Diving into a New Era of Healthcare Technology

Imagine a healthcare system where clinicians spend less time wrestling with digital paperwork and more time connecting with patients, a vision that is becoming reality as Oracle Health unveils an AI-backed Electronic Health Record (EHR) system. This development is poised to reshape the $10 billion EHR market at a critical juncture, with administrative burdens contributing to clinician burnout—a challenge affecting over 50% of U.S. physicians according to recent industry surveys. The purpose of this analysis is to dissect Oracle’s strategic move, evaluate its potential to disrupt entrenched market dynamics, and forecast its impact on healthcare delivery. By examining current trends, competitive positioning, and future projections, this exploration sheds light on whether Oracle can redefine standards in a sector hungry for efficiency and trust.

Unpacking Market Trends and Oracle’s Strategic Positioning

The EHR Landscape: Challenges and Opportunities

The EHR market has evolved into a cornerstone of healthcare technology, with adoption rates nearing 90% among U.S. hospitals. Yet, persistent issues like clunky interfaces and time-intensive documentation have fueled dissatisfaction, often extending clinicians’ work into after-hours. Data from industry reports indicate that providers spend an average of two hours on administrative tasks for every hour of patient care. Oracle’s AI-driven system enters this space with a promise to slash such inefficiencies through voice-enabled access and automated data summaries. This aligns with a broader market trend toward intuitive, user-centric solutions, reflecting a growing demand for tools that prioritize clinician well-being alongside operational needs.

Competition in this arena is fierce, with Epic commanding over 42% of acute care hospitals, while Oracle, even after its acquisition of Cerner, holds nearly 23%, per Klas Research metrics. Oracle’s latest offering is not just a technological upgrade but a strategic bid to reclaim lost ground, especially after implementation setbacks in high-profile projects. By focusing on AI integration, Oracle taps into an emerging wave of innovation that could sway smaller providers seeking scalable, cost-effective systems. The challenge lies in overcoming skepticism about AI reliability and proving that its system can deliver consistent value across diverse healthcare settings.

Core Features Driving Market Differentiation

Oracle’s AI EHR system stands out with features designed to address specific pain points. Clinicians can retrieve patient information—such as lab results or medication histories—using simple voice commands, minimizing manual navigation. Additionally, the system generates concise patient summaries by pulling data from drug databases and clinical guidelines, while flagging risks like care gaps or potential readmissions. These capabilities target the administrative overload that burdens providers, potentially freeing up significant time for direct patient interaction. Transparency is another key differentiator, as AI-generated content comes with clear labels and visual breakdowns of data sources and limitations, fostering trust among users.

Unlike some competitors who offer more rigid platforms, Oracle emphasizes customization, allowing the system to adapt to individual clinician preferences over time. Providers can also integrate custom or third-party AI agents, adding a layer of flexibility that could appeal to organizations with unique workflows. However, this strength carries risks, as excessive customization might lead to inconsistencies across implementations. Balancing user autonomy with standardized functionality will be crucial for Oracle to maintain a competitive edge in a market where ease of use often determines adoption rates.

Phased Rollout and Market Penetration Strategy

Oracle’s approach to market entry is methodical, targeting ambulatory providers initially in the current year, with plans to expand into acute care settings by 2026, pending regulatory certification. This phased rollout allows for testing and refinement in less complex environments before addressing the high-stakes demands of hospital settings. Such caution is strategic, given past challenges that have dented Oracle’s reputation in large-scale deployments. By starting small, Oracle aims to build credibility and momentum, potentially capturing a segment of the market underserved by larger players focused on acute care dominance.

The timing of this launch, ahead of major industry events, suggests an intent to seize attention and position Oracle as a leader in AI-driven healthcare solutions. Yet, hurdles remain, including the need for regulatory approval and the risk of initial adoption delays. Industry feedback highlights that addressing misconceptions about AI as an opaque “black box” will be vital to winning over hesitant providers. Oracle’s focus on transparency could serve as a key selling point, but only if paired with robust training and support to ensure seamless integration into existing workflows.

Future Projections: AI and Cloud Trends in EHR Markets

Riding the Wave of AI Integration

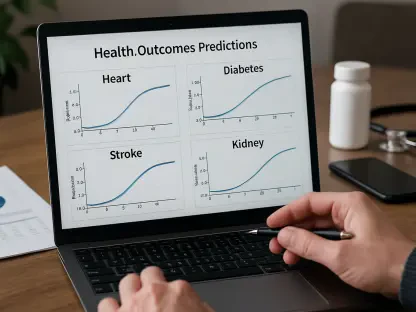

Looking ahead, the EHR market is set to be reshaped by AI integration, with projections suggesting that AI-driven systems could become standard within the next five years. Oracle’s system aligns with this trajectory, offering predictive alerts and actionable insights that position it as a decision-support tool rather than a mere data repository. Competitors are not far behind, as evidenced by Epic’s plans to introduce an AI clinical documentation assistant, signaling a shared industry recognition of AI’s transformative potential. The race is on to develop systems that not only streamline tasks but also empower clinicians with real-time, reliable guidance.

Economic pressures are likely to drive smaller providers toward solutions like Oracle’s, which leverage cloud-native architecture for scalability and cost efficiency. Cloud-based systems enable real-time data access and updates, a non-negotiable feature in modern healthcare where delays can impact outcomes. However, regulatory changes around data privacy and AI accountability could influence adoption timelines. If Oracle navigates these complexities effectively, it could capture significant market share, particularly among ambulatory providers seeking affordable, adaptable tools over the next two years.

Long-Term Market Shifts and Competitive Dynamics

Over the span from now to 2027, the EHR market is expected to witness a shift toward what industry leaders describe as an “Agentic AI era,” where technology acts as a proactive partner in clinical decision-making. Oracle’s vision of empowering clinicians with tailored insights while maintaining human control aligns with this future. Yet, the competitive landscape will intensify, with players investing heavily in AI to differentiate their offerings. Oracle’s ability to address past implementation issues and deliver on its promises of transparency and usability will determine whether it can close the gap with market leaders.

Another factor shaping the market is the growing emphasis on interoperability—ensuring systems can communicate across platforms. Oracle’s customizable AI agents could play a pivotal role here, allowing integration with third-party tools and potentially setting a new benchmark for flexibility. Still, the risk of fragmented standards looms large if customization outpaces industry-wide protocols. Monitoring how Oracle balances innovation with compatibility will offer critical insights into its long-term market viability and influence on healthcare technology norms.

Reflecting on Oracle’s Market Impact

Oracle’s introduction of an AI-backed EHR system emerged as a calculated effort to address deep-seated inefficiencies in healthcare delivery, marking a significant moment in the evolution of the EHR market. Its focus on reducing administrative burdens through voice commands, data summaries, and transparent AI operations tackled a core challenge that had long frustrated clinicians. The strategic phased rollout and emphasis on customization positioned Oracle to challenge entrenched competitors, while aligning with broader trends toward cloud solutions and AI integration. For healthcare providers, the key takeaway was the potential to reclaim time for patient care, provided they invested in training and pilot programs to mitigate adoption risks. Moving forward, stakeholders should monitor regulatory developments and competitor responses, while exploring partnerships to enhance interoperability. Oracle’s journey underscored that success in this space hinged on trust, adaptability, and a relentless focus on user needs—a lesson that shaped strategic planning for years to come.