The American healthcare system is infamous for its high costs, often leaving patients struggling with substantial financial challenges from unexpected medical bills. Individuals frequently encounter financial turmoil due to complex billing processes, insurance complications, and a lack of transparency. These issues highlight the urgent need for systemic reform to protect citizens from the financial hardship that can follow even routine medical treatments.

The Impact of Unexpected Medical Bills

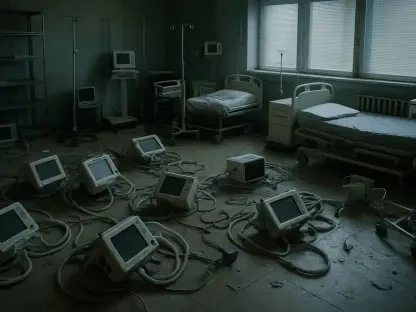

Financial Ruin from Routine Care

Patients undergoing routine medical procedures often find themselves blindsided by unexpectedly high bills, leading to substantial financial burdens. Routine care, expected to be straightforward and affordable, can unexpectedly spiral into a financial nightmare, leaving many patients reeling from the financial aftermath. The cost of even simple procedures, like routine check-ups or minor surgeries, can escalate rapidly due to various factors, including unexpected insurance charges, itemized billing for seemingly insignificant items, or unexpected laboratory fees. This financial surprise often results in people draining their savings, accumulating debt, or even postponing necessary follow-up care to manage costs.

The problem is exacerbated by the lack of price transparency in the healthcare system, making it nearly impossible for patients to anticipate the costs they will incur. In many instances, patients receive bills long after procedures have been completed, only then discovering costs for services they believed were fully covered by insurance. This lack of upfront communication about costs and coverage can lead to overwhelming financial stress, making routine healthcare a potential economic hazard. This dilemma emphasizes the pressing need for reform in how medical services are billed and covered by insurance.

Emergency Care Costs

Emergencies, by their nature, require immediate and sometimes life-saving medical intervention. However, the financial repercussions of sudden medical emergencies are frequently severe, bringing unexpected financial burdens to those already dealing with distressing health situations. Emergency care, whether it involves a hospital visit, surgery, or other acute treatments, often results in staggering out-of-pocket expenses. Many patients face shock when they receive bills for emergency services, often discovering that certain treatments, specialists, or procedures fall outside their insurance coverage or are considered excessive care.

The unpredictability of insurance coverage plays a significant role, with many plans providing limited coverage for out-of-network emergency services, leaving patients to shoulder extensive costs. Patients’ lack of choice in emergencies—unable to select in-network providers or negotiate treatment costs upfront—further compounds this financial strain. The combination of high costs and limited financial preparation for unforeseen emergencies underlies the systemic issues that plague U.S. healthcare, calling for adjustments to insurance policies and pricing structures that better protect patients from financial ruin following emergency care.

Navigating Insurance Complexities

Insurance Loopholes

The convoluted nature of insurance policies presents a significant challenge for many patients, as they navigate an intricate maze of coverage details and potential financial liabilities. Insurance loopholes often emerge when individuals least expect them, complicating the financial landscape around healthcare services. Out-of-network charges are a frequent obstacle, catching patients off guard when they discover that their insurance policy does not fully cover certain providers or services. These charges can lead to significant out-of-pocket expenses, creating financial strain and frustration for those believing they are adequately covered.

Another common issue is the presence of gaps in insurance policies, which often leave necessary medical treatments uncovered. Such gaps can lead to individuals unexpectedly bearing the full cost of specific procedures or treatments, further complicating their financial situation. Additionally, the complexity of policy language and the difficulty of interpreting insurance terms can prevent patients from fully understanding their coverage and knowing beforehand which services will or will not be reimbursed. The lack of transparency and predictability in insurance policies highlights the need for more straightforward, comprehensible policy structures that ensure patients can obtain necessary care without facing excessive financial burdens.

Challenges with Coverage Limits

Coverage limits often form another significant challenge for patients, who may find their insurance insufficient when dealing with necessary medical services. These limits can compel individuals to look for alternative financial avenues, as their existing policies fall short of covering essential treatments. Coverage limits can unexpectedly arise, particularly in the case of chronic illnesses or long-term care needs, leading patients to financially sustain themselves without sufficient insurance support. Many patients experience substantial stress while navigating the balance between treatment needs and what their insurance provider will approve and fund.

These coverage limitations can have far-reaching impacts, not only on individuals’ finances but also on their health outcomes. Patients may delay treatment, reduce medication dosages, or avoid necessary follow-ups due to unaffordable costs once coverage limits have been reached. The underlying issue here is the disconnect between patient needs and the structured insurance policy terms that do not always account for prolonged or intensive care situations. Addressing these issues involves a critical re-evaluation of coverage policies, ensuring they realistically align with patient requirements and protect them against undue financial hardships.

Discrepancies in Billing Practices

Miscommunication and Billing Errors

Miscommunications and errors in billing practices are among the more frequent frustrations patients encounter in the healthcare system, often leading to increased financial stress. Billing inaccuracies can arise from various sources, such as incorrect data entry, coding errors, or misunderstandings with insurance providers. Patients may find themselves billed for procedures that did not occur or charged incorrectly for services received, prompting extensive disputes with healthcare providers or insurance companies to correct these errors.

Such miscommunications can amplify the financial burden on patients, requiring them to invest considerable time and effort to rectify billing discrepancies. The complexities of interpreting medical bills, along with potential misunderstandings about what insurance covers versus what is patient responsibility, often leave patients feeling overwhelmed and financially vulnerable. Facing prolonged negotiations or appeals to address these errors further strains individuals both emotionally and financially. This indicates a critical need for clearer, streamlined communication and billing processes within healthcare facilities to minimize errors and improve patient confidence in the system.

Labeling of Medical Procedures

The classification of medical procedures as elective or non-essential can significantly affect the financial responsibilities patients encounter, often complicating insurance claims and coverage. Certain necessary treatments or surgeries are occasionally labeled ambiguously, influencing whether an insurer will cover the costs. This categorization issue often results in disputes between insurance companies and patients, who may disagree on what is considered essential for a patient’s health and well-being.

The challenge lies in the variability of terms and definitions across different insurers, not always reflecting the clinical necessity of specific interventions. Patients are left navigating these discrepancies while attempting to obtain coverage for what they view as essential care. Individuals must often resort to advocating for their own needs, possibly delaying treatment until coverage approvals are received, or bearing significant costs if treatments proceed without insurance validation. The need for consistent, understandable labeling practices is evident, promoting transparency in how procedures are categorized and ensuring that essential medical care receives appropriate financial support from insurers.

The Emotional and Financial Toll

Bankruptcy and Legal Battles

The daunting cost of healthcare can drive individuals into situations of extreme financial hardship, often leading to bankruptcy or legal disputes as they attempt to mitigate overwhelming medical bills. Many patients find themselves facing insurmountable debts due to the high cost of treatments and hospital stays, sometimes having to choose between financial ruin or discontinuing necessary healthcare services. The emotional toll of such heavy financial burdens compounds the stress of dealing with a medical condition, creating an environment where recovery is hindered by financial anxiety.

In some cases, patients may turn to legal recourse as a means to challenge exorbitant bills, entering prolonged and often costly negotiations or litigation with healthcare providers or insurers. This pursuit can further exacerbate their financial woes, as legal battles do not always guarantee a favorable outcome, nor do they accelerate the debt resolution process. The prevalence of such scenarios underscores the need for greater protections and support systems for patients, advocating for ethical billing practices and stronger legislative measures to prevent the financial devastation that can follow healthcare treatments.

Personal Stories: Real-Life Impacts

Personal testimonies reflect the diverse and profound impact exorbitant healthcare costs can have on individuals across the United States, highlighting the widespread nature of the issue. From young parents overwhelmed by neonatal care bills to individuals recovering from accidents or surgeries, the human aspect of these stories is both compelling and informative. These narratives reveal the emotional and financial challenges faced, illustrating a spectrum of experiences where healthcare costs not only disrupt financial stability but also affect mental health and overall quality of life.

The real-life accounts of patients dealing with immense healthcare debt serve as powerful reminders of the systemic issues within the current healthcare framework. They exemplify the resilience and resourcefulness individuals often need to employ in order to manage financial obligations while seeking necessary medical care. Collectively, these stories add a human dimension to the conversation on healthcare reform, demonstrating the urgent requirement for changes that will prevent such narratives from recurring. They highlight the necessity for policies and practices that safeguard patients from excessive financial hardships, ensuring their focus can remain on healing and wellness.

Calls for Transparency and Reform

The Need for Clear Communication

A consistent theme across patient experiences is the marked lack of transparency in healthcare billing practices, fostering confusion and unexpected financial liabilities. Patients frequently find themselves facing convoluted bills with little clarity on their breakdown or what insurance will ultimately cover, contributing to financial surprises that could otherwise be avoided. This opacity in billing processes necessitates the demand for clearer communication from healthcare providers and insurers alike, focusing on giving patients the information they need upfront to make informed decisions about their healthcare.

Better communication would involve offering more straightforward explanations regarding potential costs before services are rendered, as well as delineating insurance coverage details in easy-to-understand terms. Patients equipped with this knowledge can better prepare financially, reducing the likelihood of encountering debilitating bills post-treatment. Enhanced transparency is crucial for building trust between providers, insurers, and patients, ensuring that healthcare services are approached with awareness and a clearer understanding of financial implications.

Advocacy for Systemic Changes

Amid the pressing issues faced by patients navigating the healthcare system, there is a growing advocacy for systemic change to ensure financial security and accessibility to necessary medical services. The widespread recognition of billing and insurance complexities, as well as the financial strain they impose on patients, has driven calls for reforms in healthcare policies and practices. Advocates urge for a reformist approach that prioritizes patient protection, aiming to eliminate current systemic inefficiencies and injustices.

Proposed changes include the establishment of more equitable billing practices, enhanced patient education on insurance policies, and legislative action to cap excessive charges or outlaw untenable billing tactics. These efforts align with the broader goals of preventing financial disasters resulting from medical care. The advocacy movement emphasizes the collaborative efforts required from healthcare industry stakeholders, policymakers, and patient communities to bring about meaningful and lasting reform. Such changes aim to create a more patient-centric healthcare system, balancing the provision of quality care with the imperative to protect citizens from financial ruin stemming from their healthcare needs.