With us today is James Maitland, a leading analyst whose work focuses on the intricate intersection of U.S. healthcare policy, economics, and legislative action. As millions of Americans face the abrupt end of enhanced Affordable Care Act subsidies, we’ll delve into the political gridlock in Washington, the real-world financial consequences for families and hospitals, and the complex consumer behaviors shaping the current open enrollment period. We’ll explore the financial shockwaves hitting households, the partisan divide stalling a legislative fix, how consumers are navigating rising costs, and the immense operational hurdles of any potential retroactive solution.

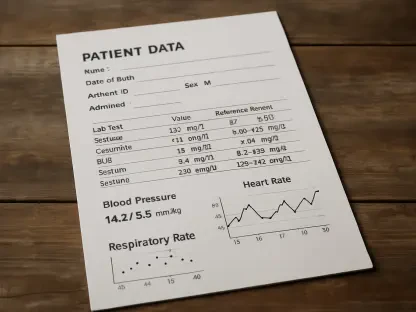

With out-of-pocket premiums set to more than double for 22 million people, can you walk us through the financial shock a typical family might face? Please share some specific metrics or anecdotes illustrating how a sudden $1,000 annual increase per person impacts their healthcare decisions.

The financial shock is less of a ripple and more of a tidal wave for the average household. We’re talking about an increase of over $1,000 per person for the year, and that’s a number that feels very abstract until the bill arrives. The reality is that for many families, this isn’t just an inconvenience; it’s a breaking point. We have survey data showing that nearly three-fifths of enrollees simply cannot absorb even a $300 increase in their healthcare costs. So when you suddenly multiply that figure, you’re forcing an impossible choice: do you pay for health insurance, or do you cover rent and groceries? This leads people to drop their coverage altogether—we expect about 4 million will become uninsured—or to gamble on their health by choosing a plan with a lower premium but a terrifyingly high deductible.

A bipartisan group in the House backed an extension before the break, yet a similar bill failed to get 60 votes in the Senate. Can you break down this political dynamic? What specific arguments from Republicans regarding taxpayer cost and fraud are proving to be the biggest hurdles?

It’s a classic example of a policy that has broad public support but gets caught in the machinery of Washington. In the House, you saw some moderate Republicans join Democrats, recognizing the immediate pain this would cause their constituents, especially with midterm elections looming. But the Senate is a different animal. The 60-vote filibuster threshold means you need significant bipartisan consensus, and that’s where the effort stalls. The primary Republican arguments center on fiscal responsibility and market integrity. They frame the subsidies as an unsustainable cost to taxpayers and point to instances of fraud within the exchanges as a reason to scrap the program rather than reform it. There’s also a deep-seated philosophical objection, articulated by President Trump, that these subsidies are just a “handout for insurance companies.” Instead of shoring up the ACA, they prefer to redirect federal funds toward other mechanisms like tax-advantaged health savings accounts.

Early enrollment was surprisingly strong at 5.8 million, yet anecdotal reports suggest a shift toward less robust bronze plans. What does this conflicting data tell you about consumer behavior right now? Could you detail the trade-offs people are making between premium cost and coverage adequacy?

This is a fascinating and telling contradiction. The strong initial enrollment of 5.8 million people suggests that consumers are still deeply committed to having health insurance; they know the risk of going without it. However, the anecdotal shift toward bronze plans tells the other half of the story: affordability is now the single most important factor. People are making a calculated, and very risky, trade-off. They’re choosing plans with the lowest possible monthly premium, which are often the bronze-level plans. The catch is that these plans come with extremely high deductibles and out-of-pocket costs. Essentially, consumers are buying “catastrophic” coverage, hoping they stay healthy enough not to need it. They are sacrificing access to routine care and predictable costs to protect themselves from a financially ruinous medical event, a clear sign of the intense financial pressure they’re under.

The text mentions a retroactive extension as a potential fix. From an operational standpoint, what are the step-by-step challenges for federal and state marketplaces in implementing this change after open enrollment has already closed? How would they effectively communicate this to consumers who may have already left?

From an operational perspective, a retroactive fix is a logistical nightmare, though a necessary one if Congress acts. The first step would be a massive recalculation of subsidies for millions of accounts, a complex technical task for federal and state systems. The real challenge, however, is communication. How do you reach the potentially millions of people who looked at the “eye-popping” premium increases, decided they couldn’t afford coverage, and walked away from the marketplace entirely? You’d need a multi-channel public awareness campaign to cut through the noise and convince people to come back. Furthermore, for those who already selected a less-comprehensive plan, you would likely need to create a special enrollment period to allow them to switch to a better plan with the newly restored aid. It’s a difficult, messy process that depends on effectively undoing the confusion and anxiety that the initial lapse has already caused.

Providers are projected to lose over $32 billion in revenue this year. Beyond that number, how does this financial strain manifest inside a hospital or clinic? Please describe the downstream effects this could have on patient care, staffing levels, or the availability of vital community health services.

That $32 billion figure is staggering, but its true impact is felt at the bedside and in the community. When millions of people lose insurance, hospitals and clinics see a dramatic increase in uncompensated care—treating patients who cannot pay their bills. This financial bleeding forces incredibly difficult decisions. It can mean a hiring freeze, which leads to higher nurse-to-patient ratios and staff burnout. It can mean delaying the purchase of new diagnostic equipment or postponing facility upgrades. For smaller, rural, or community-focused hospitals, this strain can be existential, potentially forcing them to cut back on less profitable but vital services like mental health support, substance abuse programs, or maternal care. In the end, this financial pressure degrades the quality and availability of care for everyone, not just the uninsured.

What is your forecast for the future of ACA subsidies and healthcare affordability in the coming year?

My forecast for the coming year is one of continued volatility and political brinkmanship. The pressure on lawmakers, particularly Republicans facing midterm elections, will be immense as constituents begin receiving their higher premium bills. I anticipate a frantic push to pass a retroactive extension early in the new year, but its fate in the Senate remains highly uncertain. We are likely to see a short-term patch rather than a permanent solution, meaning this same crisis could play out again in a year or two. The fundamental challenge of healthcare affordability will remain the central, unresolved issue in American politics. This cycle of temporary fixes and partisan fighting will continue to create deep instability for the 22 million people who rely on these subsidies, not to mention the insurers and providers who serve them.