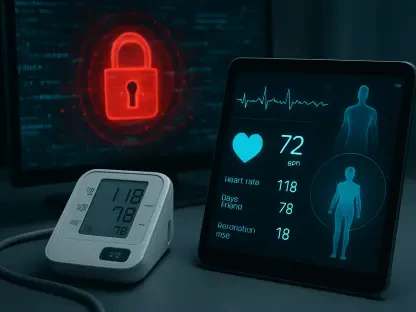

A sudden drop in UnitedHealth Group’s stock during after-hours trading has cast a harsh light on the immense regulatory and financial pressures confronting the healthcare giant, signaling that even minor policy adjustments can have significant repercussions for market sentiment. The company’s shares fell 0.9% to $328.94 immediately after it was revealed that its subsidiary, UnitedHealthcare, would be postponing a controversial policy change originally scheduled for January 1, 2026. This now-delayed policy was set to enforce more stringent reimbursement rules for remote physiologic monitoring (RPM), a growing field of telehealth where connected devices transmit patient data, like blood pressure readings, directly to healthcare providers. While RPM promises innovation, its rapid expansion has attracted intense scrutiny from both insurers and regulators, who are increasingly concerned about escalating costs and the potential for fraudulent billing practices. This single policy delay, while seemingly specific, serves as a microcosm of the challenging environment UnitedHealth must navigate as it balances innovation, cost control, and a complex web of oversight.

A Confluence of Headwinds

The recent stock movement is not an isolated event but rather the latest development in a year marked by an “unusually bright investor spotlight” on UnitedHealth. Throughout 2025, the company has grappled with the significant financial impact of higher-than-anticipated medical costs, particularly within its lucrative Medicare Advantage business. This unexpected surge in expenses previously triggered a sharp selloff of its stock, sending ripples of uncertainty across the entire health-insurance sector. The persistence of these cost pressures has created a climate of heightened sensitivity among investors, who now view any sign of operational or regulatory friction as a potential threat to the company’s bottom line. The decision to delay the RPM reimbursement changes, therefore, is interpreted less as a standalone business choice and more as another symptom of the difficulty the insurer faces in implementing cost-containment measures without provoking backlash from providers or regulators, further complicating its path to stabilizing its medical loss ratio.

Compounding the pressure from medical cost trends is a multi-front battle involving legal challenges and scrutiny of its other business segments. Beyond the issues with remote monitoring, the company’s pharmacy operations have come under fire following a detailed Wall Street Journal analysis. The report uncovered practices of excessive prescription refilling by mail-order pharmacies, a system that allegedly cost the Medicare program billions of dollars and raised serious questions about oversight within UnitedHealth’s vast network. Simultaneously, the company is actively engaged in legal disputes to defend its business practices. In one notable case, UnitedHealth recently secured a preliminary injunction in Idaho, which temporarily blocks the state from enforcing specific unfair-competition laws aimed at its Medicare Advantage marketing strategies and broker commission structures. This mix of public criticism over its pharmacy benefits and ongoing state-level legal fights illustrates a company stretched thin, defending its current operations while trying to manage future costs in an increasingly adversarial environment.

The Path Ahead

With these mounting pressures as a backdrop, the company’s upcoming full-year financial results and its 2026 guidance became the next critical focal point for the investment community. Stakeholders awaited these disclosures with the expectation of gaining clarity on several key fronts that had defined the company’s tumultuous year. The central questions revolved around whether UnitedHealth had developed a sustainable strategy to manage the persistent medical cost trends that had eroded investor confidence. Furthermore, the performance of its Optum health-services unit, a significant driver of growth, was under intense examination to see if it could offset the challenges within the insurance division. The report was seen as a crucial test of management’s ability to articulate a clear and convincing path forward, one that could successfully navigate the intricate landscape of regulatory demands and provider relations without sacrificing financial stability or future growth prospects. The outcome of this financial reporting was poised to be a major catalyst, determining the stock’s trajectory.