An extraordinary shift is underway in the world of specialized energy, where the global market for betavoltaic power is projected to more than double in value, rocketing from nearly USD 53 million in 2024 to over USD 131 million by 2032. This remarkable expansion, representing a compound annual growth rate of 12.12%, is not a speculative bubble but a direct response to a burgeoning global demand for power sources that can operate autonomously for decades without maintenance or replacement. In critical sectors such as aerospace, defense, and implantable medical devices, where failure is not an option and reliability is measured in years, not hours, this technology is transitioning from a niche concept to a cornerstone of future innovation. As the world pushes the boundaries of electronic miniaturization and remote operation, betavoltaic devices are emerging as a vital solution to one of modern technology’s most persistent challenges: creating truly independent, long-lasting power.

Understanding the Market Dynamics

Core Drivers and Emerging Opportunities

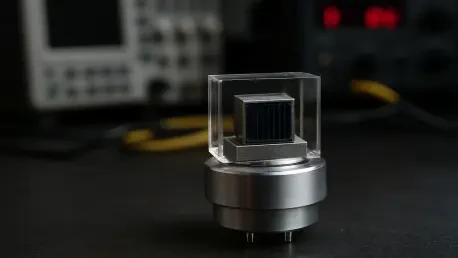

At the forefront of the betavoltaic market’s expansion are foundational advancements in materials science and device engineering that are fundamentally reshaping the technology’s capabilities. Continuous innovation in nanotechnology and sophisticated semiconductor fabrication techniques is enabling the creation of devices with significantly enhanced efficiency and power density. The development of nano-engineered semiconductors and the application of ultra-thin isotopic coatings are not merely incremental improvements; they represent a leap forward in maximizing energy output from a minimal footprint while upholding the most stringent safety protocols against radiation. This progress directly addresses a core industrial and military imperative: the need for power solutions that drastically reduce, or entirely eliminate, the need for human intervention. For applications in remote, inaccessible, or hazardous environments—such as deep-sea sensors, orbital satellites, or deep-space probes—where battery replacement is physically impossible or prohibitively expensive, betavoltaic power sources provide the decades-long operational autonomy required.

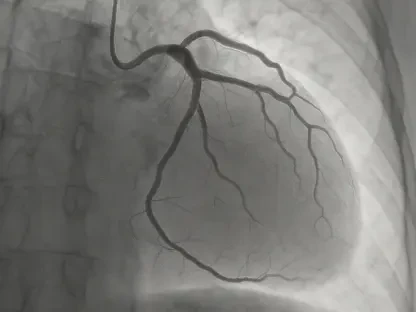

This technological push is met by a powerful demand-pull from high-stakes industries where long-term, uninterrupted power is a non-negotiable requirement. The global expansion in both governmental and private space missions, coupled with ambitious defense modernization programs, has created a significant need for highly reliable energy sources that can withstand extreme temperatures, high radiation, and the sheer duration of modern operations. Betavoltaic technology excels in these punishing conditions, powering critical systems on satellites, rovers, and unmanned platforms. Simultaneously, the advanced medical field is experiencing a growing need for long-term implantable devices like pacemakers and neurological stimulators. Here, betavoltaic cells are revolutionary, offering the potential to power these life-sustaining devices for a patient’s entire lifetime, thereby obviating the need for high-risk surgical procedures for battery replacement. These converging trends, alongside strategic efforts to diversify the radioisotope supply chain, are unlocking new opportunities and solidifying the market’s growth trajectory.

A Closer Look at Market Segments

A granular analysis of the betavoltaic market reveals distinct patterns of growth and dominance across its various segments, painting a clear picture of current priorities and future trends. While standard betavoltaic devices commanded the majority of the market in 2024, holding a 62.12% share due to their proven reliability and wide applicability, it is the miniaturized devices that represent the future. This segment is projected to experience the fastest growth, with a compound annual growth rate of 13.45% through 2032. This surge is directly fueled by the relentless macro-trend toward smaller, more compact electronics, particularly within the burgeoning Internet of Things (IoT) ecosystem and advanced medical implants where space is at an absolute premium. In terms of power output, medium-power devices (100 mW to 1 W) currently capture the largest share at 42.18%, offering a versatile balance for a broad spectrum of industrial and defense applications. However, looking forward, high-power output devices are poised for the highest growth, driven by the increasingly energy-intensive demands of next-generation space missions and large-scale industrial systems.

Dissecting the market by application and functionality further clarifies the key end-user demands shaping the industry. In 2024, military applications constituted the largest revenue segment with a 41.75% share, a testament to the extensive use of betavoltaics in powering unmanned aerial and ground vehicles, covert GPS trackers, and remote surveillance sensors that require long-term, unattended operation. Following closely in growth potential, the medical devices segment is forecasted to expand at a rapid 13.37% CAGR as the technology becomes more deeply integrated into long-term implants. This demand is intrinsically linked to the core functionality of the technology: long lifespan. Devices categorized by this attribute dominated the market with a 49.15% share, underscoring the technology’s primary value proposition. Concurrently, the self-powered systems segment is projected to grow swiftly at a 13.23% CAGR, highlighting its role as a critical enabler for the development of fully autonomous energy solutions in emerging fields like smart infrastructure and widespread IoT sensor networks.

The Global Landscape: Who’s Leading the Charge?

Regional Powerhouses and Future Hotspots

Geographically, North America stands as the clear leader in the global betavoltaic device market, having secured a commanding 33.89% share in 2024. This dominance is overwhelmingly propelled by the United States, which serves as the epicenter of innovation and adoption. The nation’s leadership is built upon a powerful combination of substantial defense spending, pioneering government-led aerospace initiatives, and one of the world’s most advanced medical technology infrastructures. The U.S. market is projected to grow from USD 11.97 million in 2024 to USD 25.82 million by 2032, a trajectory reinforced by robust federal funding for research and development. Furthermore, strong, synergistic collaborations between national laboratories and private sector companies, along with the active exploration of betavoltaic applications in over a dozen distinct military programs, have created a fertile ecosystem for sustained growth and technological leadership, cementing the region’s preeminent position for the foreseeable future.

While North America currently leads, the Asia Pacific region is rapidly emerging as the market’s most dynamic growth engine, projected to expand at an impressive CAGR of 13.28%. This accelerated growth is spearheaded by technological powerhouses like China, Japan, and South Korea. These nations are leveraging their formidable and expanding semiconductor manufacturing capabilities, consistently increasing defense budgets, and a surging domestic demand for advanced medical devices to carve out a significant share of the global market. In contrast, the European market, led by Germany, France, and the United Kingdom, is characterized by steady and stable growth, underwritten by the region’s extensive nuclear research infrastructure and strong government policies promoting technological innovation. Beyond these primary hubs, growth is also being catalyzed in other regions. In the Middle East & Africa, the UAE’s strategic investments in nuclear energy and space exploration are fostering adoption, while in Latin America, Brazil is at the forefront, utilizing its growing aerospace sector to cultivate market development.

A Foundation for Future Growth

The comprehensive analysis of the betavoltaic device market revealed a sector poised for transformative expansion. The investigation identified that this growth was not driven by a single factor but by a powerful confluence of technological innovation, escalating demand from critical industries, and a broadening global adoption landscape. Key technological breakthroughs in semiconductor materials and device miniaturization were established as the primary enablers, unlocking new levels of efficiency and applicability. The unrelenting demand for long-life, maintenance-free power from the aerospace, defense, and medical fields was confirmed as the principal market engine. Finally, the strategic positioning of regional leaders and the emergence of new growth hotspots painted a picture of an industry on a clear path to achieving its projected valuation, having solidified its role as a critical component in the future of autonomous technology.