The intricate web connecting pharmaceutical manufacturers to patient medicine cabinets is quietly being rewoven as a landmark settlement threatens to expose the secretive financial mechanics driving America’s insulin crisis. For years, the rising cost of this life-saving medication has been a source of public outrage and political debate, with blame often directed at the opaque operations of industry middlemen. Now, with federal regulators zeroing in on Cigna’s Express Scripts, the entire pharmaceutical supply chain is on notice, prompting a critical examination of whether this legal pressure will finally translate into tangible relief for millions of Americans.

The PBM Power Play: Understanding the Gatekeepers of U.S. Drug Prices

At the center of the U.S. drug pricing system are pharmacy benefit managers (PBMs), entities that wield immense influence over which drugs are covered by insurance plans and how much patients ultimately pay. Initially created to process prescription claims and negotiate lower prices for health plans, their role has expanded dramatically. Today, they act as powerful intermediaries, managing formularies—the lists of approved medications—for insurers, large employers, and government programs, effectively deciding which treatments are accessible to patients.

This influence is consolidated among a small number of players. The “Big Three” PBMs—Cigna’s Express Scripts, CVS’s Caremark, and UnitedHealth’s Optum Rx—now control approximately 80% of all prescriptions filled in the United States. Such market concentration gives them unparalleled negotiating leverage with drug manufacturers, but critics argue it also creates significant conflicts of interest that can prioritize profits over patient affordability.

A Shifting Landscape: Trends and Forecasts in Drug Pricing

The Rebate Game: How PBMs Are Accused of Inflating Insulin Prices

A primary point of contention is the rebate system, a complex financial arrangement between PBMs and drug makers. In exchange for placing a manufacturer’s drug on a preferred tier of a formulary, PBMs receive a rebate, which is a percentage of the drug’s list price. This system is intended to create competition and drive down net costs for health plans.

However, the Federal Trade Commission (FTC) alleges that this model has had the opposite effect on insulin prices. The agency’s lawsuit claims that PBMs have an incentive to favor insulins with higher list prices because they generate larger rebates. Consequently, manufacturers may be discouraged from lowering list prices, as doing so could result in their products being excluded from formularies, leaving patients and their insurers to cover the inflated costs.

A Domino Effect?: Analyzing the Cigna Settlement and Its Potential Industry-Wide Impact

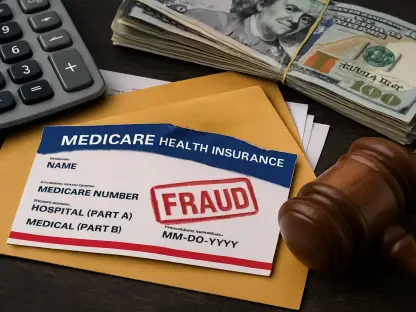

The recent move by the FTC to suspend its case against Cigna’s subsidiaries—including Express Scripts—to review a proposed consent agreement is a pivotal development. While the terms remain undisclosed, this action marks the first potential resolution in the sweeping lawsuit targeting the industry’s largest PBMs. It suggests a willingness on Cigna’s part to alter its practices to avoid a protracted legal battle with federal regulators.

This development could trigger a cascade of similar agreements across the industry. Shortly after the Cigna announcement, the FTC paused the entire case for two weeks, a move widely interpreted as an opportunity for CVS and UnitedHealth to enter parallel settlement negotiations. If all three major PBMs agree to new terms of conduct, it could fundamentally reshape the standards for transparency and competition in the drug pricing market.

Unraveling the System: The Core Challenges in Regulating PBM Practices

Regulating PBMs has historically been difficult due to the highly secretive nature of their operations. The specific terms of their rebate contracts and pricing models are often shielded as trade secrets, making it challenging for lawmakers and even their own clients to fully understand how money flows through the system. This lack of transparency obscures whether savings from rebates are being passed on to health plans and patients or retained as profit.

PBMs have consistently defended their business models, arguing they are a critical check on the power of pharmaceutical manufacturers and that they pass substantial savings back to their clients. In response to the FTC’s investigation, some have even countersued the agency, asserting that the government’s demands for information are overly broad and burdensome. This resistance highlights the formidable legal and political hurdles that stand in the way of comprehensive reform.

Under the Microscope: The FTC’s Crackdown on PBMs and Insulin Pricing

The FTC’s lawsuit and the subsequent Cigna settlement discussions do not exist in a vacuum. They are part of a much broader and intensified campaign of scrutiny from federal and state authorities aimed at reining in healthcare costs. For several years, lawmakers have introduced bipartisan legislation to mandate greater transparency and curb certain PBM practices, signaling a growing political consensus that the status quo is unsustainable.

This mounting pressure from multiple fronts has created a new operational reality for PBMs. The industry can no longer operate with the same level of opacity it once enjoyed. The combination of regulatory enforcement, legislative action, and public outcry has forced these powerful gatekeepers into a defensive position, compelling them to justify their role and demonstrate their value in a system under fire.

Beyond the Settlement: What’s Next for Insulin Affordability and PBM Oversight?

A finalized settlement with Cigna, and potentially others, would likely involve specific changes to business practices. These could include prohibitions on tying rebates to list price increases, requirements for greater transparency in negotiations, or mandates to pass a larger portion of rebates directly to clients and consumers. Such measures would aim to dismantle the misaligned incentives that regulators believe have driven up insulin costs.

However, a settlement is not a silver bullet for insulin affordability. The final price a patient pays is determined by a combination of factors, including the manufacturer’s list price, the insurance plan’s design, and pharmacy-level markups. While reforming PBM practices is a crucial step, achieving lasting relief for patients will require a more holistic approach that addresses pricing dynamics across the entire supply chain.

The Final Verdict: Will Patients See Relief at the Pharmacy Counter?

The prospect of a settlement between Cigna and the FTC represented a significant crack in the armor of the PBM industry. It validated many of the long-standing criticisms regarding the role of rebates in inflating drug costs and signaled that regulators were prepared to enforce meaningful change. The move suggested that the era of operating behind a veil of commercial secrecy was drawing to a close.

Ultimately, the Cigna settlement did not instantly resolve the insulin affordability crisis, but it marked an undeniable turning point in the oversight of pharmacy benefit managers. The agreement set a new precedent for accountability, forcing the industry’s most powerful players to confront their role in a system that had failed millions of patients. The path forward remained complex, but the foundation for a more transparent and equitable drug pricing landscape had been firmly established.