I’m thrilled to sit down with James Maitland, a renowned expert in robotics and IoT applications in medicine, whose passion for integrating technology into healthcare solutions has positioned him as a thought leader in the field. With a deep understanding of medical supply chains and policy impacts, James offers unique insights into the pressing challenges hospitals face today. In this interview, we explore the complexities of tariffs on medical equipment and personal protective equipment (PPE), the risks of supply chain disruptions, the heavy reliance on imported medical supplies, and the broader implications for patient care and hospital operations.

How do you see the push for tariff exceptions on medical equipment and PPE playing out, and what’s driving this urgency from organizations like the American Hospital Association?

The push for tariff exceptions is really about protecting access to critical medical supplies. Hospitals are worried that tariffs, especially those tied to national security investigations like Section 232, could create barriers to importing essential items. The urgency comes from the fact that these tariffs could disrupt the supply of tools and PPE that healthcare providers rely on every day. Without exceptions, we’re looking at potential shortages or delays that could directly impact patient care and staff safety. It’s a balancing act—ensuring security while not crippling the healthcare system.

What specific medical tools or equipment seem to be at the greatest risk if new tariffs are imposed?

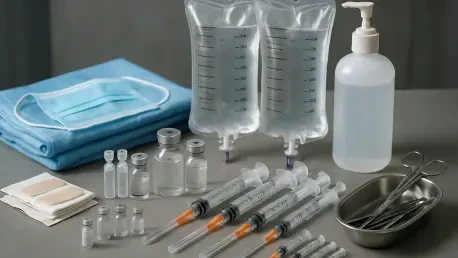

Items like single-use blood pressure cuffs, sterile drapes, surgical instruments, and syringes are particularly vulnerable. These are often low-margin products that are hard to produce cost-effectively in the U.S. Then there’s PPE—think masks, gloves, and respirators—which are heavily sourced from overseas. Any tariff that hikes up costs or restricts imports could make it tough for hospitals to keep these essentials stocked, especially during a crisis.

Can you elaborate on how tariffs might disrupt the supply chain for critical items like PPE?

Tariffs essentially act like a tax on imported goods, raising costs for hospitals that are already operating on tight budgets. For PPE, where a huge chunk comes from international suppliers, this could mean paying more for the same items or facing delays if suppliers pull back due to reduced profitability. In a worst-case scenario, we could see shortages during high-demand periods like a pandemic. It’s not just about cost—it’s about availability. If the supply chain slows down or stops, hospitals can’t just pivot overnight to another source.

What kind of impact could these disruptions have on patient care and the safety of hospital staff?

The impact could be profound. Without enough PPE, staff are at higher risk of exposure to infections, which compromises their safety and ability to work. For patients, a lack of diagnostic tools or treatment equipment due to supply issues could delay critical care or force hospitals to ration resources. It’s a domino effect—disruptions at the supply level ripple out to affect every aspect of healthcare delivery, potentially leading to worse outcomes for patients and burnout for staff.

Why is the U.S. so heavily dependent on foreign sources for medical devices and supplies, with imports exceeding $75 billion in 2024?

A lot of it comes down to cost and specialization. Manufacturing medical devices and supplies often requires specific expertise, infrastructure, and economies of scale that many countries, particularly in Asia, have mastered. The U.S. simply hasn’t invested in the same level of domestic production for many of these items because it’s often cheaper and faster to import them. Over time, this has created a dependency that’s hard to unwind, especially for high-volume, low-cost items that don’t make financial sense to produce locally under current conditions.

How does this reliance on international suppliers, especially from certain dominant countries, complicate things for hospitals?

When you’re reliant on a handful of countries for the majority of your supplies, any hiccup—be it geopolitical tensions, trade disputes, or even a natural disaster—can cut off access to critical goods. For instance, a significant portion of PPE comes from China, so if there’s a policy shift or a supply chain snag there, U.S. hospitals feel the pinch immediately. This dependency creates a vulnerability that’s especially dangerous during emergencies when demand spikes and alternative sources aren’t readily available.

Let’s talk about the cost angle. How might tariffs drive up expenses for hospitals already stretched thin?

Tariffs increase the price of imported goods, plain and simple. For hospitals, which imported over $75 billion in medical supplies just this year, that’s a massive hit to their budgets. They’re forced to either absorb the cost, which cuts into funding for other areas like staffing or equipment upgrades, or pass it on through higher healthcare costs. Neither option is ideal. Plus, if tariffs lead to retaliatory trade actions from other countries, it could further inflate costs or restrict access to even more goods, creating a vicious cycle.

Why is it so challenging to produce certain medical items, like syringes or blood pressure cuffs, domestically at a reasonable cost?

It’s a mix of economics and logistics. These items are often low-cost, high-volume products, and producing them in the U.S. means dealing with higher labor costs, stricter regulations, and a lack of existing manufacturing infrastructure compared to countries that have specialized in this for decades. Building that capacity here would require significant investment and time, and even then, the end product might still be pricier than imports. It’s not impossible, but the financial incentives just aren’t aligned right now to make it viable on a large scale.

Given the heavy reliance on international PPE, particularly from Chinese manufacturers, how does this affect hospitals during emergencies or shortages?

It’s a huge risk factor. In 2023, for example, Chinese manufacturers supplied the majority of N95 respirators, a third of disposable face masks, and nearly all plastic gloves used in healthcare. When an emergency hits, like a pandemic, demand skyrockets, and if there’s any disruption—whether it’s export restrictions, shipping delays, or production halts—hospitals are left scrambling. We saw this early in the COVID-19 crisis. This over-reliance means hospitals have little buffer or backup, making them incredibly vulnerable in a crunch.

What is your forecast for the future of medical supply chains, especially in light of potential tariffs and ongoing global dependencies?

I think we’re at a turning point. Tariffs and trade tensions are forcing a hard look at supply chain resilience, and there’s likely to be a push for more domestic manufacturing or at least diversifying sources to reduce reliance on any single country. But this won’t happen overnight—it’ll take years of investment, policy support, and innovation to build up capacity. In the short term, I expect continued volatility, with hospitals bracing for cost increases and potential shortages if tariffs go into effect without exceptions. Long term, I’m optimistic that technology, like IoT for supply chain tracking and robotics for manufacturing, can help bridge some gaps, but it’s going to require a concerted effort across government, industry, and healthcare sectors to get there.