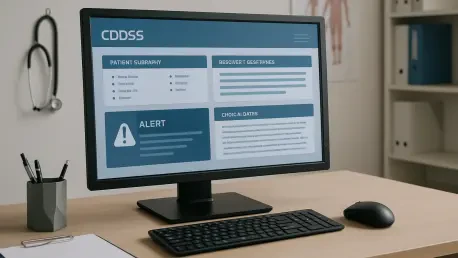

The U.S. Clinical Decision Support Systems (CDSS) market stands at a pivotal moment, with projections indicating a remarkable surge from a valuation of $2.18 billion in 2024 to an astounding $4.84 billion by 2034, driven by a steady compound annual growth rate (CAGR) of 8.3%. This growth trajectory underscores a fundamental transformation in healthcare technology, where CDSS tools are becoming essential for enhancing patient care and optimizing clinical workflows. These systems, designed to deliver real-time, evidence-based guidance to healthcare professionals, integrate seamlessly with Electronic Health Records (EHRs) to provide actionable insights during critical processes such as diagnosis and treatment planning. As the healthcare sector in the U.S. increasingly prioritizes digitization and value-based care, the adoption of CDSS is gaining unprecedented momentum, reflecting a broader shift toward data-driven decision-making that promises to redefine medical practice over the coming decade.

Beyond the impressive numbers, the expansion of this market signals deeper systemic changes within the healthcare landscape. Technological innovations, particularly in artificial intelligence (AI), are enhancing the precision and scalability of CDSS, while supportive federal policies are facilitating wider implementation across diverse medical settings. However, challenges such as alert fatigue among clinicians and the intricacies of system integration remain significant hurdles that must be addressed to sustain this growth. Additionally, evolving expectations from both healthcare providers and patients for more personalized and transparent solutions are pushing companies to innovate relentlessly. The competitive dynamics, marked by strategic moves from major players and emerging innovators, further add to the vibrancy of this space, making it a focal point for stakeholders aiming to capitalize on emerging opportunities.

Market Overview and Growth Drivers

Defining CDSS and Its Role in Healthcare

The essence of Clinical Decision Support Systems lies in their ability to empower healthcare professionals with real-time, evidence-based guidance that enhances clinical decision-making. These sophisticated tools are designed to assist physicians and nurses during pivotal moments, such as diagnosing conditions, planning treatments, and managing medications. By integrating seamlessly with EHRs, CDSS provides a robust framework for accessing patient data, generating alerts for potential issues, and offering predictive insights that improve accuracy. Their role extends beyond mere assistance; they are becoming indispensable in reducing medical errors and ensuring consistency in care delivery. As healthcare systems grapple with increasing patient volumes and complex cases, CDSS stands as a cornerstone technology that aligns with the goals of improving outcomes and operational efficiency across hospitals and clinics nationwide.

Moreover, the significance of Clinical Decision Support Systems (CDSS) in modern healthcare cannot be overstated, particularly in the context of a rapidly digitizing industry. These systems serve as a bridge between vast amounts of clinical data and actionable recommendations, enabling providers to make informed choices swiftly. The focus on patient safety and quality of care drives their adoption, as they help mitigate risks associated with human oversight. Additionally, CDSS tools support compliance with clinical guidelines, ensuring that treatments align with the latest standards. This transformative impact is evident in settings ranging from small practices to large hospital networks, where the demand for reliable decision-support mechanisms continues to grow. The push toward value-based care models further amplifies their relevance, positioning CDSS as a vital component in achieving sustainable healthcare improvements.

Growth Projections and Key Metrics

Delving into the financial outlook, the U.S. CDSS market’s current valuation of $2.18 billion is set to more than double, reaching $4.84 billion by 2034, propelled by a consistent CAGR of 8.3% from the current year through the forecast period. This growth is not merely a statistical projection but a reflection of the increasing reliance on technology to address healthcare challenges. The numbers highlight a surge in adoption across various medical institutions, driven by the need for precision and efficiency in clinical processes. This upward trend aligns with broader industry shifts toward digitization, where data-driven tools are prioritized to enhance patient outcomes. Stakeholders can view these metrics as a clear indicator of the market’s potential, offering a roadmap for investment and strategic planning over the next decade.

Furthermore, the implications of this growth extend to systemic changes in how healthcare is delivered and managed. The projected increase signifies a growing trust in CDSS to tackle pressing issues like chronic disease management and resource optimization. It also reflects the impact of technological maturity, as more providers recognize the value of integrating advanced systems into their workflows. This expansion is supported by a favorable environment of innovation and policy incentives that encourage scaling up implementations. Beyond the financials, the CAGR of 8.3% serves as a benchmark for gauging the pace of transformation, urging companies to adapt swiftly to emerging needs. As the market evolves, understanding these metrics becomes crucial for identifying high-growth areas and aligning business strategies with long-term industry goals.

Technological and Policy Influences

The Impact of AI and Predictive Analytics

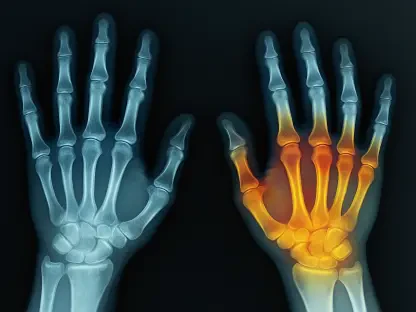

Artificial intelligence and predictive analytics are at the forefront of transforming Clinical Decision Support Systems, making them more dynamic and responsive to clinical needs. AI-powered algorithms enable these systems to analyze vast datasets in real time, identifying patterns and generating precise recommendations for patient care. This technological leap enhances the ability of CDSS to deliver personalized treatment plans, ensuring that interventions are tailored to individual patient profiles. Real-time alerts for potential health risks, such as adverse drug interactions, further bolster their utility, allowing clinicians to act swiftly. The scalability of AI-driven solutions means that even smaller healthcare facilities can access cutting-edge tools, expanding the reach of advanced care. As these technologies continue to evolve, their integration into CDSS is poised to redefine standards of accuracy and efficiency in medical decision-making.

Additionally, the role of predictive analytics in Clinical Decision Support Systems (CDSS) extends to anticipating future health trends and outcomes, offering a proactive approach to patient management that can significantly improve healthcare delivery. By leveraging historical data and machine learning, these systems can forecast potential complications, enabling early interventions that save lives and reduce costs. This forward-looking capability is particularly valuable in managing chronic conditions, where timely action can prevent escalations. The ongoing refinement of AI models ensures that CDSS remains adaptable to new medical insights, maintaining relevance in a fast-changing field. Healthcare providers benefit from a deeper understanding of patient needs, supported by data-driven insights that enhance trust in clinical recommendations. This technological edge not only improves care quality but also positions the U.S. as a leader in healthcare innovation, setting a benchmark for global standards.

Regulatory Support and Federal Mandates

Government policies and federal mandates play a pivotal role in accelerating the adoption of Clinical Decision Support Systems across the U.S. healthcare landscape. Initiatives aimed at healthcare digitization, coupled with incentives for adopting value-based care models, have created a conducive environment for CDSS implementation. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) ensures that data security and interoperability remain priorities, addressing critical concerns around patient privacy. Subsidies and tax benefits further encourage hospitals and clinics to invest in these technologies, reducing financial barriers to entry. The alignment of federal goals with technological advancement underscores a commitment to improving healthcare delivery through structured policy frameworks that support market growth.

Equally important are the mechanisms of public-private partnerships and streamlined approval processes that facilitate the integration of CDSS into clinical settings, enabling faster deployment of innovative solutions by bridging gaps between technology developers and healthcare providers. Regulatory bodies are increasingly focused on harmonizing standards, ensuring that systems meet stringent quality and safety requirements while remaining user-friendly. Fast-track approvals for CDSS products help reduce time-to-market, allowing companies to address urgent healthcare needs promptly. This supportive policy environment not only boosts confidence among stakeholders but also fosters an ecosystem where continuous improvement is encouraged. As a result, the synergy between regulation and innovation drives sustained market expansion, paving the way for broader access to advanced decision-support tools.

Challenges and Opportunities

Barriers to Widespread Adoption

Despite the promising growth of the U.S. CDSS market, several barriers continue to impede widespread adoption among healthcare providers, with alert fatigue standing out as a significant issue. Clinicians are often overwhelmed by frequent notifications, leading to the potential oversight of critical alerts. This challenge diminishes the effectiveness of CDSS and can result in user frustration, undermining trust in the technology. Additionally, the complexity of integrating these systems with diverse EHR platforms often creates technical inefficiencies, requiring substantial resources to resolve. Liability concerns further complicate adoption, as providers worry about legal repercussions from incorrect recommendations. Tackling these obstacles demands innovative approaches to system design and comprehensive training programs to ensure that healthcare staff can utilize CDSS tools effectively without disruption to their workflows.

Another layer of difficulty arises from the inherent variability in healthcare environments, which can exacerbate integration challenges, especially since different institutions operate on unique systems and protocols, making standardization a daunting task for CDSS implementation. Data privacy issues also loom large, as ensuring the secure handling of sensitive patient information remains paramount amidst growing cyber threats. The financial burden of adopting and maintaining these systems can be prohibitive for smaller facilities, limiting access to advanced tools. Addressing these multifaceted barriers requires a collaborative effort among technology vendors, healthcare administrators, and policymakers to streamline integration processes and enhance user experience. By prioritizing user-centric solutions and robust support mechanisms, the industry can mitigate these hurdles, paving the way for broader acceptance and utilization of CDSS across diverse settings.

Focus on Interoperability and Patient-Centered Care

Interoperability emerges as a critical focus area for the future of Clinical Decision Support Systems, ensuring seamless communication with other healthcare IT infrastructures. The ability to share data across platforms enhances care coordination, allowing providers to access comprehensive patient information regardless of the system in use. This connectivity reduces redundancies and errors, fostering a more cohesive approach to treatment. Efforts to standardize data formats and protocols are gaining traction, supported by industry stakeholders who recognize the value of unified systems. As interoperability improves, CDSS can deliver more accurate and timely insights, directly impacting patient safety and care quality. This trend is expected to shape technological advancements, driving innovations that prioritize compatibility and ease of integration in the years ahead.

Simultaneously, the emphasis on patient-centered care is transforming how CDSS tools are developed and deployed, aligning them with individual patient needs. These systems are increasingly designed to provide customized treatment recommendations, leveraging data to tailor interventions that reflect personal health profiles. This shift not only improves clinical outcomes but also enhances patient satisfaction by ensuring transparency and relevance in care delivery. The integration of patient feedback into CDSS design further supports this model, allowing for continuous refinement based on real-world experiences. Regulatory frameworks are adapting to encourage such personalized approaches, recognizing their potential to address disparities in healthcare access. By focusing on both interoperability and patient-centric solutions, the CDSS market is poised to meet evolving demands, setting a foundation for sustainable growth and innovation.

Competitive and Regional Dynamics

Key Players and Market Competition

The competitive landscape of the U.S. CDSS market is characterized by intense rivalry among established giants and agile newcomers, each striving to capture a larger share of this burgeoning space. Companies like Cerner Corporation, IBM Corporation, and Allscripts Healthcare, LLC lead the charge with comprehensive product portfolios and robust technological capabilities. Their strategies often involve significant investments in research and development to integrate AI and advanced analytics into their offerings. Mergers and acquisitions are also prevalent, allowing these players to expand their reach and enhance their solutions through combined expertise. This dynamic environment fosters continuous innovation, as market leaders push boundaries to maintain dominance while addressing the evolving needs of healthcare providers with cutting-edge tools.

In parallel, emerging challengers and niche innovators are making notable strides by targeting specific gaps in the market, adding a layer of complexity to the competitive scene. These smaller entities often focus on specialized applications or underserved segments, offering tailored solutions that resonate with particular user groups. Their agility enables rapid adaptation to technological trends and customer feedback, posing a challenge to larger corporations. Brand equity and customer loyalty remain critical differentiators, as trust in reliability and performance influences purchasing decisions. The competitive intensity drives a focus on customer experience, with companies prioritizing user-friendly interfaces and responsive support. As the market evolves, strategic partnerships and collaborations are expected to play a pivotal role, shaping how players position themselves for long-term success in this fast-paced arena.

Regional Variations in Adoption

Adoption rates of Clinical Decision Support Systems across the U.S. exhibit significant regional disparities, influenced by varying levels of healthcare infrastructure and technological readiness. In areas with well-established IT systems, such as major urban centers, demand for CDSS is strong and stable, driven by the presence of large hospital networks and academic medical institutions. These regions benefit from advanced connectivity and resources that facilitate seamless integration of decision-support tools into clinical workflows. The maturity of local healthcare ecosystems supports consistent growth, as providers in these areas are often early adopters of innovative technologies. This trend underscores the importance of infrastructure in enabling the effective deployment of CDSS, ensuring that benefits are realized swiftly and sustainably.

Conversely, regions with emerging healthcare needs and less developed IT frameworks present untapped opportunities for market expansion, though they face unique challenges. Rural and underserved areas often lack the financial and technical resources to implement sophisticated systems, resulting in slower adoption rates. However, these regions hold significant potential for growth as awareness of CDSS benefits increases and targeted initiatives address accessibility barriers. Cultural and operational differences also play a role, as local preferences and practices influence how technology is received. Stakeholders looking to penetrate these markets must tailor strategies to account for regional nuances, such as investing in scalable, cost-effective solutions. Understanding these variations is essential for maximizing reach and impact, ensuring that the advantages of CDSS are accessible across diverse geographic landscapes.

Strategic Insights for Stakeholders

Investment Priorities in Technology

For stakeholders in the U.S. CDSS market, prioritizing investment in technology, particularly artificial intelligence and predictive analytics, is essential to maintaining a competitive edge. These advancements enable the development of systems that offer unparalleled precision in clinical recommendations, addressing complex healthcare challenges with data-driven solutions. Allocating resources toward AI research can enhance real-time decision-making capabilities, making CDSS tools more responsive and effective in dynamic environments. Additionally, focusing on scalable architectures ensures that solutions can adapt to varying institutional needs, from small clinics to expansive hospital systems. As technological trends evolve rapidly, consistent funding for innovation will be crucial for companies to anticipate market shifts and deliver cutting-edge products that meet emerging demands.

Beyond AI, investing in user interface design and system integration technologies is equally vital to drive adoption and satisfaction among healthcare providers. Seamless integration with existing EHR platforms reduces friction during implementation, addressing a key barrier to widespread use. Enhancing user experience through intuitive designs minimizes learning curves and boosts clinician engagement, ensuring that CDSS tools are practical in high-pressure settings. Stakeholders should also consider partnerships with tech firms specializing in cybersecurity to safeguard patient data, reinforcing trust in these systems. By channeling resources into these areas, companies can position themselves as leaders in a market where technological superiority translates directly into competitive advantage, paving the way for sustained growth through the forecast period.

Collaboration and Consumer-Centric Strategies

Collaboration with regulatory bodies and healthcare providers stands as a cornerstone strategy for overcoming adoption barriers in the CDSS market, ensuring compliance and fostering trust among all parties involved. Engaging with policymakers helps align product development with federal mandates, such as those promoting value-based care, while addressing data security standards like HIPAA. Partnerships with medical institutions provide valuable insights into real-world challenges, enabling the creation of solutions that resonate with clinical workflows. These collaborative efforts facilitate the design of training programs that equip staff with the skills needed to maximize CDSS benefits, reducing resistance to change. By building strong networks across the healthcare ecosystem, stakeholders can navigate complex regulatory landscapes and accelerate the integration of decision-support tools into diverse settings.

Equally critical is the adoption of consumer-centric strategies that prioritize transparency and personalization in CDSS offerings, aligning with modern healthcare expectations. Developing systems that provide clear, explainable recommendations enhances trust among clinicians and patients, addressing concerns about automated decision-making. Tailoring solutions to individual patient needs through advanced data analytics ensures that care remains relevant and effective, boosting satisfaction and outcomes. Listening to end-user feedback and incorporating it into iterative design processes can further refine usability, making systems more intuitive. By focusing on these aspects, stakeholders can differentiate their products in a crowded market, building loyalty and driving demand. This dual approach of collaboration and consumer focus offers a robust pathway to success, ensuring that growth targets are met with sustainable impact.