Behind closed doors, a series of critical negotiations are underway that will profoundly influence the safety, innovation, and availability of every medical device used by Americans, from simple blood glucose monitors to complex implantable heart valves. These discussions, aimed at forging the sixth Medical Device User Fee Amendments (MDUFA VI), bring together the U.S. Food and Drug Administration (FDA) and representatives from the multi-billion dollar medical technology industry. The resulting five-year agreement, which must be finalized before the current pact expires in September 2027, will determine the user fees manufacturers pay to the agency. More importantly, it will set the performance goals, hiring targets, and regulatory policies for the FDA’s Center for Devices and Radiological Health (CDRH). While the primary parties negotiate, patient advocates and public health organizations are watching intently from the sidelines, fighting to shift the focus from regulatory speed to long-term patient safety and transparency, setting the stage for a debate that will define the future of medical device oversight for years to come.

The Core Negotiation Landscape

A Push for Swift Resolution Amid Diverging Priorities

The MDUFA VI negotiations are proceeding with a notable sense of urgency, signaling a clear intent from both the FDA and industry to finalize an agreement and secure congressional approval within the current year. This accelerated timeline suggests that the core negotiating parties are largely satisfied with the existing framework, aiming for what they term a “steady state” agreement that carries forward the principles of MDUFA V. Industry lobbying groups, including AdvaMed and the Medical Device Manufacturers Association (MDMA), have been vocal in their support for maintaining the current structure. They argue that the program has reached a mature and predictable state and are pushing for stability in funding and performance goals, particularly after what the MDMA described as a “significant ramp up in user fees under MDUFA V” during its later years. This push for continuity reflects a desire to avoid disruptive changes and maintain a predictable regulatory environment that facilitates market access for new technologies, a position that forms the baseline for their negotiating strategy.

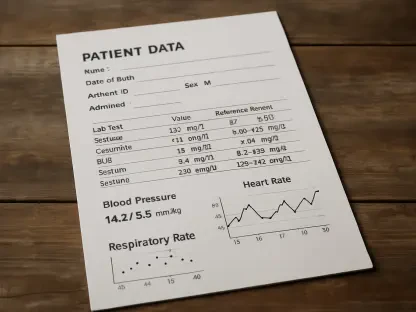

This desire for a steady continuation, however, stands in stark contrast to the perspectives of other key stakeholders and the FDA’s own expressed needs. While the industry seeks predictability, the FDA has consistently communicated a pressing need for additional resources to adequately fulfill its expanding regulatory duties. The existing MDUFA V agreement authorizes the CDRH to collect between $1.78 and $1.9 billion in user fees over its five-year term, but this funding is contingent upon the agency meeting specific performance and hiring benchmarks. This complex structure, with its various triggers and add-on payments, is something the FDA had reportedly considered simplifying. The fundamental tension is further magnified by the vocal concerns of patient and consumer protection groups. These organizations are largely excluded from the primary, closed-door negotiations and are forcefully advocating for a paradigm shift—one that moves the emphasis away from the speed of premarket reviews and toward enhanced postmarket surveillance, device effectiveness, and public transparency, creating a significant divergence in priorities that complicates the path to a universally accepted agreement.

The Universal Crisis of Workforce Capacity

Among the many points of contention, one issue has forged a rare and powerful consensus among all parties involved in the MDUFA talks: a profound and shared concern over the FDA’s dwindling workforce. Following significant workforce reductions in previous years, the agency’s device center has been hit hard by staff cuts and attrition. A detailed analysis revealed that the CDRH had lost over 20% of its personnel, a staggering figure that has created what the FDA itself has acknowledged as severe “system strain.” This critical shortage of expert reviewers, inspectors, and support staff has forced the agency into a reactive posture, with remaining employees in 2025 focused almost exclusively on premarket review work to meet mandated deadlines. Public Citizen’s senior health researcher, Michael Abrams, effectively summarized the sentiment of outside observers, stating that the FDA has made it clear that it is “shorthanded” and “feeling stressed,” a condition that directly impacts its ability to perform comprehensive oversight and protect public health.

The industry, while approaching the issue from a different angle, shares this deep anxiety over the FDA’s staffing levels. During negotiation meetings, industry representatives have repeatedly questioned how the substantial increase in user fees collected under MDUFA V can be effectively invested if the agency is hobbled by a 20% staff reduction and a concurrent federal hiring freeze. Their concern is rooted in a desire for efficiency and predictability; a well-staffed agency is essential for timely reviews and clear communication. Industry groups have sought firm confirmation that the hiring goals established under the current agreement will indeed be met by the end of fiscal year 2027. This challenge is significantly compounded by the inherently slow and bureaucratic nature of the government hiring process. As former FDA analyst Madris Kinard has pointed out, filling a position can take anywhere from six months to a year, making it incredibly difficult for the agency to rapidly rebuild its workforce and effectively deploy the resources provided by industry user fees, creating a bottleneck that frustrates all stakeholders.

Competing Agendas and Proposed Changes

The FDA’s Bid for Financial Restructuring

In a move to secure its long-term financial stability, the FDA has introduced several significant proposals aimed at altering the fundamental architecture of the MDUFA agreement. A primary proposal involves changing the financial “triggers” that connect the collection of industry user fees to the level of funding appropriated by Congress. These triggers are a crucial safeguard designed to ensure that industry fees supplement, rather than replace, federal taxpayer dollars. The FDA has proposed increasing both the appropriation threshold, which is the minimum funding Congress must provide for the fees to be collected, and the budgetary spending threshold, which is the minimum amount the CDRH must spend from non-user-fee funds. This strategic adjustment is intended to protect the agency’s core budget from political and economic fluctuations. The proposal was met with a mixed response from industry representatives, who indicated they were open to discussing the spending trigger but voiced strong opposition to changing the appropriations trigger, setting up a key point of negotiation.

A second, more transformative proposal from the FDA seeks to completely restructure the fee system by differentiating between domestic and overseas companies. Citing the substantial additional resources required to effectively inspect and oversee foreign manufacturing establishments, the agency has proposed levying higher user fees on medical device firms located abroad. This represents a radical departure from the current one-size-fits-all model. According to an FDA presentation, this restructuring could lead to a scenario where user fees for companies operating solely within the United States remain flat or are even decreased. Such a change would not only provide the agency with targeted funding to address the complexities of a global supply chain but would also represent a significant shift in how the financial burden of regulation is distributed across the international medtech industry, potentially incentivizing domestic manufacturing while increasing costs for foreign-based firms.

The Public’s Demand for a Safety-First Paradigm

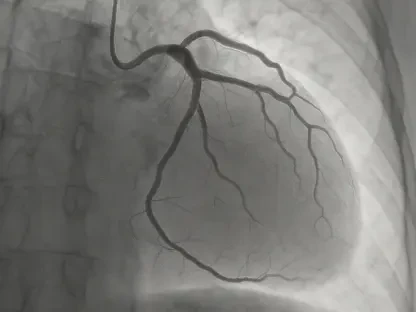

Patient advocates and consumer protection groups are using the MDUFA negotiation period to champion a significant reprioritization of the FDA’s mission, demanding a greater focus on robust device safety and long-term effectiveness over the prevailing emphasis on the speed of premarket reviews. Public health advocates like Michael Abrams of Public Citizen have raised alarms about fast-track programs, such as a pilot allowing some digital health products to bypass traditional premarket requirements in favor of collecting real-world data post-launch, arguing such approaches risk lowering evidence standards for safety and efficacy. This sentiment was strongly echoed by Alexander Naum of Generation Patient, who articulated the concern that “innovation isn’t coming with appropriate safeguards.” He specifically called for more rigorous postmarket monitoring, particularly for high-risk implantable devices, to provide patients and physicians with crucial data on how a device will perform over many years, not just in the short term. Stakeholders have also highlighted the urgent need for more user-friendly adverse event reporting systems and have called for stronger FDA enforcement powers to ensure companies report device-related malfunctions, injuries, and deaths in a timely and transparent manner.

This determined push for a safety-first paradigm was severely hampered by a pervasive lack of transparency and limited public influence over the negotiation process. Patient and public health organizations were barred from the core meetings between the FDA and industry, relegated to separate, less frequent briefings. They had to rely on meeting minutes that were often posted weeks after the fact and were described as vague and sparse in detail. Isabella Xu, a policy associate at the Center for Science in the Public Interest, described this opacity as a “major barrier,” stating that it was “challenging for stakeholders to engage productively when the details of the negotiations are kept in the dark.” This frustration was compounded by a perceived disconnect between the topics the FDA presented in stakeholder meetings and the issues most pressing to patients. The Patient, Consumer and Public Health coalition noted that the scope of these meetings often prioritized faster reviews and greater industry access to FDA staff. Diana Zuckerman summarized this sentiment by stating, “There’s just nothing about issues that a lot of the patient groups really care about,” which revealed a fundamental divide that defined these talks and left the most critical safety questions hanging in the balance.