In a landmark transaction set to reshape the medical technology landscape, global life sciences conglomerate Danaher Corporation has officially announced its definitive agreement to acquire Masimo, a pioneer in advanced patient monitoring technologies. The all-cash deal, valued at a substantial $9.9 billion, represents a calculated and decisive move by Danaher to fortify its diagnostics business and establish a formidable presence in the burgeoning telehealth and remote patient monitoring markets. Priced at $180 per share for Masimo, the acquisition is slated for completion in the latter half of 2026, contingent upon the satisfaction of standard closing conditions. As part of the strategic integration, Masimo is expected to function as a standalone business unit, preserving its well-regarded brand identity while operating under the umbrella of Danaher’s extensive diagnostics division. This structure indicates a plan to leverage Masimo’s innovative power and operational autonomy while enhancing its global reach through Danaher’s established infrastructure, particularly within acute care settings.

A Decisive Move with Immediate Market Impact

The announcement of the acquisition sent an immediate and powerful signal to investors, triggering a dramatic surge in Masimo’s stock value. On the day the deal was made public, February 17, shares on the Nasdaq exchange soared by over 34%, climbing from a previous close of $130.15 to an impressive $175 per share at the opening bell. This significant uptick propelled Masimo’s market capitalization much closer to the acquisition’s valuation, underscoring the market’s enthusiastic approval of the transaction. Before the news broke, Masimo’s market cap stood at $6.99 billion, making the subsequent rise a clear indicator of the perceived value and strategic fit that investors saw in the merger. This overwhelmingly positive financial reaction is expected to smooth the path for shareholder approval, validating the premium valuation and signaling strong confidence in the combined entity’s future potential. The market’s response reflects a broader understanding that this is not merely a financial transaction but a strategic alignment poised to create substantial long-term value.

This acquisition is the culmination of a deliberate, long-term strategy by Danaher to penetrate the telehealth sector. According to industry analysis, Danaher has been actively evaluating opportunities in this space for several years, and the purchase of Masimo represents its most definitive step to date. Rainer Blair, the CEO of Danaher, emphasized the strategic vision, noting Masimo’s leadership in pulse oximetry and its trusted brand. He articulated that integrating Masimo’s differentiated technology with the renowned “Danaher Business System” and Danaher’s global scale presents clear opportunities to expand Masimo’s market reach and further improve patient outcomes. This move is poised to significantly augment Danaher’s diagnostics business, which already accounted for a formidable $9.94 billion of its total $24.57 billion revenue in 2025. By absorbing Masimo, Danaher not only acquires a portfolio of leading products but also gains an instant and solid foothold in the high-growth arena of remote health monitoring.

Integrating a Market Leader with Proven Technology

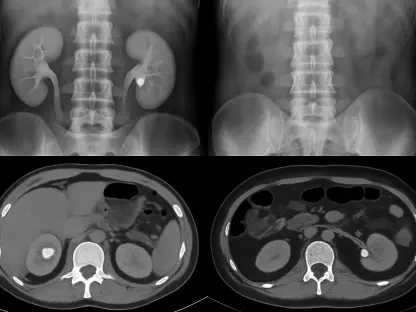

Masimo’s commanding position in the pulse oximetry systems market is a cornerstone of its value to Danaher. The global market for these critical devices, which measure blood oxygen saturation and heart rate, is on a significant growth trajectory, with projections estimating its valuation will reach $2.1 billion by 2034. Within this expanding market, Masimo stands out as the undisputed leader. In 2025, the company commanded a substantial 23.1% share of the U.S. market, placing it far ahead of its nearest competitor, ICU Medical, which held an 11.3% share. This dominance extends globally, where Masimo’s 21.3% market share in the same year positioned it well ahead of its next closest competitor, Philips, at 13.3%. This acquisition means Danaher is not just entering a market; it is acquiring the established frontrunner, complete with its highly regarded Signal Extraction Technology (SET) pulse oximetry system and a deep well of intellectual property that has consistently set industry standards for accuracy and reliability in patient monitoring.

The acquisition comes at the end of a strenuous yet triumphant period for Masimo, marked by both high-stakes legal battles and significant internal corporate restructuring. A pivotal event was Masimo’s successful patent infringement lawsuit against technology giant Apple. The legal victory, which culminated in a November 2025 California court ruling, ordered Apple to pay Masimo $634 million in damages for infringing on its blood oxygen meter technology. This outcome was more than a financial windfall; it was a powerful validation of the strength and value of Masimo’s intellectual property, particularly within the competitive “wellness” wearable medtech space. The triumph not only fortified Masimo’s financial position but also highlighted the immense value of its innovation, undoubtedly making it an even more attractive target for a strategic acquirer like Danaher, which places a high premium on differentiated technology and robust intellectual property portfolios.

A Synergistic Future Forged from Recent Turmoil

While celebrating its legal victories, Masimo also navigated a period of significant internal strife that likely influenced its path to acquisition. The company’s 2022 purchase of Sound United, a consumer-grade audio company, for $1 billion proved to be a highly controversial decision among its shareholders. The move sparked a rebellion led by the activist investor firm Politan Capital, which argued that the acquisition diluted Masimo’s focus on its core healthcare technology business. The resulting pressure and conflict led to a major corporate shake-up, which included the ouster of Masimo’s founder and CEO, Joe Kiani, from the company’s board. This period of internal turmoil, juxtaposed with its external successes in innovation and litigation, created a complex corporate environment. It is plausible that this internal instability made the company more receptive to a stabilizing acquisition by a larger, well-structured entity like Danaher, which could provide the resources and focus to maximize the potential of Masimo’s core assets.

This deal has been widely characterized by industry experts as highly synergistic, representing a strategic integration of a complementary business rather than the simple elimination of a competitor. The high valuation, as one analyst noted, is a testament to the value Danaher places on Masimo’s unique assets and is expected to ensure a smooth approval from shareholders. The financial composition of Masimo adds another layer of value, with approximately $1.4 billion in healthcare revenue, including a veterinary division, and a separate consumer segment that is growing at a healthy rate of about 9%. By bringing together Danaher’s operational excellence and global scale with Masimo’s market leadership and technological prowess, the combined entity is positioned to accelerate innovation and expand its footprint in the global diagnostics and telehealth industries. The acquisition concluded a chapter of transition for Masimo and opened a new one defined by integrated strength and strategic growth under the Danaher umbrella.