With a career spanning decades at the intersection of medical technology and finance, James Maitland has a unique vantage point on the forces shaping the industry. After a turbulent 2025 that saw medtech navigate trade wars and policy shifts, the sector proved its resilience with strong procedure volumes and a late-year surge in M&A. Today, James joins us to dissect the key issues on the horizon for 2026. We’ll explore the potential ripple effects of expiring healthcare subsidies on hospital spending, the strategic thinking behind the next wave of acquisitions, the complex challenge of industry-specific tariffs, and the burgeoning competition in the high-stakes surgical robotics market.

With enhanced ACA subsidies having expired, potentially leaving millions uninsured, how might this impact procedure volumes across different medical specialties? Please walk us through the potential ripple effect on capital spending for companies that make hospital equipment versus those focused on high-priority surgical robots.

It’s a significant question, and one that creates a real sense of uncertainty. The hard truth is there’s no clean formula to say that if 4 million people lose insurance, procedure volumes will drop by a precise percentage. No one has been able to draw that direct quantitative line. However, logic dictates that when you take healthcare coverage away from a large group of people, you’re going to see lower overall utilization of healthcare services. The impact won’t be a tidal wave that hits everyone equally; it’s going to be much more nuanced and specific to the company and the procedure. A company whose products are used in surgeries primarily covered by commercial insurance will feel a different effect than one reliant on Medicare.

This then creates a domino effect on capital spending. If a hospital system is bracing for, or already experiencing, a meaningful drop in procedures, the first thing they do is tighten the purse strings on big-ticket purchases. That’s where you’ll see a divergence. A high-priority, high-demand item like an Intuitive surgical robot is likely to be protected. Hospitals see that as an essential investment. But companies like Stryker or Baxter, which make a broader range of essential but perhaps less “urgent” medical equipment, could feel a real squeeze. I expect we might see many hospitals pause capital spending at the beginning of the year, taking a wait-and-see approach to understand just how deeply these expired subsidies will cut into their business.

Last year ended with a surge in multibillion-dollar M&A deals after a slow start. Given that many large medtech companies have significant cash to deploy, what specific types of acquisitions do you anticipate in 2026, and how might lingering economic uncertainty influence their timing or structure?

You’re right, 2025 was a tale of two halves for M&A. The first half was incredibly quiet, with macroeconomic jitters from the Trump administration’s tariff policies keeping everyone on the sidelines. But then the floodgates opened. We saw a rush of deals in the final weeks, headlined by Abbott’s massive $21 billion acquisition of Exact Sciences, not to mention significant moves from BD, Hologic, and Boston Scientific. This end-of-year momentum absolutely signals a stronger M&A environment for 2026. I don’t know if I’d call it a “boom,” but it will certainly be more active.

The major players have incredibly healthy balance sheets and are sitting on a lot of cash. For most of them, M&A is the number one priority for deploying that capital. You hear it directly from companies like Stryker and Johnson & Johnson, who are openly on the lookout. Boston Scientific has been consistently acquisitive with tuck-in deals, and I wouldn’t be surprised to see Medtronic become more active later in the year, especially after it spins off its diabetes business. As for the uncertainty, I think the industry has accepted it as the new reality. Political unpredictability is now the norm, and these companies have proven they know how to navigate that environment. It might affect the timing of a deal here or there, but it’s not going to stop them from making strategic acquisitions.

An ongoing Section 232 investigation could result in industry-specific tariffs. Since medtech reimbursement is tied to procedures, not just devices, what operational or supply chain adjustments could companies make to absorb these costs? What specific metrics will leadership be watching most closely in response?

This Section 232 investigation is a particularly thorny issue for medtech, and it’s very different from what other industries face. Last year, companies managed the existing tariffs relatively well; firms like Boston Scientific and J&J took charges of $100 million or more, but even those figures were about half of what was initially feared. The problem with new, industry-specific tariffs is how reimbursement is structured. When the pharmaceutical industry was hit with Section 232 tariffs, they could lower drug prices to offset the cost to the government. Medtech doesn’t have that lever.

Think about it: the government doesn’t buy a hip implant; it pays for a hip replacement procedure. The device is just one part of that bundled payment. A company can’t just slash the price of its knee replacement by 20% and expect it to save the government money, because the hospital is still getting paid the same amount for the overall surgery. This means companies can’t easily adjust their pricing to absorb the blow. Operationally, they are forced to look inward. They’ll need to double down on supply chain efficiencies, manufacturing optimization, and internal cost-cutting measures. Leadership teams will be watching their gross margins like a hawk. Any erosion there will be a major red flag. They’ll also scrutinize operating expenses and overall profitability metrics to see where they can find savings to offset a cost that they simply cannot pass on.

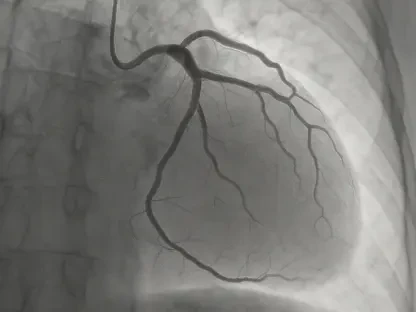

Medtronic’s Hugo robot has now entered the market to compete with Intuitive’s da Vinci. What specific strategies, beyond pricing, might Medtronic use to gain placements in hospitals dominated by Intuitive? Could you share a step-by-step example of how that negotiation with a hospital might unfold?

The arrival of Medtronic’s Hugo is a fascinating development in a market that has been dominated by Intuitive for so long. Frankly, I don’t think Hugo is a direct threat to Intuitive’s market share right now, especially since it’s only cleared for urology. But Medtronic is playing a longer, more strategic game that leans heavily on its deep, existing relationships with hospitals. Their biggest advantage isn’t technology or even price—it’s market psychology. If there’s one thing surgeons and hospital administrators dislike, it’s a monopoly. They hate being told there’s only one option, the da Vinci, and that they have to pay whatever price Intuitive sets.

Here’s how a negotiation might play out. A Medtronic sales leader sits down with a major hospital system. They know the hospital already has a fleet of da Vinci robots and has a capital plan to buy ten more this year. The pitch isn’t, “Rip out your da Vincis and buy Hugo.” Instead, it’s a conversation about choice and leverage. They’ll say, “We understand your surgeons are comfortable with the da Vinci. But you have residents and fellows who need to learn on the newest platforms. And being locked into a single supplier puts you at a disadvantage in future negotiations.” Then comes the offer: “You have a mandate to buy ten new robots. Instead of making them all da Vincis, why don’t you make two or three of them Hugo? We’ll be flexible on the pricing for these initial placements to get you started.” For the hospital, it’s a low-risk way to diversify, to give their surgeons a new tool, and to send a subtle message to Intuitive. That’s how Medtronic gets placements—not by trying to be a “da Vinci killer,” but by positioning itself as the viable alternative everyone has been waiting for.

What is your forecast for the overall health of the medtech sector through 2026?

My forecast is one of resilient optimism. When you look past the headlines about tariffs and policy debates, the fundamentals of the medtech industry remain incredibly strong. Procedure volumes are healthy, which is the lifeblood of the sector. Innovation continues to be a powerful driver; we’re seeing tremendous success with new products like Intuitive’s da Vinci 5 and the latest pulsed field ablation systems. And companies are, by and large, delivering strong financial results.

Of course, challenges remain. The lingering uncertainty from 2025 will certainly spill into this year, creating what some have called “fears of the unknown.” Questions around insurance coverage and the potential for new tariffs are real headwinds. However, if the past year has taught us anything, it’s that this industry knows how to manage through a “roller coaster” environment. Companies have become adept at navigating these unpredictable conditions. So, while the path forward may not be perfectly smooth, the sector is stable, fundamentally sound, and well-positioned to continue its growth trajectory through 2026.