A fundamental shift is rearchitecting the global healthcare technology landscape, transforming what was once a series of discretionary upgrades into an urgent operational and financial necessity for providers worldwide. The era of siloed, department-specific software is definitively over, replaced by a new paradigm driven by powerful external forces, including stringent government mandates and the establishment of national claims-exchange infrastructures. This transformation is not merely about digitization; it is a global convergence toward a unified architectural model built on three core pillars: interoperability-first platforms, comprehensive revenue cycle automation, and the deployment of production-grade clinical artificial intelligence. The findings from a comprehensive global survey of over 21,000 healthcare IT users reveal that 2026 is the pivotal year where these trends have solidified, defining a new standard for digital health infrastructure on an international scale.

The New Architectural Standard

The End of Siloed Systems

The long-standing practice of departmental digitization, where individual hospital units procured isolated software solutions to meet their specific needs, has been overwhelmingly rejected as an unviable long-term strategy. An emphatic 84% of healthcare organizations in the world’s fastest-adopting countries report they are actively moving away from this fragmented approach, instead standardizing on comprehensive, end-to-end platform architectures. This strategic pivot is a direct response to the operational inefficiencies, clinical data gaps, and financial leakages caused by systems that cannot communicate with one another. The old model created a patchwork of digital islands, making it nearly impossible to get a holistic view of a patient’s journey, manage population health effectively, or streamline the complex revenue cycle. The consensus viewpoint is clear: true digital transformation requires a unified ecosystem that integrates core clinical systems with the operational and patient-facing functions that drive the business of healthcare. This shift represents a move from simply buying software to architecting a cohesive digital foundation for the entire enterprise.

This modern architectural approach is crystallized in the concept of the “interoperability-first platform stack,” a cohesive set of integrated components designed for the seamless and secure flow of information. At its core is the foundational EHR/EMR system, but its power lies in the surrounding connective tissue. This includes robust API and FHIR integration layers, which 92% of providers now cite as a top-three procurement requirement, enabling data exchange between disparate systems. Essential security and compliance are handled by dedicated identity and consent services, which manage patient data access in accordance with evolving privacy regulations. Furthermore, the stack incorporates sophisticated analytics platforms for population health management, risk stratification, and quality reporting, turning raw data into actionable insights. It also features advanced revenue cycle automation tools to manage claims, eligibility, and authorizations, alongside tight integration with Radiology Information Systems (RIS) and Laboratory Information Systems (LIS) to bring diagnostic data directly into clinical workflows. Finally, this ecosystem is completed with omnichannel patient communication systems and, crucially, governed and embedded AI, which is deployed directly within workflows to provide decision support and automate tasks.

The Rise of Production-Grade AI

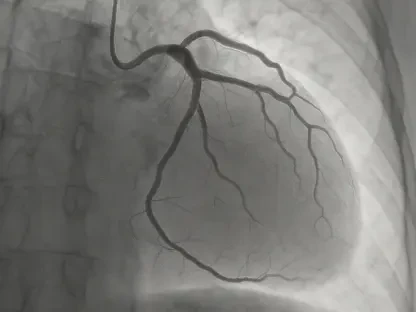

The current year marks a significant inflection point for the role of artificial intelligence in healthcare, signaling its definitive transition from the experimental realm of innovation labs and pilot projects to widespread deployment in live clinical and operational environments. This evolution toward “production-grade” AI is driven by a growing body of evidence demonstrating its ability to deliver tangible, measurable value in real-world settings. Unlike earlier AI initiatives, which were often isolated and difficult to scale, today’s solutions are deeply embedded within core workflows, such as EHRs and diagnostic imaging platforms. This integration ensures that AI-driven insights are delivered to clinicians at the point of care, where they can have the greatest impact on decision-making. Moreover, this new generation of AI comes with robust governance frameworks that ensure its outputs are reliable, auditable, and aligned with clinical best practices, building the trust necessary for mainstream adoption. This maturation reflects a growing confidence among healthcare leaders that AI is no longer a futuristic concept but a critical tool for addressing pressing challenges like workforce shortages, diagnostic accuracy, and operational efficiency.

The tangible impact of this trend is clearly reflected in adoption data, which shows a marked acceleration in the deployment of applied AI across high-velocity global markets. The survey found that 18% of responding organizations now have AI in production in at least one key workflow, a substantial increase from just 11% in the previous year. This growth is not limited to a single application but spans a range of high-value use cases, including the automated triage of radiological images to prioritize urgent cases, ambient clinical intelligence tools that reduce the burden of documentation on physicians, and predictive analytics that identify patients at high risk for adverse events. This shift indicates that the industry has moved past the proof-of-concept stage and is now focused on scaling AI capabilities across the enterprise. As a result, the ability to deploy governed, workflow-embedded AI is quickly becoming a standard component of the modern healthcare IT platform and a key differentiator for providers seeking to enhance clinical outcomes and operational performance in an increasingly competitive landscape.

Global Drivers and Regional Acceleration

Mandates and Modernization in Asia and the GCC

In Southeast Asia, government mandates have emerged as the single most powerful catalyst for healthcare IT modernization, transforming platform upgrades from strategic options into non-negotiable, time-sensitive imperatives. National digitization policies, coupled with the consolidation of provider groups that amplifies the return on investment for enterprise-wide systems, are creating immense pressure for rapid adoption. In Indonesia, for instance, strict compliance deadlines are the primary driver behind a surge in activity, with an impressive 84% of providers actively adopting interoperability tooling and 78% undertaking major EHR/EMR modernization projects. The market dynamics here strongly favor vendors who offer repeatable, multi-site deployment playbooks and “interoperability-by-default” architectures capable of supporting large-scale networks. Meanwhile, Vietnam’s focus has progressed beyond basic digitization toward achieving structured-data maturity. This is evident in the high rates of EHR modernization (72%) and the expansion of population health analytics platforms (71%), reflecting a national push to ensure data is not only captured but is also useful for system-wide reporting, public health surveillance, and advanced analytics.

A parallel wave of transformation is sweeping across the Gulf Cooperation Council (GCC), where the modernization of revenue cycle management (RCM) has become a central priority. The prevalence of complex, mixed-payment models and the rollout of national claims exchanges are driving the need for industrial-grade claims processing and seamless clinical-financial integration. In Saudi Arabia, the national NPHIES exchange has effectively turned reimbursement into a real-time interoperability workflow, compelling providers to ensure tight connectivity between clinical documentation and financial systems to maintain payment continuity. This has led to significant investment in revenue cycle modernization (39%) and claims connectivity automation (26%). In the highly mature and competitive market of the United Arab Emirates, the focus is on broad-based adoption of advanced technologies that can differentiate services. This has resulted in some of the world’s highest adoption rates for analytics platforms (63%) and production-grade AI (34%), as providers leverage technology to optimize operational throughput, enhance the patient experience, and deliver visibly superior clinical outcomes.

Compliance and Execution in Europe and The Americas

Across leading European markets, technology procurement decisions are increasingly dictated by stringent requirements for cross-organizational data exchange, auditable patient consent management, and adherence to standards-based APIs. The dual pressures of enabling seamless care coordination across health systems and facilitating regulated secondary use of data for research are pushing healthcare buyers toward exchange-ready architectures. An estimated 62% of European survey respondents now list interoperability as a top-three procurement driver, while 41% are either adopting or planning to deploy sophisticated consent and identity services to manage data access. This adoption pattern is governed by the establishment of “trust frameworks,” where the ability to prove data provenance, ensure auditability, and operationalize governance is paramount. Consequently, vendors who can demonstrate these capabilities baked into their platforms hold a distinct competitive advantage in a region defined by complex regulatory landscapes and a strong emphasis on data privacy and security.

In Latin America, the momentum in healthcare IT is characterized by a decisive shift from strategic planning to active implementation, as national technology roadmaps translate into funded, large-scale procurement cycles. Providers in the region are now intensely focused on achieving measurable implementation timelines and demonstrating tangible operational performance improvements. The complex, multi-payer reality of many Latin American healthcare systems is also fueling strong demand for solutions that offer deep clinical-financial integration to streamline reimbursement and reduce administrative burdens. The data reflects this shift to execution, with 55% of organizations having budgeted for major EHR modernization initiatives and 44% undertaking significant RCM integration projects. In this environment, key differentiators for technology partners are implementation velocity and predictable lifecycle costs, creating a preference for platforms that can scale efficiently across diverse provider networks without necessitating large, specialized internal IT teams to manage and maintain them.

A New Foundation for Global Health

The accelerated and convergent evolution of the global healthcare IT market marked a profound realignment of technological priorities with operational and financial realities. The era where discretionary, department-level IT projects could exist was replaced by a strategic imperative to construct integrated digital ecosystems. This shift was no longer driven by internal choice but by external mandates from governments and payers that inextricably linked technological capability to organizational viability. Interoperability became the non-negotiable foundation upon which all other technology decisions were built, serving as the critical enabler for everything from clinical data exchange and patient engagement to claims automation and the effective deployment of artificial intelligence. Providers that standardized on this “interoperability-first” platform stack demonstrated a clear competitive advantage, achieving significantly higher penetration of both advanced integration layers and production-level AI compared to their slower-moving peers. This decisive move toward unified, exchange-ready, and intelligent platforms solidified a new global standard for digital health infrastructure.