Setting the Stage: A Critical Moment for Heart Failure Solutions

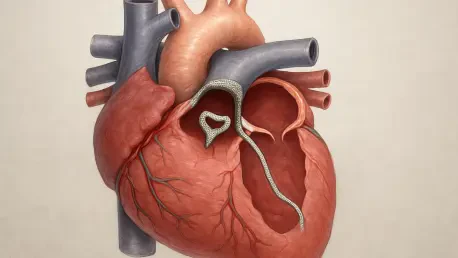

Imagine a medical breakthrough poised to transform the lives of millions suffering from chronic heart failure, only to stumble at the final regulatory hurdle. This scenario unfolded recently when an FDA advisory panel unanimously voted against approving Johnson & Johnson’s (J&J) V-Wave Ventura interatrial shunt, a device designed to address a dire unmet need in cardiovascular care. With heart failure affecting over 6 million Americans and costing the healthcare system billions annually, the stakes for innovative treatments are extraordinarily high. This analysis explores the market implications of the panel’s 15-0 decision, delving into the factors behind the rejection, the current trends shaping heart failure treatment, and the future outlook for J&J and the broader medtech sector. By unpacking these dynamics, the goal is to provide strategic insights for stakeholders navigating this complex and critical market.

Deep Dive into Market Dynamics: What the Rejection Signals

Clinical Evidence as a Market Barrier

The core of the FDA panel’s decision hinges on the underwhelming results of the RELIEVE-HF clinical trial, which failed to demonstrate that the V-Wave shunt could significantly improve outcomes for patients with advanced heart failure. This setback is not merely a technical hurdle but a profound signal to the market: regulatory bodies are tightening their grip on efficacy standards, especially for devices targeting life-threatening conditions. Investors and medtech companies must now grapple with the reality that even a promising concept, backed by a $1.7 billion acquisition as in J&J’s case, can falter without ironclad data. This trend suggests a market environment where clinical trial design and execution are becoming as critical as innovation itself, pushing firms to allocate more resources toward rigorous testing before seeking approval.

Safety Perceptions and Investor Sentiment

While the panel’s 9-6 vote in favor of the device’s short-term safety offers a sliver of reassurance, lingering concerns about potential long-term risks have introduced uncertainty into the market narrative. For investors, this split opinion underscores a volatile risk profile for heart failure devices, particularly those with invasive mechanisms like shunts. Unlike other cardiovascular technologies that have secured approval with clearer safety data, the ambiguity surrounding the V-Wave shunt may dampen enthusiasm for similar innovations in the near term. Consequently, companies operating in this space might face heightened scrutiny from both regulators and shareholders, potentially slowing the pace of investment in novel heart failure solutions until confidence in long-term outcomes is restored.

Competitive Landscape and Market Positioning

Beyond J&J’s immediate challenges, the rejection casts a shadow over the competitive landscape for heart failure treatments. The market, already crowded with pharmaceutical interventions and established devices like implantable defibrillators, craves disruptive technologies to address patients unresponsive to standard care. The V-Wave shunt was positioned to fill this gap, leveraging its breakthrough designation to capture attention. However, the panel’s verdict signals to competitors that the bar for entry remains exceptionally high, possibly deterring smaller players with limited R&D budgets. Meanwhile, larger firms may see an opportunity to pivot toward alternative approaches, such as non-invasive monitoring systems or next-generation shunt designs, reshaping market priorities over the next few years from 2025 onward.

Forecasting the Future: Trends and Opportunities in Heart Failure Tech

Looking ahead, the medtech sector faces a pivotal moment as regulatory expectations continue to evolve. The emphasis on robust clinical evidence, as demonstrated by the V-Wave decision, is likely to accelerate a trend toward data-driven innovation, compelling companies to integrate advanced analytics and real-world evidence into their development processes. Moreover, economic pressures within healthcare systems may push for cost-effective solutions, potentially favoring technologies that demonstrate clear value over speculative promise. This shift could open doors for startups focusing on scalable, evidence-backed devices, even as giants like J&J recalibrate their strategies.

On the horizon, emerging technologies such as wearable heart monitors and AI-driven diagnostic tools are gaining traction, offering non-invasive alternatives to traditional devices. These advancements could redefine the treatment paradigm, reducing reliance on complex implants like shunts if they prove effective. For J&J, the path forward may involve targeted studies to refine the V-Wave shunt’s application, perhaps focusing on niche patient groups where benefits are more evident. If successful, such efforts could reposition the device as a viable contender by 2027, though the market will demand transparency and measurable impact.

Regulatory policies themselves may also shift, with potential reforms aimed at balancing innovation with patient safety. Industry observers anticipate that the FDA might introduce more flexible pathways for breakthrough devices, provided post-market surveillance is robust. This evolution could create a more dynamic market environment, encouraging calculated risks while safeguarding public trust. For now, the heart failure treatment space remains a high-stakes arena, where perseverance and adaptability will determine the winners.

Reflecting on the Outcome: Strategic Lessons Learned

Looking back, the unanimous rejection of J&J’s V-Wave shunt by the FDA panel served as a stark reminder of the challenges embedded in the medtech market. It highlighted how even substantial investments and early designations of promise could be undermined by a lack of conclusive clinical evidence. The mixed signals on safety further complicated the narrative, leaving investors and competitors to reassess their approaches to risk in this sensitive field. For the broader industry, the event underscored a growing regulatory rigor that shaped market expectations in profound ways.

Moving forward, the key takeaway for stakeholders was the need to prioritize comprehensive trial data from the outset, ensuring that innovation was matched by proof of impact. Companies were encouraged to explore strategic partnerships with data analytics firms to bolster trial outcomes, while also considering narrower, more defined patient cohorts to demonstrate efficacy. Additionally, maintaining open dialogue with regulatory bodies emerged as a critical step to align development with evolving standards. As the heart failure market continued to demand solutions, this moment of setback paved the way for renewed focus on evidence, collaboration, and patient-centered design, offering a blueprint for navigating future challenges with greater precision.