In an era where healthcare costs are spiraling and administrative burdens are mounting, a striking development has emerged in the nonprofit health insurance sector with Blue Shield of California’s sister company, Stellarus, forging a transformative partnership. This alliance with Blue Cross Blue Shield (BCBS) of Kansas and Hawaii Medical Service Association (HMSA) spotlights a critical shift in how smaller, mission-driven payers can compete with for-profit giants. This alliance, rooted in advanced health technology, underscores a pressing reality: nonprofit plans must innovate or risk obsolescence in a market dominated by well-capitalized national insurers.

The purpose of this market analysis is to dissect the implications of this collaboration for the nonprofit healthcare landscape. By examining the strategic motivations behind Stellarus’ platform, the specific trends driving technology adoption, and the potential long-term impacts, this exploration aims to provide clarity on how shared resources can reshape operational efficiency and affordability. The importance of such partnerships cannot be overstated, as they offer a lifeline to plans serving local communities while navigating financial constraints.

This analysis will delve into current market dynamics, data-driven insights, and projections for the health tech space within nonprofit insurance. It seeks to equip stakeholders—ranging from payers to policymakers—with a comprehensive understanding of how collaborative models can address systemic challenges. As the industry grapples with shrinking margins and rising member expectations, the Stellarus initiative serves as a beacon of innovation worth scrutinizing.

Market Dynamics and Emerging Trends in Nonprofit Health Tech

Collaborative Platforms as a Competitive Edge

The nonprofit health insurance market is undergoing a profound transformation, driven by the urgent need to modernize operations amid declining profitability. Industry data reveals a stark drop in insurer margins from 2.2% in recent years to just 0.8% currently, as reported by the National Association of Insurance Commissioners, reflecting pressures from increased medical utilization and soaring costs. Smaller nonprofit plans, often managing limited budgets, struggle to invest in the digital infrastructure necessary to streamline processes and enhance member experiences, placing them at a disadvantage against larger competitors.

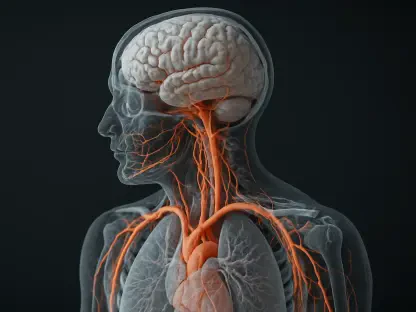

Stellarus, launched under Blue Shield of California’s restructured parent company Ascendiun, emerges as a pivotal player in this landscape. By offering a shared technology platform that integrates over 60 datasets—including clinical, claims, and demographic information—it enables services like prior authorization automation and population health management. For partners like BCBS of Kansas and HMSA, each serving approximately 1 million members, access to such tools represents a significant leap forward, allowing them to reduce administrative overheads estimated at $950 billion annually across the U.S. healthcare system, per a study by the American Hospital Association.

Looking ahead, the trend of collaborative tech platforms is poised to accelerate through 2027, as more nonprofit payers recognize the value of pooled resources. Projections suggest that adoption of integrated data hubs could cut operational costs by up to 15% for smaller plans, based on early pilot outcomes from similar initiatives in California. However, barriers such as staff training needs and system integration complexities must be addressed to ensure scalability across diverse markets.

Cost Innovation Through Pharmacy and Payment Models

Another critical facet of the market shift lies in cost-saving strategies, particularly through innovative pharmacy benefit structures. Stellarus promotes Blue Shield’s multi-vendor pharmacy care model, which disrupts traditional benefit management by fostering competition and transparency among vendors. This approach tackles one of the largest drivers of healthcare expenses—drug costs—offering potential savings that could lower premiums for members of BCBS of Kansas and HMSA.

Beyond pharmacy solutions, the platform’s focus on payment integrity is gaining traction as a means to curb fraud and ensure billing accuracy. Market analysis indicates that payment discrepancies account for billions in annual losses for insurers, a burden disproportionately felt by smaller plans with limited oversight resources. By embedding these capabilities, Stellarus positions itself as a catalyst for financial sustainability, though challenges like vendor resistance and implementation costs remain on the horizon.

Forecasts for the next few years highlight a growing emphasis on such hybrid models, with an estimated 20% of nonprofit plans expected to adopt outsourced pharmacy frameworks by 2027. This shift could redefine cost structures, but success hinges on balancing innovation with operational feasibility. As economic pressures intensify, the ability to deliver tangible savings will likely determine which platforms gain widespread acceptance in this niche.

Regional Variations Shaping Tech Adoption

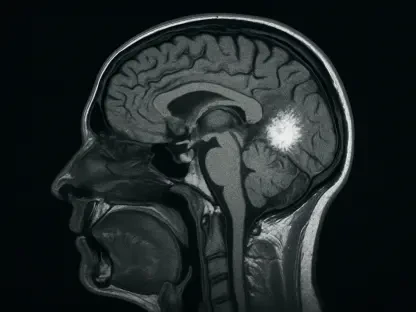

Diving deeper into market nuances, regional dynamics play a substantial role in shaping the impact of health tech partnerships. For HMSA, operating in Hawaii’s geographically isolated environment, accessing Stellarus’ platform addresses unique barriers such as limited mainland resources and a smaller market base. Tailored solutions like data-driven member engagement tools can bridge gaps in care delivery for remote populations, enhancing outcomes in ways previously unattainable.

In contrast, BCBS of Kansas contends with challenges tied to a predominantly rural membership, where healthcare access and affordability are longstanding issues. The Stellarus collaboration offers population health management strategies that can pinpoint regional needs, though digital literacy gaps among rural members may necessitate hybrid approaches combining tech with traditional outreach. These localized considerations underscore the importance of adaptable platforms in a fragmented market.

Market projections suggest that regional disparities will continue to influence technology adoption rates, with isolated or rural-focused plans potentially lagging behind urban counterparts by 10-15% through the next few years. Nevertheless, partnerships that prioritize customization stand to gain traction, as they align with the diverse needs of nonprofit insurers. This trend points to an evolving landscape where flexibility becomes as critical as innovation itself.

Strategic Implications and Future Pathways

Reflecting on the insights gathered, the Stellarus partnership with BCBS of Kansas and HMSA marks a significant milestone in the nonprofit health tech arena. It highlights a viable path for smaller payers to leverage shared technology, addressing both operational inefficiencies and cost burdens that have long plagued the sector. The collaboration validates the potential of integrated platforms to level the playing field, offering a glimpse into how mission-driven plans could sustain their community focus amid competitive pressures.

Key implications from this analysis point toward a broader industry shift, where collaboration becomes not just an option but a necessity for survival. The data underscores that without access to scalable tools, many nonprofit insurers risk further margin erosion, potentially compromising their ability to deliver affordable care. Stellarus’ early success with its partners sets a precedent, suggesting that similar models could proliferate if barriers like integration costs are mitigated.

Moving forward, stakeholders are encouraged to explore strategic alliances that mirror this framework, prioritizing investments in adaptable tech solutions. Smaller plans could benefit from joining collaborative networks to access shared resources, while larger payers might consider developing analogous platforms to support peers. For policymakers, fostering regulatory environments that support data sharing and innovation is critical. Ultimately, the path ahead demands a collective commitment to harnessing technology in ways that preserve the ethos of nonprofit healthcare while ensuring its viability for years to come.