ten-year monitoring period to ensure its strict compliance with the agreement. This settlement established a powerful new benchmark in the ongoing effort to reform the nation’s drug pricing system. While it directly impacted only one of the three dominant PBMs, its comprehensive terms created a clear template for future regulatory action and increased the pressure on its competitors to abandon long-standing business practices. The deal represented a significant step forward, shifting the industry conversation from whether reform was needed to how quickly it could be universally applied.