The U.S. medical billing outsourcing market is on the cusp of a significant transformation, projected to be valued at USD 5.9 billion in 2024 and expected to swell to USD 16.9 billion by 2033. This robust growth trajectory is driven by rising health expenditures, a complex regulatory landscape, and an increasing demand for efficient billing services. Outsourcing medical billing functions offers healthcare providers a strategic advantage, allowing them to streamline operations, reduce administrative errors, and focus more on patient care and revenue cycle management. Moreover, the process involves several tiers of services – from front-end administrative tasks to back-end billing activities, making it a comprehensive solution for healthcare providers.

The Rising Demand for Outsourced Medical Billing

The healthcare industry is grappling with escalating costs and intricate regulatory requirements that compel healthcare organizations to seek efficient solutions for managing their billing operations. As a result, outsourcing medical billing has emerged as a viable option; it enables providers to enhance operational efficiencies and reduce administrative burdens. By leveraging specialized expertise, advanced technologies, and streamlined processes through outsourcing, healthcare providers can significantly improve their revenue cycle management.

Outsourced medical billing services encompass various tiers, including front-end, mid-end, and back-end services. Front-end services like patient registration, insurance verification, and prior authorization dominate the market because they form the foundation of accurate and efficient billing. Furthermore, as healthcare providers continue to adopt advanced billing software and electronic health records (EHRs), the demand for outsourced services is projected to escalate, driving market growth even further. This trend is also supported by the increasing complexity of billing operations, which demands more sophisticated solutions.

Market Insights and Key Segments

The U.S. medical billing outsourcing market is characterized by several key segments. Outsourced medical billing holds the major share, accounting for 63.1% of the market in 2024. This significant share underscores the strong demand for efficient and comprehensive billing services across the healthcare sector. Additionally, hospitals emerge as the leading end-users due to their substantial structural complexities and voluminous billing operations, making them prime beneficiaries of outsourcing services.

The market’s growth is further propelled by the adoption of advanced technologies and value-based care models. The integration of advanced billing software and EHRs plays a pivotal role in enhancing data accuracy and streamlining billing processes, thereby minimizing manual errors and increasing overall efficiency. Value-based care models, which emphasize quality and efficiency, further drive the demand for outsourced medical billing services that adhere to these stringent standards. This dynamic market landscape sees prominent players like Cerner Corporation, Allscripts Healthcare Solutions, R1 RCM Inc., and McKesson Corporation actively expanding their service offerings and implementing cutting-edge technologies to stay competitive.

Competitive Landscape and Key Players

The competitive landscape of the U.S. medical billing outsourcing market is marked by the presence of numerous large multinational companies and specialized local firms. These companies are investing heavily in automation and artificial intelligence to further streamline billing operations and reduce the margin of error. As a result, the market remains highly competitive, with companies continually innovating to offer more efficient and cost-effective solutions that enhance revenue cycle management for healthcare organizations.

Recent developments in this market include the launch of new products and services, strategic acquisitions, and robust partnerships. For instance, in December 2023, Experian launched Ascend Ops and Retro on Demand, which significantly enhance revenue cycle management and billing efficiency. Meanwhile, R1 RCM Inc.’s acquisition of Acclara expands its suite of RCM technology solutions, underlining the dynamic nature of the market and the ongoing efforts by key players to innovate and improve their offerings. These strategic moves are pivotal for maintaining a competitive edge and meeting the ever-evolving needs of healthcare providers.

Growth Drivers and Market Dynamics

Several factors drive the tremendous growth of the U.S. medical billing outsourcing market. Rising healthcare costs push providers to seek more affordable and efficient billing solutions, with outsourcing emerging as a viable option to manage administrative overheads and free up resources for more value-added activities. The increasingly complex regulatory landscape in healthcare also necessitates specialized billing knowledge, which outsourcing firms provide. This helps healthcare providers navigate the intricate web of regulations effectively and ensures compliance, which is crucial in avoiding hefty penalties.

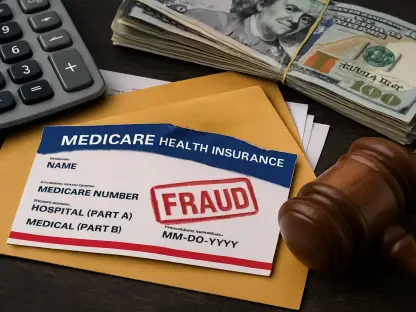

However, the market also faces certain challenges. Data security concerns are a notable limiting factor, as outsourcing patient information to third-party vendors raises concerns related to HIPAA compliance and the increased risk of data breaches. These security issues remain a significant point of contention for many healthcare providers considering outsourcing. Additionally, over-reliance on outsourcing firms can lead to dependency problems, where operational disruptions at these firms result in billing interruptions, thereby removing some control from the healthcare provider over their own operations.

Opportunities in Telemedicine and Specialized Clinics

The proliferation of telemedicine services has created a burgeoning demand for customized billing solutions. Virtual care-facilitated billing management represents a key growth opportunity for outsourcing companies, as the expansion of telemedicine necessitates efficient and accurate billing processes. This shift aligns with broader healthcare trends, indicating a lucrative market segment for outsourcing firms that can cater to the unique billing complexities associated with virtual consultations.

Furthermore, specialized clinics, such as those in oncology and cardiology, encounter unique and often intricate billing requirements, making them more likely candidates for outsourcing these functions. Firms offering specialized services in these fields can tap into significant opportunities, providing tailored solutions that address the specific needs of these clinics. This growing trend is expected to drive further growth in the outsourcing market as specialized clinics seek to optimize their billing operations and improve financial outcomes.

Recent Developments and Innovations

The U.S. medical billing outsourcing market has witnessed several significant developments in recent times. Companies are continuously innovating and expanding their service offerings to meet the evolving needs of healthcare providers. For example, in October 2023, eClinicalWorks introduced Sunoh, an AI-powered EHR tool designed to improve clinical documentation and operational efficiency. This is a testament to the industry’s ongoing commitment to leveraging cutting-edge technologies to enhance service delivery.

In February 2023, GeBBS Healthcare Solutions made a strategic acquisition by purchasing CPa Medical Billing. This move broadened its service offerings for health centers and multi-specialty practices, further cementing its position in the market. Experian Health also launched AI Advantage in February 2023, utilizing artificial intelligence and big data to effectively manage insurance claim denials. These advancements highlight the market’s dynamic nature and the continuous efforts by key players to innovate and remain competitive.

Conclusion

The U.S. medical billing outsourcing market is poised for dramatic growth, with projections indicating it will be valued at USD 5.9 billion by 2024 and expanding further to USD 16.9 billion by 2033. This strong growth trend is influenced by increasing healthcare expenditures, the complexities of regulatory requirements, and the rising need for effective billing services. By outsourcing medical billing tasks, healthcare providers gain a significant edge. It allows them to streamline their operations, minimize administrative errors, and concentrate more energy on patient care and efficient revenue cycle management. This outsourcing covers a wide range of services, from initial administrative responsibilities to detailed back-end billing processes, providing a holistic solution for healthcare providers.

Additionally, the demand for skilled billing services is propelled by the ever-evolving healthcare industry, which constantly grapples with changes in insurance policies, coding standards, and compliance mandates. With outsourcing, healthcare facilities can stay current with these updates without burdening their in-house staff. This results in not only improved accuracy in billing but also enhanced overall efficiency in managing healthcare services. As the market continues to expand, healthcare providers will likely increasingly rely on these outsourced services to maintain competitive and high-quality patient care.