The medical device equipment market is poised for an extraordinary surge, with projections estimating its value to climb from $19.24 billion this year to a staggering $27.8 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 7.6%. This remarkable trajectory underscores the critical role that advanced manufacturing tools play in meeting the escalating global demand for high-quality medical devices. As healthcare systems worldwide grapple with aging populations, rising chronic disease rates, and the need for innovative solutions, the equipment used to produce everything from diagnostic tools to surgical instruments has become a linchpin of the industry. This growth is not merely a number—it represents a transformative shift in how medical technology is developed and delivered. Exploring the driving forces behind this expansion, from cutting-edge innovations to regional market trends, reveals a dynamic sector brimming with potential, yet not without its challenges. This analysis aims to unpack these elements, offering a comprehensive look at what propels this market forward and what obstacles lie in its path.

Cutting-Edge Technologies Fueling Expansion

The rapid growth of the medical device equipment market is largely driven by groundbreaking technological advancements that are revolutionizing production processes. Automation and robotics have emerged as pivotal forces, significantly reducing manufacturing times while enhancing precision—a critical factor in an industry where even the smallest error can have serious consequences. These technologies allow for the efficient production of intricate devices, such as those used in minimally invasive surgeries, ensuring consistency and quality that meet stringent standards. Beyond automation, precision machining has also gained prominence, enabling manufacturers to craft components with unparalleled accuracy. This capability is vital for creating devices that must integrate seamlessly into complex medical procedures. As technology continues to evolve, its adoption is becoming less of an option and more of a necessity for companies aiming to remain competitive in a fast-paced and highly demanding field.

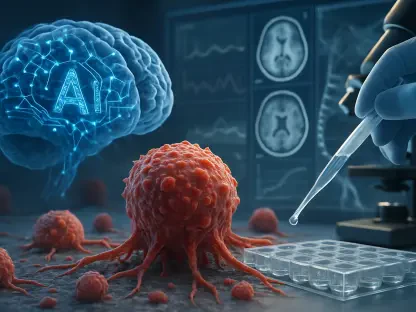

Another transformative element in this market is the integration of digital innovations like the Internet of Things (IoT) and Artificial Intelligence (AI), which are reshaping how equipment operates and performs. IoT enables real-time monitoring of machinery, providing manufacturers with immediate insights into performance and potential issues, thus minimizing downtime and boosting efficiency. Meanwhile, AI takes this a step further by offering predictive maintenance capabilities and optimizing workflows through data-driven decision-making. Additionally, additive manufacturing, widely known as 3D printing, is carving out a significant niche by facilitating the creation of customized medical devices tailored to individual patient needs. This technology not only reduces material waste but also allows for the production of complex geometries that traditional methods struggle to achieve. Together, these digital and additive solutions are paving the way for more adaptive, efficient, and personalized production, aligning perfectly with the growing trend toward customized healthcare solutions.

Surging Global Demand and Emerging Opportunities

The escalating global demand for medical devices stands as a primary catalyst for the expansion of the equipment market, driven by demographic shifts and health trends. With aging populations requiring more frequent medical interventions and the prevalence of chronic conditions like diabetes and heart disease on the rise, the need for advanced tools—ranging from diagnostic equipment to therapeutic implants—has never been greater. This surge directly translates into a heightened requirement for sophisticated manufacturing equipment capable of producing these life-saving products at scale. Particularly in regions where healthcare access is expanding, the pressure on manufacturers to deliver high-quality devices quickly and efficiently is immense. This dynamic is pushing the boundaries of what production equipment must achieve, emphasizing speed without sacrificing the stringent quality standards that define the medical field.

Beyond immediate demand, significant opportunities are unfolding in emerging economies where healthcare infrastructure is undergoing rapid development. Countries in Asia, Africa, and Latin America are witnessing substantial investments from both governmental and private sectors to bolster medical facilities, creating a burgeoning need for locally produced devices and, consequently, the equipment to manufacture them. This trend is amplified by the cost advantages these regions offer, making them attractive hubs for production. Furthermore, the growing emphasis on personalized medicine is opening new avenues, as technologies like 3D printing enable the creation of patient-specific solutions at a fraction of the traditional cost. These opportunities highlight a pivotal shift, where the market is not only growing in established regions but also finding fertile ground in areas previously underserved, thus broadening the global footprint of medical device manufacturing.

Navigating Regulatory and Financial Hurdles

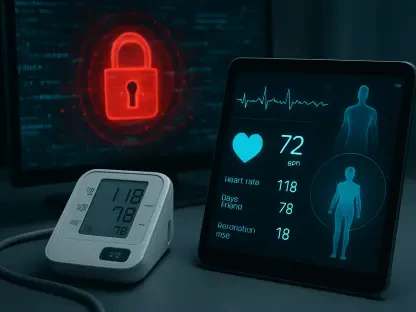

Despite the promising growth trajectory, the medical device equipment market faces substantial challenges, particularly in the realm of regulatory compliance. Health authorities across the globe impose rigorous standards to ensure the safety and efficacy of medical devices, necessitating the use of top-tier manufacturing equipment that can meet these benchmarks. However, the diversity of regulatory frameworks across different regions adds a layer of complexity, often requiring manufacturers to adapt their processes and invest heavily in certifications and training. For smaller companies, these requirements can be especially daunting, as the financial burden of compliance may limit their ability to scale or even enter the market. This regulatory landscape, while crucial for patient safety, often acts as a double-edged sword, fostering innovation in equipment design but also creating barriers that can stifle smaller players in the industry.

Financial constraints represent another significant obstacle, as the high cost of acquiring and maintaining cutting-edge manufacturing equipment can be prohibitive. State-of-the-art machinery, while essential for producing devices that meet modern standards, often comes with a hefty price tag, not to mention the ongoing expenses related to upgrades and repairs. This capital-intensive nature of the industry poses a particular challenge for smaller manufacturers or new entrants who may lack the resources to invest at such levels. Compounding this issue are supply chain disruptions, which can lead to material shortages or logistical delays, further driving up costs and slowing production timelines. These financial and operational hurdles underscore the need for strategic planning and innovative financing solutions to ensure that all players, regardless of size, can participate in and contribute to the market’s growth.

Global Market Leadership and Regional Trends

Geographically, Europe holds a commanding position in the medical device equipment market, underpinned by a robust manufacturing ecosystem, substantial investments in research and development, and elevated healthcare spending. The region benefits from a well-established network of original equipment manufacturers (OEMs) that drive innovation and maintain high production standards. Additionally, Europe’s stringent regulatory environment, though challenging, compels manufacturers to adopt the most advanced equipment, ensuring that the devices produced are of the highest quality. This combination of infrastructure, policy, and investment cements Europe’s role as a leader, setting a benchmark for quality and technological advancement that influences global trends. The region’s dominance is a testament to how a supportive framework can propel an industry forward, even amidst complex challenges.

Elsewhere, other regions are making significant strides, contributing to the market’s global diversity and growth potential. Asia, in particular, is emerging as a powerhouse, fueled by expanding healthcare access and cost-effective manufacturing capabilities that attract international investment. This region is becoming a key player as it balances affordability with the adoption of advanced technologies. Meanwhile, North America remains a vital hub for innovation, with a strong focus on integrating cutting-edge tech like AI and IoT into production processes. The presence of leading tech companies and research institutions in this region fosters an environment where new ideas and equipment designs are continuously developed. These regional dynamics illustrate a multifaceted market, where leadership in one area complements rapid growth in others, creating a balanced global landscape that promises sustained expansion through diverse contributions.

Future Pathways for Sustainable Growth

Reflecting on the journey of the medical device equipment market, it’s evident that the sector has navigated a complex path filled with both remarkable progress and formidable challenges. The projected rise to a $27.8 billion valuation by 2030, underpinned by a steady 7.6% CAGR from the current base of $19.24 billion, highlights the transformative impact of technological innovation and soaring demand. Automation, digital tools, and additive manufacturing have played pivotal roles in enhancing production capabilities, while Europe’s leadership and the rise of emerging markets have shaped a truly global industry. Challenges like regulatory intricacies and financial barriers have tested the resilience of manufacturers, yet they also spurred creative solutions and strategic adaptations that strengthened the market’s foundation.

Looking ahead, the focus must shift toward sustainable growth strategies that address lingering obstacles while capitalizing on untapped potential. Manufacturers should prioritize investments in scalable technologies like 3D printing to meet the demand for personalized devices, while also exploring partnerships to mitigate supply chain risks. Policymakers could play a crucial role by harmonizing regulatory standards to ease compliance burdens, particularly for smaller firms. Additionally, fostering innovation hubs in emerging regions could accelerate local production capabilities, ensuring broader access to life-saving devices. These steps, taken collectively, promise to guide the market toward a future where growth is not just robust but also inclusive and resilient, meeting the evolving needs of global healthcare with agility and foresight.