The surgical robotics market is on the cusp of transformation, with 2025 poised to be a pivotal year for the sector. This upcoming period could see significant shifts due to potential new market entries, competitive dynamics, and policy changes in the United States that impact the healthcare industry at large.

Intuitive Surgical’s Dominance

Established Leadership

Intuitive Surgical has long enjoyed a dominant position in the surgical robotics market, largely due to the success of its da Vinci surgical robot. The company boasts a significant market share, with nearly 60% of the global market in 2024. Intuitive’s market dominance is attributed to its comprehensive installed base, robust surgeon training programs, and a continuous drive for innovation. The company has built a strong ecosystem around its da Vinci systems, which includes a network of trained surgeons, ongoing support and maintenance services, and a pipeline of technological advancements.

One of the keys to Intuitive’s success has been its ability to maintain a high level of trust and satisfaction among its user base. Surgeons who have trained on da Vinci systems often become advocates for the technology, further solidifying Intuitive’s market position. In addition, the company’s commitment to continuous improvement has led to iterative enhancements in both hardware and software, ensuring that their systems remain at the cutting edge of surgical technology. This combination of factors has allowed Intuitive to maintain its leadership position in a rapidly evolving market.

Upcoming Innovations

In 2025, Intuitive Surgical aims to launch the latest version of its robotic system, the da Vinci 5, in the United States. This latest iteration, which received FDA clearance in March 2024, is anticipated to be a major growth driver for the company. The da Vinci 5 promises substantial upgrades, including advanced case insights, artificial intelligence, and machine learning capabilities. These improvements are expected to enhance surgical precision, efficiency, and outcomes, making the system even more attractive to hospitals and surgical centers.

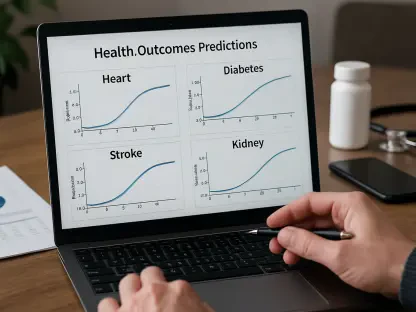

Dr. Bruce McIntosh, a surgeon with extensive experience using da Vinci systems, highlights the ergonomic improvements in the da Vinci 5, noting that they contribute to reduced surgeon fatigue and improved overall user experience. The incorporation of AI and machine learning is particularly noteworthy, as these technologies can provide real-time assistance and decision support, potentially reducing the risk of errors and improving patient outcomes. With these advancements, Intuitive Surgical is well-positioned to maintain its leadership in a market that demands constant innovation.

Competitive Landscape

Medtronic’s Hugo

Despite Intuitive’s stronghold, the market is witnessing emerging competitors. Medtronic’s Hugo robotic system, already in use across more than 25 countries, represents a formidable challenge. Medtronic plans to submit Hugo for FDA approval in early 2025 for a urology indication, with further plans for hernia and gynecology indications. The company has invested heavily in the development of Hugo, emphasizing features such as its modular build and open console setup.

Dr. Ben Challacombe, a prominent urological surgeon, emphasizes Hugo’s unique features, such as its modular build and open console setup, which facilitate teaching and provide superior visual clarity. Although Hugo is currently more affordable than da Vinci, its market penetration primarily targets new customers rather than displacing Intuitive’s established base. This strategic approach allows Medtronic to carve out a niche in the market without directly challenging Intuitive’s dominance.

The potential success of Hugo hinges on its ability to gain regulatory approval and demonstrate clinical efficacy. If Medtronic can navigate these hurdles, Hugo could become a significant player in the surgical robotics market. Moreover, Medtronic’s extensive global presence and established relationships with healthcare providers give it a competitive advantage in terms of market access and distribution.

J&J’s Ottava

Johnson & Johnson (J&J) is another significant player making strides with its Ottava surgical system. The company has received an FDA investigational device exemption (IDE) for a clinical trial, indicating a serious bid to enter the market. Ottava aims to compete on workflow efficiency and reduced operating room footprint, which could be appealing to healthcare facilities looking to optimize their resources. J&J’s extensive experience in the medical device industry and its strong financial position provide a solid foundation for the successful launch of Ottava.

However, J&J faces challenges similar to those of Medtronic, including regulatory approvals and surgeon training. The success of Ottava will depend on its ability to demonstrate clinical benefits and gain acceptance among surgeons and hospitals. J&J has already begun investing in training programs and building partnerships with medical institutions to facilitate the adoption of Ottava. If these efforts prove successful, Ottava could emerge as a strong competitor in the surgical robotics market.

J&J’s strategic approach also includes leveraging its existing portfolio of surgical products and technologies to create an integrated solution for healthcare providers. By offering a comprehensive suite of products and services, J&J aims to create a compelling value proposition for its customers. This holistic approach could give Ottava an edge in a market that is becoming increasingly competitive.

Other Competitors

Further competition comes from CMR Surgical, with its Versius system, and Stryker, which is exploring the soft tissue robotic surgery space with its Mako robotic arm. CMR Surgical’s Versius system is designed to be flexible and cost-effective, making it an attractive option for hospitals with budget constraints. The system’s modular design allows for easy integration into existing surgical workflows, and its compact size makes it suitable for a wide range of surgical procedures. CMR Surgical has already gained traction in several international markets and is now focusing on expanding its presence in the United States.

Stryker, on the other hand, has taken a different approach by focusing on the soft tissue robotic surgery space. Its Mako robotic arm has been primarily used for orthopedic procedures, but the company is now exploring applications in other surgical areas. By leveraging its expertise in robotic-assisted surgery, Stryker aims to develop innovative solutions that meet the needs of surgeons and patients alike. The company’s strong track record in the medical device industry positions it well to compete in the evolving surgical robotics market.

Technology giant Sony is also testing the waters with a prototype microsurgery assistance robot. This move signals Sony’s interest in entering the medical technology space and leveraging its expertise in imaging and robotics to develop advanced surgical solutions. Sony’s collaboration with academic and medical institutions to advance its technology highlights the company’s commitment to innovation and its potential to become a significant player in the surgical robotics market.

Market Pressures and Challenges

Economic and Regulatory Factors

Apart from inter-market competition, companies in the surgical robotics market face shared challenges. Economic uncertainties in China and the lingering effects of tariffs imposed by the Trump administration present hurdles that could stifle innovation. These economic pressures can lead to increased production costs, reduced profit margins, and potential delays in product development. Companies must navigate these challenges while continuing to invest in research and development to maintain their competitive edge.

Regulatory factors also play a crucial role in shaping the market dynamics. Obtaining FDA approval for new surgical robotic systems is a complex and time-consuming process that requires substantial investment and rigorous testing. The regulatory landscape can impact the speed at which new technologies are introduced to the market, potentially affecting companies’ market share and growth prospects. Companies must stay informed about regulatory changes and adapt their strategies accordingly to ensure compliance and minimize potential setbacks.

Additionally, the global nature of the surgical robotics market means that companies must also contend with regulatory requirements in other countries. Each market has its own set of regulations and standards that must be met, which can add complexity to the commercialization process. Successful navigation of these regulatory landscapes requires a deep understanding of local requirements and a proactive approach to addressing potential challenges.

Impact of Pharmaceuticals

The rising popularity of weight loss drugs, particularly GLP-1RA drugs, poses a threat to the number of bariatric procedures, as acknowledged by Intuitive. These drugs, which have shown significant promise in helping individuals achieve weight loss without the need for surgery, could lead to a decline in demand for bariatric procedures. This trend may force companies in the surgical robotics market to diversify their offerings and explore new surgical specialties to offset potential declines in specific procedure volumes.

In addition to the impact on bariatric procedures, pharmaceutical advancements could also affect other surgical areas. For instance, the development of new medications for conditions such as diabetes, cardiovascular disease, and cancer could reduce the need for certain types of surgeries. Companies must stay attuned to these developments and be prepared to adapt their product portfolios and strategies to address shifting demands in the healthcare landscape.

Moreover, the integration of pharmaceuticals and surgical robotics could open up new opportunities for innovation. Collaborations between pharmaceutical companies and surgical robotics firms could lead to the development of advanced treatment solutions that combine drug therapies with robotic-assisted surgeries. Such synergies could enhance patient outcomes and create new avenues for growth in the market.

Future Trajectory

Technological Advancements

The introduction of advanced robotic systems such as the da Vinci 5, Hugo, and Ottava will drive the market towards greater innovation and competition. Companies must stay agile, focusing on technological advancements and cost-efficient solutions to maintain their competitive edge. The continuous evolution of robotics technology, artificial intelligence, and machine learning will play a crucial role in shaping the future of surgical robotics. As these technologies mature, they will enable the development of more sophisticated and capable robotic systems that can perform increasingly complex surgical procedures.

In addition to advancements in hardware, software innovations will also be critical in driving the next generation of surgical robots. Enhanced imaging and visualization capabilities, real-time data analytics, and integration with other medical devices and systems will further improve the precision and efficiency of robotic-assisted surgeries. Companies that can successfully leverage these technologies to create intuitive and user-friendly solutions will be well-positioned to capture market share and drive industry growth.

Collaborations and partnerships with academic institutions, research organizations, and other technology companies will also be key to fostering innovation in the surgical robotics market. By pooling resources and expertise, companies can accelerate the development of new technologies and bring them to market more quickly. Such collaborations can also help address common challenges, such as regulatory hurdles and surgeon training, by creating comprehensive and integrated solutions.

Strategic Market Entries

The intricate interplay of economic pressures, regulatory landscapes, and competitive dynamics will shape the future trajectory of surgical robotics. Companies need to navigate these factors effectively to secure a competitive edge. Strategic market entries will be crucial for capturing new opportunities and expanding market presence. Companies must conduct thorough market research and analysis to identify potential growth areas and tailor their strategies accordingly. This may involve targeting specific surgical specialties, geographic regions, or customer segments that offer the greatest potential for success.

Moreover, companies should focus on building strong relationships with key stakeholders in the healthcare ecosystem, including surgeons, hospitals, and regulatory authorities. By fostering trust and collaboration, companies can facilitate the adoption of their technologies and create a supportive environment for innovation. Investing in training programs and educational initiatives will also be essential for ensuring that surgeons are well-equipped to use the latest robotic systems effectively.

Additionally, companies must remain adaptable and responsive to changing market conditions and emerging trends. This may involve reevaluating their product portfolios, exploring new business models, or pursuing mergers and acquisitions to strengthen their competitive position. By staying agile and proactive, companies can better navigate the complexities of the surgical robotics market and capitalize on new opportunities for growth.

Final Thoughts

The surgical robotics market is on the brink of a major transformation, with 2025 forecasted to be a critical year for the sector. We anticipate significant changes during this period, driven by various factors including the arrival of new competitors, shifts in market dynamics, and potential policy reforms in the United States that could broadly affect the healthcare landscape. The introduction of innovative robotic systems could enhance surgical precision, potentially lowering recovery times and improving patient outcomes. New players entering the market may spur technological advancements and drive down costs due to heightened competition. Policy shifts, especially those related to healthcare regulations, reimbursement structures, and approval processes, could play a decisive role in shaping the future of surgical robotics.

For instance, changes in FDA approval processes might speed up the time it takes for new technologies to reach the market, allowing for quicker adoption of advanced surgical robots. Simultaneously, adjustments in reimbursement policies could make it easier for hospitals and clinics to invest in these high-tech systems. On the flip side, stringent regulatory requirements could slow down innovation or limit market access for new entrants. However, with these dynamic forces at play, the surgical robotics market is set for an exciting journey toward enhanced medical procedures and improved patient care. Moving forward, stakeholders in this industry will need to stay agile, adapting quickly to the evolving landscape.