Imagine a world where a hospital can craft a prosthetic limb perfectly matched to a patient’s unique anatomy in mere hours, or where surgeons plan complex operations using detailed, custom-made models of a patient’s organs. This isn’t science fiction—it’s the reality unfolding right now through the remarkable advancements in 3D printing technology within the healthcare sector. Over the decade from 2025 to 2035, this market is projected to skyrocket from USD 4.2 billion to USD 18.8 billion, driven by a robust compound annual growth rate (CAGR) of 16.2%. This explosive growth signals a profound shift in how medical solutions are designed, produced, and delivered, promising a future where personalized care becomes the norm rather than the exception.

The implications of this technology extend far beyond mere innovation; they touch on the very core of patient care. Hospitals and medical device manufacturers are embracing 3D printing to create tailored solutions that enhance precision and drastically improve outcomes. From custom implants to intricate surgical guides, the ability to produce on-demand, patient-specific tools is revolutionizing healthcare delivery. Yet, this rapid ascent is not without its challenges, as high costs and technical complexities pose significant barriers to widespread adoption. This article delves into the key drivers, technological advancements, regional dynamics, and future prospects of this transformative market, shedding light on how 3D printing is poised to redefine the medical landscape over the next ten years.

Market Dynamics and Growth Trajectory

Key Growth Indicators

The trajectory of 3D printing in the healthcare sector paints a picture of remarkable expansion, with market value expected to climb from USD 4.2 billion in 2025 to USD 18.8 billion by 2035, reflecting a steady CAGR of 16.2%. This growth unfolds in two distinct phases over the decade. The first, spanning from 2025 to 2030, anticipates the market more than doubling to USD 9.8 billion, fueled by a surge in demand for personalized medical solutions. During this period, the technology transitions from a novel concept to an essential component in many clinical environments, as healthcare providers recognize its potential to address individual patient needs with unprecedented accuracy.

In the subsequent phase from 2030 to 2035, growth accelerates even further, adding an additional USD 9.1 billion to the market’s value. This maturation stage focuses on deeper integration into broader healthcare systems, where 3D printing becomes a staple in medical manufacturing and treatment protocols. Hospitals and clinics will likely see this technology embedded into routine operations, streamlining processes like surgical preparation and device production. This shift signals not just an increase in adoption but a fundamental change in how healthcare delivery is approached, prioritizing customization and efficiency on a scale previously unattainable.

Drivers of Expansion

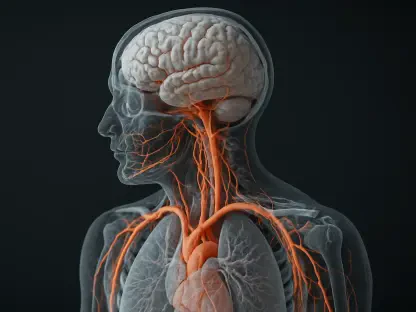

A pivotal force behind this market’s rise is the growing emphasis on personalized medicine, which seeks to tailor treatments and devices to the specific needs of each patient. 3D printing meets this demand head-on by enabling the creation of bespoke solutions, such as prosthetics and implants, that align perfectly with individual anatomical requirements. This capability not only improves patient outcomes but also reduces the risk of complications, making it a compelling choice for healthcare providers aiming to enhance care quality in an increasingly patient-centric landscape.

Equally significant is the wave of healthcare modernization sweeping across the globe, as institutions upgrade their infrastructure to incorporate advanced technologies. Hospitals are investing heavily in 3D printing to boost the precision of surgical planning and the efficiency of device production, cutting down on both time and costs associated with traditional methods. Government initiatives and funding, particularly in technologically advanced regions like the United States and South Korea, further accelerate this trend by providing the necessary financial and policy support to integrate such innovations into mainstream medical practice, ensuring that the benefits of 3D printing reach a wider audience.

Technological Innovations

Leading Technologies

At the forefront of this market’s expansion is stereolithography, a technology commanding a substantial 35.0% share due to its exceptional precision and cost-effectiveness in producing intricate medical devices. Whether it’s crafting detailed implants or surgical models, stereolithography offers a level of accuracy that makes it indispensable in clinical settings. Its ability to work with a variety of biocompatible materials also ensures that the resulting products meet stringent medical standards, positioning it as the go-to choice for hospitals and manufacturers aiming to deliver high-quality, tailored solutions without breaking the bank.

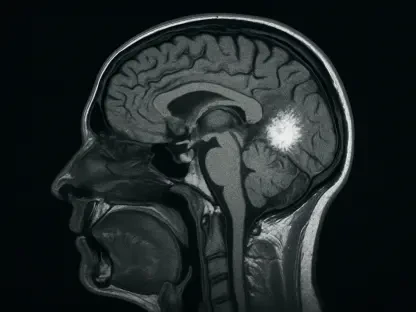

Beyond stereolithography, other technologies like fused deposition modeling and selective laser sintering play crucial roles in addressing niche requirements within the healthcare sector. These methods provide flexibility for specific applications, such as creating lightweight, durable components or experimenting with unique material properties. Meanwhile, bioprinting stands out as an emerging frontier with transformative potential, particularly in tissue engineering. As research progresses, bioprinting could enable the creation of viable biological structures for transplantation or testing, opening up new possibilities for addressing complex medical challenges over the coming decade.

Integration with Modern Healthcare

The synergy between 3D printing and Healthcare 4.0 technologies, such as artificial intelligence and real-time monitoring systems, is significantly enhancing its value in medical settings. These smart integrations allow for predictive manufacturing and precision medicine, where devices and treatments are not only customized but also optimized based on dynamic patient data. Hospitals adopting these advanced systems are finding that they can design and produce critical tools on-site, slashing delays and reducing dependency on external suppliers, a trend that is expected to gain momentum through 2035 as technology becomes even more accessible.

This integration also streamlines clinical workflows, enabling healthcare providers to respond more swiftly to patient needs. For instance, the ability to print a surgical guide tailored to a specific procedure right before an operation minimizes preparation time and enhances accuracy. As digital health platforms continue to evolve, 3D printing systems are becoming integral to a connected ecosystem where data-driven insights inform every step of the manufacturing process. This convergence of technology not only boosts operational efficiency but also positions 3D printing as a cornerstone of future-focused healthcare delivery, capable of adapting to the ever-changing demands of modern medicine.

Applications and End Users

Dominant Applications

Among the myriad uses of 3D printing in healthcare, prosthetics and implants stand out as the leading applications, driven by their ability to directly address critical patient needs with customized solutions. These devices, crafted to match the exact specifications of an individual’s anatomy, significantly improve comfort and functionality compared to generic alternatives. This personalization reduces recovery times and enhances the overall quality of life for patients, making 3D printing a vital tool in orthopedic and reconstructive care, with adoption rates climbing steadily as awareness of its benefits spreads.

In addition to prosthetics, surgical instruments and tissue engineering are carving out significant roles in the market. Surgical instruments produced via 3D printing enable greater precision during complex procedures, often being designed for single-use to minimize infection risks. Meanwhile, tissue engineering represents a frontier with immense long-term potential, as bioprinting techniques advance toward creating functional biological structures. These applications underscore the technology’s dual capacity to meet immediate clinical demands while pushing the boundaries of medical research, setting the stage for groundbreaking developments in regenerative medicine over the next decade.

Primary End Users

Hospitals emerge as the dominant end users of 3D printing technology, holding a substantial 44.0% of the market share due to their focus on surgical planning and the production of custom devices. With access to larger budgets and modernization initiatives, these institutions are well-positioned to invest in advanced systems that enhance patient care through tailored solutions. The ability to print tools and models on-demand directly within hospital settings is transforming how surgeries are prepared and executed, marking a shift toward more agile and responsive medical environments.

Supporting this trend are research institutes and medical device companies, which play essential roles in driving innovation and scalability within the sector. Research institutes focus on pushing the limits of what 3D printing can achieve, exploring new materials and applications like bioprinting for organ development. Meanwhile, medical device companies leverage the technology to streamline production processes, reducing costs and accelerating the time-to-market for new products. Together, these end users form a dynamic ecosystem where clinical application, research, and manufacturing intersect, ensuring that 3D printing continues to evolve in step with the broader needs of the healthcare industry.

Regional Variations

Market Leaders

North America, spearheaded by the United States with a remarkable 18.7% CAGR, stands as the global leader in the adoption of 3D printing in healthcare, thanks to its robust ecosystem of innovation and substantial government funding. Hospital networks in this region boast an impressive 92% deployment rate, reflecting a deep penetration of the technology into clinical practice. Cities like Boston and San Francisco serve as hubs for research and development, continuously pushing the boundaries of what’s possible with 3D printing, while federal initiatives provide the financial backbone to support widespread integration across diverse medical facilities.

Europe follows closely, with countries like Germany (17.3% CAGR) and the U.K. (16.4% CAGR) demonstrating strong growth fueled by advanced healthcare infrastructure and stringent regulatory alignment. Germany’s emphasis on engineering excellence ensures that 3D printing systems are seamlessly integrated into medical workflows, often cutting validation cycles by significant margins through strategic partnerships. The U.K., meanwhile, benefits from a unified health system that facilitates the rapid rollout of innovative technologies, ensuring that hospitals and clinics remain at the forefront of adopting customized medical solutions, a trend that will likely persist through the decade.

Emerging Hotspots

Asia Pacific is rapidly emerging as a critical region for 3D printing in healthcare, with South Korea (17.9% CAGR) and Japan (15.8% CAGR) leading the charge through aggressive modernization efforts. In South Korea, cities like Seoul are witnessing a dramatic surge in system procurement, with annual growth rates signaling a robust demand for advanced medical technologies. Government policies in the region are heavily focused on integrating cutting-edge solutions into healthcare, positioning Asia Pacific as a key growth area where innovation meets escalating patient needs over the next several years.

Further behind but brimming with potential are emerging markets in Latin America and the Middle East & Africa, where healthcare budgets are on the rise. Although adoption rates currently lag due to limited infrastructure and financial constraints, increasing investments are laying the groundwork for future expansion. As local governments and private sectors prioritize healthcare development, the demand for cost-effective, scalable solutions like 3D printing is expected to grow, transforming these regions into significant contributors to the global market by 2035, provided that barriers to entry are systematically addressed.

Challenges and Opportunities

Barriers to Adoption

One of the most formidable obstacles to the widespread adoption of 3D printing in healthcare is the high initial cost of the technology, which can be prohibitive for smaller hospitals or those operating in resource-constrained regions. The expense of acquiring advanced systems, coupled with the need for specialized materials, often places this innovation out of reach for facilities with limited budgets. This financial barrier slows down the democratization of 3D printing, particularly in areas where healthcare funding is already stretched thin, creating disparities in access to cutting-edge medical solutions.

Beyond cost, technical challenges also hinder progress, especially when it comes to integrating 3D printing systems with existing, often outdated, medical equipment. These integration issues can lead to operational inefficiencies, requiring additional investments in training staff and upgrading infrastructure. Moreover, market fragmentation caused by varying regulatory standards across different countries complicates matters further. Manufacturers must navigate a complex web of compliance requirements, which can delay the deployment of new technologies and increase costs, posing a significant challenge to achieving uniform global adoption.

Pathways for Growth

Despite these hurdles, numerous opportunities exist to propel the market forward, particularly through government-backed programs that alleviate financial pressures. In leading regions like the United States and South Korea, substantial funding and supportive policies are making 3D printing more accessible to healthcare providers of all sizes. These initiatives not only reduce the burden of upfront costs but also encourage innovation by fostering partnerships between public institutions and private companies, ensuring that the technology reaches a broader spectrum of medical facilities.

Another promising avenue lies in the increasing regulatory acceptance of 3D-printed medical devices, as agencies worldwide begin to recognize their safety and efficacy. This shift is paving the way for greater investment and trust in the technology, encouraging manufacturers to expand their offerings. Additionally, the potential for growth in emerging markets cannot be overlooked. As healthcare infrastructure improves in regions like Latin America and the Middle East & Africa, the demand for advanced, customizable solutions will likely surge, presenting a significant opportunity for stakeholders to tap into new demand pools and drive global market expansion by 2035.

Future Horizons and Strategic Insights

Navigating Technological Evolution

Looking back over the decade from 2025 to 2035, the journey of 3D printing in healthcare unfolded as a story of remarkable transformation, growing from a market valued at USD 4.2 billion to an impressive USD 18.8 billion with a steady 16.2% CAGR. Technologies like stereolithography led the charge with their precision, while hospitals cemented their role as primary adopters, leveraging customized solutions for patient care. Regional leaders in North America, Europe, and Asia Pacific set benchmarks for innovation, even as challenges like high costs and integration complexities tested the industry’s resilience at every turn.

Shaping the Next Decade

As the industry moves beyond 2035, stakeholders must focus on strategic collaborations to overcome lingering barriers, particularly in cost and accessibility. Forming partnerships between technology providers, healthcare institutions, and regulatory bodies can accelerate the development of affordable, scalable solutions. Investment in training programs will also be critical to ensure that medical staff are equipped to handle advanced systems, bridging the gap between innovation and practical application. These steps can help sustain the momentum built over the past decade.

Moreover, attention should turn to emerging markets where untapped potential awaits. Tailored approaches that address local infrastructure challenges and regulatory landscapes will be key to unlocking growth in these regions. Simultaneously, continued research into bioprinting and integration with AI-driven platforms promises to push the boundaries of what’s possible, potentially revolutionizing areas like organ transplantation. By prioritizing adaptability and forward-thinking strategies, the industry can ensure that 3D printing remains a vital force in reshaping healthcare for years to come.