In the world of leisure travel, cruising holds a special allure, offering passengers an escape from daily life into a realm of luxury and exploration. Yet, beyond the serene waters and exotic destinations, there is a less romantic aspect that travelers must consider: the cost of medical emergencies at sea. Recent incidents, such as a passenger on the Norwegian Escape being billed nearly $10,000 for medical care, highlight the unpredictable financial burdens cruise travelers might face. These incidents underscore an important aspect of cruise travel that is often overshadowed by more glamorous considerations: the necessity for comprehensive travel insurance and meticulous financial planning to avoid unexpected expenses while aboard.

The Financial Implications of Medical Care Aboard

Understanding the Growing Need for Travel Insurance

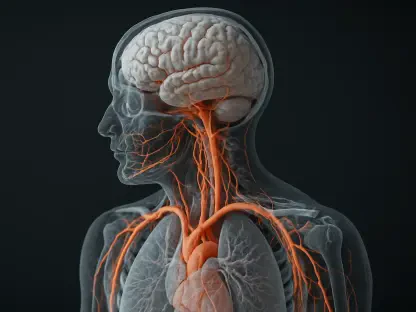

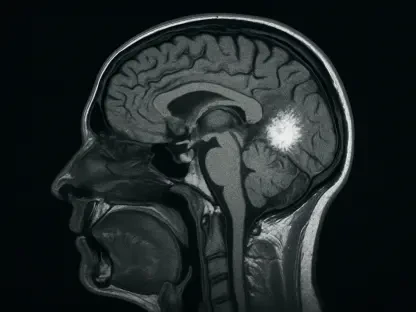

Cruise ships, while offering a plethora of entertainment, cuisine, and luxury, also present unique challenges, particularly regarding accessibility to medical care. Unlike land-based travel, cruises are relatively isolated, complicating medical logistics and leading to elevated costs for even basic treatment. As medical emergencies can arise without warning, travelers find themselves at the mercy of onboard medical facilities where costs can quickly escalate. Consequently, many seasoned travelers emphasize the critical necessity of securing robust travel insurance to offset these potential expenses. This doesn’t just include medical costs but also covers evacuation and extended stay expenses, which can otherwise devastate a travel budget. However, it is vital to understand that not all expenses may be covered by insurance. Each policy varies significantly, with terms that differ based on specific situations and prescribed coverage limits.

The importance of thoroughly understanding one’s insurance policy cannot be overstated. Many experienced travelers recommend carefully examining the terms and ensuring that all potential scenarios are covered, especially those concerning routine care and emergency interventions. Even with coverage, discrepancies in what is considered reimbursable can leave policyholders shocked when certain charges are deemed out-of-scope. Hence, prospective cruisers are advised to work closely with insurance providers to tailor a policy suited to the unique needs of cruise travel, accounting for the medical infrastructure and potential for extended periods of confinement on the ship.

Evaluating Medical Costs on Cruise Ships

The costs associated with receiving medical care on a cruise ship can be considerably higher than on land due to several factors, including the limited availability of medical resources and personnel. This limitation often necessitates higher fees to cover the operational expenses of medical personnel and equipment upkeep on board. For instance, an emergency visit may incur initial charges upward of several hundred dollars, with additional costs accruing for further tests and treatments. Such expenses are not only exacerbated by the confines of being at sea but also by the premium nature of cruise line services. As these costs are itemized with precision on onboard accounts, travelers may find themselves surprised by the sheer magnitude compared to standard land-based medical visits.

The aftermath of incidents like those reported on the Norwegian Escape has sparked broader discussions about this financial aspect of cruising. Complaints about potential overcharges or duplicative services have prompted travelers to advocate for careful review and contestation of any ambiguous fees. The transparency of onboard billing practices is thus becoming an area of growing concern, drawing the attention of both passengers and industry observers alike. This underscores the importance of travelers taking an active role in reviewing their medical bills, understanding the services received, and questioning any unfamiliar charges. By doing so, they can protect themselves from financial discrepancies that may arise from errors or misinterpretations in billing.

Dealing with Billing Discrepancies

Importance of Careful Bill Examination

Scrutiny of onboard expenses is not just advisable—it’s essential. The complexities of medical billing, combined with the high-pressure environment of emergency care, can lead to administrative errors or duplicate charges slipping through unnoticed. As travelers often preoccupy themselves with relaxation and excursions, there’s a tendency to trust the accuracy of bills presented by the cruise line. However, the financial ramifications are too significant to overlook, and the experience of those like the passenger billed on the Norwegian Escape serves as a potent reminder.

Discrepancies, whether due to clerical errors or misunderstandings about charges, necessitate proactive measures by passengers. Experienced travelers advocate for diligently reviewing account statements and itemized bills to ensure that all charges reflect the services received. If inconsistencies are identified, addressing them on board rather than post-cruise is far more effective. Cruise lines typically have customer service protocols in place, allowing passengers to dispute charges with some immediacy. The challenge becomes greater and the resolution slower once back on land, often requiring drawn-out processes to rectify.

Navigating Financial Challenges Post-Cruise

Once a cruise concludes, disputing charges becomes a significantly more challenging endeavor. Passengers attempting to resolve billing issues post-cruise often encounter extended wait times and complex negotiation processes. With the urgency of resolution fading, the impetus for cruise lines to address concerns swiftly diminishes, further complicating the situation for the traveler. Consequently, passengers are encouraged to engage with the ship’s customer service before disembarkation whenever possible. Being thorough in this stage can alleviate potential headaches later on, allowing for a smoother process should any reimbursements or adjustments be warranted.

In addition to examining the bills on board, the role of detailed documentation cannot be overstated. Retaining all receipts and relevant medical documentation provides a clear record of events that can support disputes and aid in discussions with insurance providers. Such documentation is invaluable not just for resolving current discrepancies but also in protecting against similar scenarios in future travels. The habit of maintaining meticulous records is thus emerging as an essential part of the traveler’s toolkit, particularly amidst the increasing trend of discerning travelers prioritizing their financial due diligence in every aspect of the cruising experience.

The Importance of Being Prepared

Proactive Measures for Future Cruisers

In light of these revelations, it becomes apparent that potential cruisers need to approach their travels with both enjoyment and prudence. Being prepared extends beyond packing for various climates and curating itineraries; it involves understanding that medical care, while vital, comes at a price that isn’t always included in the trip’s initial costs. Travelers are urged to approach bookings with a comprehensive strategy that incorporates financial scrutinies, such as opting for policies that cover extensive medical scenarios, ensuring all emergency needs are addressed.

Furthermore, using past incidents as a benchmark for potential costs gives travelers a more practical understanding of possible financial obligations. This foresight enables them to allocate preemptive funds for unexpected circumstances rather than facing unplanned debts. Such strategies provide peace of mind, reducing the likelihood of being caught off guard by expenses that could have been mitigated with careful initial consideration.

Broader Implications for the Cruise Industry

In the realm of leisure travel, cruises offer a unique escape, allowing passengers to immerse themselves in a world of opulence and adventure. However, behind the tranquil seas and captivating destinations lies a more sobering reality that travelers must take into account: the potential cost of medical emergencies at sea. Recent cases, such as a passenger on the Norwegian Escape facing a medical bill close to $10,000, shed light on the potentially hefty financial challenges travelers may encounter during their cruise journey. Such incidents emphasize an often overlooked facet of cruise travel overshadowed by its glamorous appeal: the critical need for extensive travel insurance and thorough financial planning. These precautions can help travelers avoid the shock of unexpected expenses while onboard. Thus, as enticing as cruise vacations may be, prudent preparations are essential to ensure a carefree voyage, safeguarding both one’s health and finances in the face of unforeseen circumstances.