With a unique background in the systems and technology that underpin modern healthcare, James Maitland offers a critical perspective on the operational strategies of major health insurers. His work provides insight into how data and process optimization are used within complex regulatory environments like Medicare. Today, we delve into the findings of a recent Senate investigation into Medicare Advantage, exploring the tension between its intended purpose and its real-world application as a profit engine. We’ll discuss the mechanics of risk adjustment, how insurers navigate the fine line between compliance and “gaming the system,” and what the future may hold for the program as regulators increase their scrutiny.

Some insurers send nurses to members’ homes for health assessments, while coders perform secondary chart reviews. What is the stated goal of these activities, and how might they be used to maximize risk scores, potentially blurring the line between patient care and revenue generation? Please share some specifics.

On the surface, these programs are presented as proactive, patient-centered care. The idea of sending a nurse to a senior’s home sounds wonderful—it’s about getting a holistic view of their health in their own environment. The official goal is to identify and manage chronic conditions early. However, when you look at the operational mechanics, a second, more powerful incentive emerges. Every single diagnosis that nurse or coder can identify and add to a patient’s chart directly increases the “risk score” assigned to that patient. That score is what determines the payment from the federal government. So, a home visit isn’t just a wellness check; it becomes a data-mining expedition. A coder reviewing a chart isn’t just ensuring accuracy; they are hunting for unlisted conditions that can boost reimbursement. The line gets incredibly blurry when the financial reward for finding a diagnosis is so direct and substantial. It transforms a healthcare interaction into a transaction designed to maximize revenue.

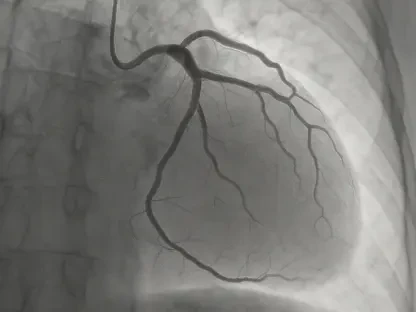

Providers are sometimes guided to diagnose serious conditions like dementia or chronic obstructive pulmonary disease without standard, conclusive tests. What institutional pressures lead to this, and what are the step-by-step consequences for both a patient’s medical record and the insurer’s reimbursement from the government?

The institutional pressure is systemic and subtle. It’s not usually a manager telling a doctor to commit fraud. Instead, the technology and workflows that insurers provide to physicians are designed to prompt these diagnoses. A doctor might see a note in the system suggesting a diagnosis of COPD is possible based on a prescription, even without a standard lung function test. Step-by-step, the process is alarmingly simple. First, the insurer’s data analytics identify an opportunity—a patient on certain drugs or with related symptoms. Second, the physician is prompted through their software to consider adding a high-value diagnosis like dementia or atrial fibrillation. Third, once the code is entered, it’s submitted to the Centers for Medicare & Medicaid Services (CMS). The immediate consequence is that the insurer’s payment for that patient goes up. The patient, however, is now saddled with a serious diagnosis on their permanent medical record, one that was made based on probability rather than actual testing. This can affect their future care and is a deeply concerning byproduct of a system incentivized to find sickness.

The risk adjustment process was designed to pay more for sicker patients to prevent ‘cherry-picking.’ How has this system, intended to protect vulnerable members, evolved into what some call a “major profit-centered strategy”? Could you walk us through the mechanics of that shift?

The original intent was absolutely noble. Regulators knew that if they paid a flat rate for every senior, insurers would have a massive incentive to only enroll the healthiest, least expensive people, leaving the sickest and most vulnerable behind. So, risk adjustment was created to pay more for sicker patients, neutralizing that incentive. The shift happened when insurers, particularly a giant like UnitedHealth with its vast resources, realized they didn’t have to passively accept a patient’s documented risk. They could actively manage and inflate it. The mechanics involved building a sophisticated infrastructure—a workforce of nurses and coders, backed by powerful technology—all aimed at one goal: capturing the maximum number of diagnosis codes. It’s no longer just about getting paid fairly for the sick patients you have; it’s about making every patient appear as sick as permissibly possible on paper. The entire focus pivoted from managing healthcare costs to maximizing risk-based revenue, turning a protective shield for patients into a sword for profits.

Insurers often state their coding practices comply with CMS requirements and pass government audits. How can activities described by critics as “gaming the system” still fall within regulatory compliance? Please explain the gray areas or potential loopholes that might exist in the current oversight framework.

This is the crux of the issue. Insurers aren’t necessarily breaking the law; they are exploiting the rules as written. The gray area lies in the distinction between documenting a condition and actively treating it. CMS rules require accurate and thorough coding, so an insurer can argue that sending a nurse to find every possible diagnosis is simply good diligence. The loophole is that the system often rewards the code itself, regardless of the severity or the treatment plan. For instance, the guidelines might allow for a diagnosis of opioid dependence for a patient on prescribed opioids, even if they aren’t being treated for addiction. As long as they can point to a justification in the chart that fits the technical definition of the code, they can claim compliance. They can pass audits because they are meticulously following the letter of the law, even while completely subverting its spirit. It’s a masterful navigation of regulatory ambiguity.

Federal regulators recently stopped paying for thousands of diagnosis codes to curb upcoding, impacting insurer revenues and stock prices. What further actions might regulators take, and how will major insurers likely adapt their business models in response to this increased scrutiny?

The decision by the Biden administration to stop payments for over 2,000 diagnosis codes was a significant shot across the bow. It showed regulators are moving from auditing to actively changing the payment rules to close loopholes. The next steps will likely involve even more aggressive actions. We could see stricter requirements for how certain high-value conditions are diagnosed, demanding more than just a note in a chart and requiring proof from specific tests. We may also see more intense investigations, like the current DOJ probe into UnitedHealth. In response, these massive insurers are already feeling the heat, with stock prices plummeting after disappointing results. They will adapt by becoming even more sophisticated, using their data and technology to find the next set of profitable loopholes. At the same time, you’re seeing a reshuffling of executives and public promises of reform. It’s a two-pronged strategy: adapt their systems to the new rules while publicly working to regain trust. It’s a high-stakes chess match, and the financial health of these $400 billion giants is on the line.

What is your forecast for Medicare Advantage?

My forecast is for a period of significant turbulence and transformation. The program is incredibly popular with seniors, so it isn’t going anywhere. However, the era of easy money through aggressive risk score optimization is ending. I predict we will see a sustained crackdown from regulators, leading to compressed profit margins for insurers and forcing a fundamental shift in their strategy. They will be compelled to move away from financial engineering and back toward the original promise of Medicare Advantage: delivering better health outcomes at a lower cost through genuine care coordination and innovation. This won’t be a smooth transition. There will be intense lobbying and legal battles as insurers fight to protect their revenue streams. Ultimately, Medicare Advantage is at a crossroads. It will either evolve into a more tightly regulated, utility-like program focused on care efficiency, or the cycle of finding and closing loopholes will continue. I believe the regulatory tide has turned for good, and the program will be forced to become more accountable and transparent in the years ahead.