In a significant policy shift that reverberated through the technology and healthcare sectors, the U.S. Food and Drug Administration has substantially redefined its approach to regulating the burgeoning market of digital health tools. The updates, implemented on January 6, clarify the boundaries between regulated medical devices and the vast ecosystem of consumer-facing wellness applications and wearables. By revising key guidance documents for Clinical Decision Support (CDS) software and general wellness products, while simultaneously withdrawing its framework for Software as a Medical Device (SaMD), the agency has signaled a clear move toward a more targeted, risk-based enforcement strategy. This evolution in policy creates new pathways for innovation in low-risk technologies, allowing developers greater freedom while concentrating stringent oversight on products that directly impact clinical diagnoses and treatments.

A New Framework for Clinical Software

Redefining Clinical Decision Support

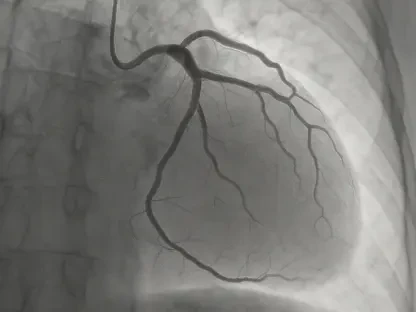

A cornerstone of the FDA’s updated stance involves a significant relaxation of the rules governing Clinical Decision Support (CDS) software, a category of tools designed to aid healthcare professionals in their decision-making processes. In a notable departure from its 2022 revision, the agency announced it will now practice enforcement discretion for certain CDS functions that provide a single, specific, and clinically appropriate treatment or prevention recommendation. Previously, to remain outside the scope of device regulation under the 21st Century Cures Act, such software was expected to present a list of options rather than a direct suggestion. This change means a tool that analyzes a patient’s medical history and suggests a specific antibiotic for a physician to consider would no longer be subject to the same regulatory burdens. Furthermore, the FDA broadened this deregulatory scope by removing prior language that automatically classified software producing a risk probability or a predictive score as a medical device, a move that directly impacts the growing field of AI-driven predictive health analytics.

Reassessing Software as a Medical Device

Contributing to the theme of strategic re-evaluation, the FDA also formally withdrew its guidance document on the clinical evaluation of Software as a Medical Device (SaMD). This framework, which was originally based on principles developed by the International Medical Device Regulators Forum (IMDRF), served as a foundational document informing the agency’s perspective on how to assess the validity and performance of standalone health software. It is important to note that this guidance did not establish new, legally binding submission requirements but instead provided a structured approach for developers to follow. While the FDA did not provide an immediate, detailed rationale for this withdrawal, the action is not viewed in isolation. When considered alongside the concurrent updates to the CDS and general wellness policies, it strongly suggests a comprehensive internal reassessment of the entire digital health regulatory framework. This move could signal a shift away from a harmonized international model toward a more tailored approach uniquely suited to the dynamic U.S. market.

Empowering the Wellness and Wearables Market

Broadening the Scope of General Wellness

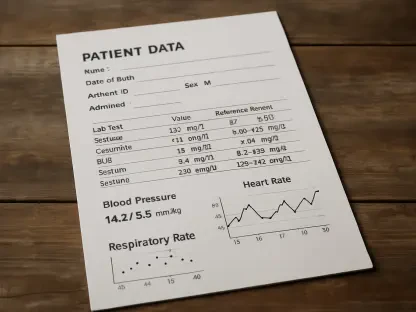

The updated guidance on “General Wellness: Policy for Low Risk Devices” represents a significant expansion of the category of products that are exempt from FDA device regulation, particularly impacting the consumer wearables market. A key development is the clarification that non-invasive monitoring features commonly found in smartwatches and fitness trackers can be classified as general wellness products under specific conditions. For this exemption to apply, the technology must employ non-invasive sensing methods, such as optical sensors, to estimate physiological parameters like blood pressure, oxygen saturation, or heart rate variability. Crucially, the outputs from these sensors must be explicitly intended and marketed for general wellness purposes only, such as promoting a healthy lifestyle, tracking fitness goals, or managing sleep. For instance, a wrist-worn wearable that monitors a user’s activity levels, sleep quality, and pulse rate is now definitively considered a general wellness product, provided its marketing materials make no claims related to the diagnosis, treatment, or management of any medical condition.

The Critical Line Between Wellness and Diagnosis

The agency’s new guidance also provides critical clarity on the fine line that separates a wellness product from a regulated medical device, emphasizing that a product’s classification hinges almost entirely on its intended use and marketing claims. A powerful illustration of this principle is the FDA’s clarification regarding a minimally invasive wearable designed for blood glucose monitoring. The guidance specifies that such a device, when intended to help users assess the nutritional impact of their food choices, would be considered a wellness product. However, this classification is strictly conditional; the product cannot be marketed for use by individuals with diabetes or pre-diabetes, as that would position it as a tool for managing a specific disease state. This distinction places a significant onus on manufacturers to be meticulously precise in their labeling and advertising, as promoting the same hardware for disease management would immediately subject it to the full scope of FDA medical device regulations, including requirements for premarket approval and rigorous clinical validation.

Navigating the New Regulatory Horizon

The series of regulatory updates issued on January 6 marked a pivotal moment in the evolution of digital health oversight in the United States. These actions collectively established a clearer, more permissive pathway for a wide array of low-risk health and wellness technologies, effectively lowering the barrier to entry for innovators in the software and consumer electronics spaces. By explicitly defining what does not require stringent oversight, the FDA drew a firmer and more discernible line around higher-risk software intended for diagnostic or therapeutic purposes. This strategic pivot signaled a future where the agency would concentrate its finite resources on complex medical algorithms and clinical-grade devices, while entrusting the burgeoning wellness market to innovate more freely within the new, well-defined boundaries. The changes ultimately placed a greater responsibility on manufacturers to self-regulate through precise product claims and a clear understanding of their technology’s intended use.